Bitcoin Supply Trends

News

|

Posted 15/03/2022

|

6320

Bitcoin accumulation trends have softened in the short term, despite extremely constructive long-term demand trends. The potential energy for a capitulation event is in place but is yet to manifest as it has in previous market cycles.

Bitcoin prices continue to consolidate this week, compressing into an increasingly tight range between a low of $37,274 US, and a high of $42,455. As was covered in the previous edition, the market currently exists in a delicate balance, amidst a backdrop of high macro and geopolitical uncertainty playing out on the global stage.

We are now two years on from the major capitulation event in March 2020 that saw Bitcoin prices plummet over 52%, fall from $8k to $3.8k in two trading days, and marked the end of the 2019-20 bear cycle. Capitulation events like this often signify a complete and total flush out of all remaining sellers, turning the tides in the favour of the bulls.

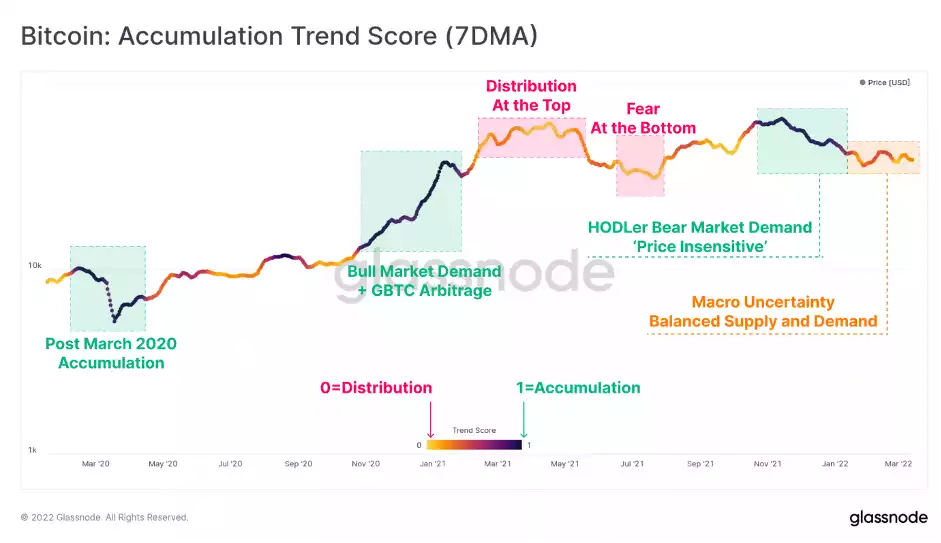

We can see that the period from October 2021 to Jan 2022 was one of very strong accumulation (> 0.9, dark purple), likely by price-insensitive HODLers. However, for most of 2022, this metric has fluctuated between a value of 0.2 and 0.5. This highlights the impact of global macro uncertainty on investor sentiment, with weaker accumulation taking place as a result.

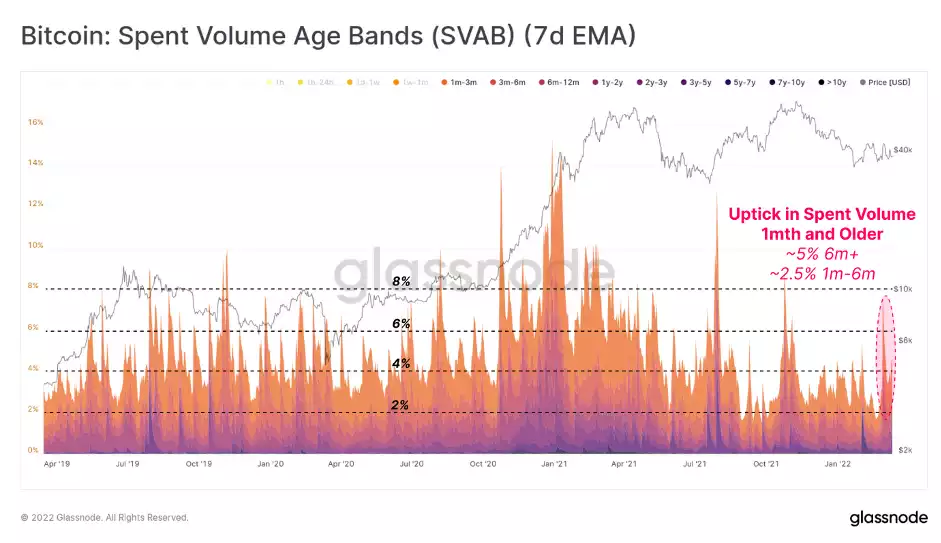

This week we have also seen a notable increase in older coins being spent. Older coins are held by investors who have more experience with the characteristic volatility of Bitcoin markets, and are often considered synonymous with 'smarter money'.

As such, when we see older coins being spent at higher levels, it can indicate a more bearish tilt in sentiment within the HODLer class. Coins older than 6mths represented 5% of all spending volume this week, which is a notable uptick from recent months. This could also be an indication that longer-term holders are reaching peak frustration with the market, finally selling their hands potentially at the bottom.

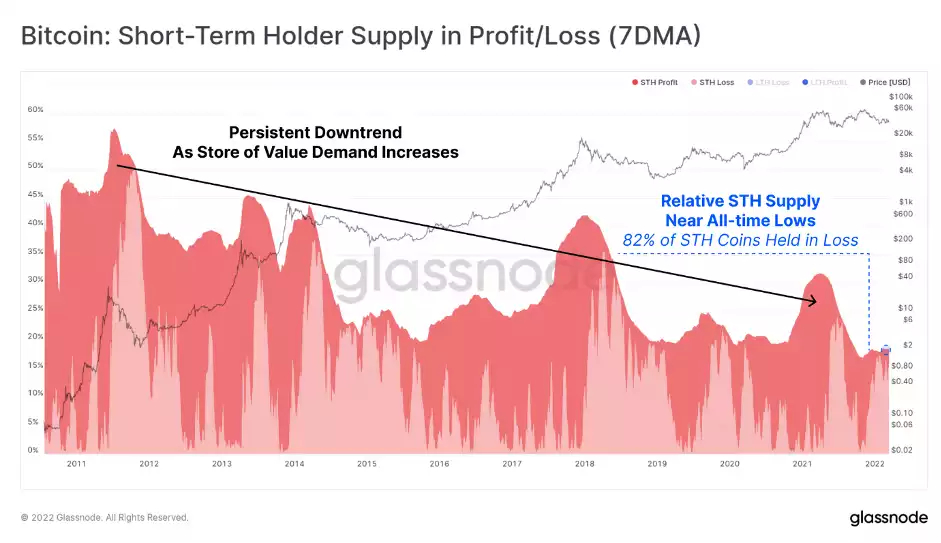

The chart below shows the relative proportion of the coin supply held by Short-Term Holders (STHs) who accumulated within the last 155-days. This cohort is statistically the most likely to sell their coins in the face of market volatility, especially during a final capitulation flush out.

We have continued to see the amount of coin supply held by the Short-Term Holder cohort decline. This can only occur when large portions of the coin supply are dormant and crossing the 155-day age threshold, becoming Long-Term Holder supply. STH supply reaching low levels is historically associated with the later stages of bear markets, as patient buyers send coins to cold storage for the long hold.

STH supply is currently near all-time-lows which is constructive for prices.

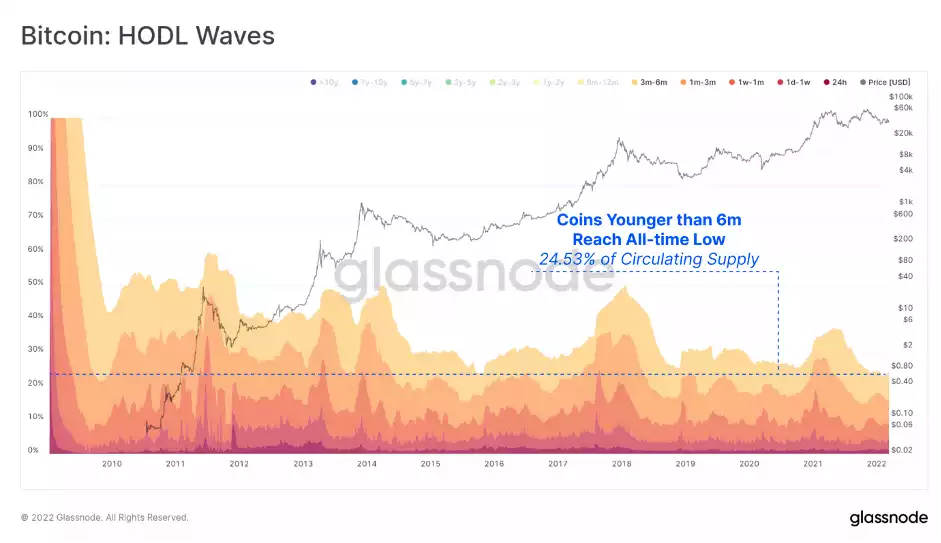

The HODL waves are also showing that coins younger than 6-months old are at all-time-lows. 24.53% of the circulating supply is in this young age cohort, which means that 75.47% of the supply has remained dormant for more than 6-months.

This is again a relatively constructive observation for prices and indicates that HODLing is dominating investor behaviour, even with the prevailing macro risks as headwinds.

If we look at the Illiquid Supply Shock Ratio (ISSR), we can see a significant uptick this week, suggesting that these withdrawn coins have been moved into a wallet with little-to-no history of spending.

This metric will trend higher as more coins move into such wallets, and we can see that it currently has a similar market structure to the 2018-20 bear market, albeit on a shorter time scale. The ISSR metric is currently at 3.2, which means that the amount of supply held in Illiquid wallets is 3.2x larger than Liquid and Highly Liquid supply combined.

This metric does indicate that a persistent demand is present, despite struggling prices.

The uncertainty associated with the many macro and geopolitical risks have weakened shorter-term on-chain accumulation trends since January. We can also see marginally elevated spending by older coins this week, although it is still not suggestive of any widespread loss of investor conviction on a macro scale.

With over 2.51M BTC held by Short-term Holders at an unrealised loss, there remains a risk that sellers have not yet been fully exhausted. The 'potential energy' for a capitulation event is there, and such an event would be consistent with all prior bear cycles.

However, HODLing does continue to dominate investor behaviour, and the longer-term accumulation trends are still impressively constructive.