Gold & Silver Jump ‘33’ on Jobs Report

News

|

Posted 06/06/2016

|

5966

Those who awoke Saturday morning and checked the gold and silver prices were met with a big surprise. Gold jumped $33 and silver 33c.

So what happened? Against expectations of 160,000 new jobs for May in the US we instead saw an NFP payrolls report just 38,000 jobs added, the lowest number in nearly 6 years. Oh, and they quietly revised down the 160,000 last month to just 123,000, and March from the heralded 208,000 down to 186,000… But if that wasn’t bad enough, we saw participation plummet by 664,000, with the total of people now not in the labour force at an all time record 94.7m. That meant the now completely meaningless ‘unemployment rate’ (which only counts people ‘participating’ in the work force) actually dropped to 4.7%.

The quality continues to decline too, with the last 2 months now seeing a total of 312,000 full time jobs lost, and only partly replaced with 118,000 new part time jobs.

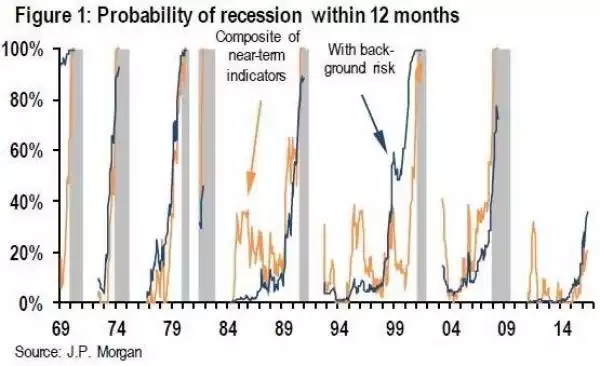

So needless to say expectations of the June rate hike have come off sharply, now sitting at a resounding ‘no chance’ of 2% odds. A July hike dropped to 36% from 48%. Now remember a rate hike happens when ‘everything is awesome’. Yet at the same time we see JP Morgan’s Recession Indicator screaming a very clear warning….