Ainslie Intelligence, Trading Signals update

News

|

Posted 20/08/2019

|

6911

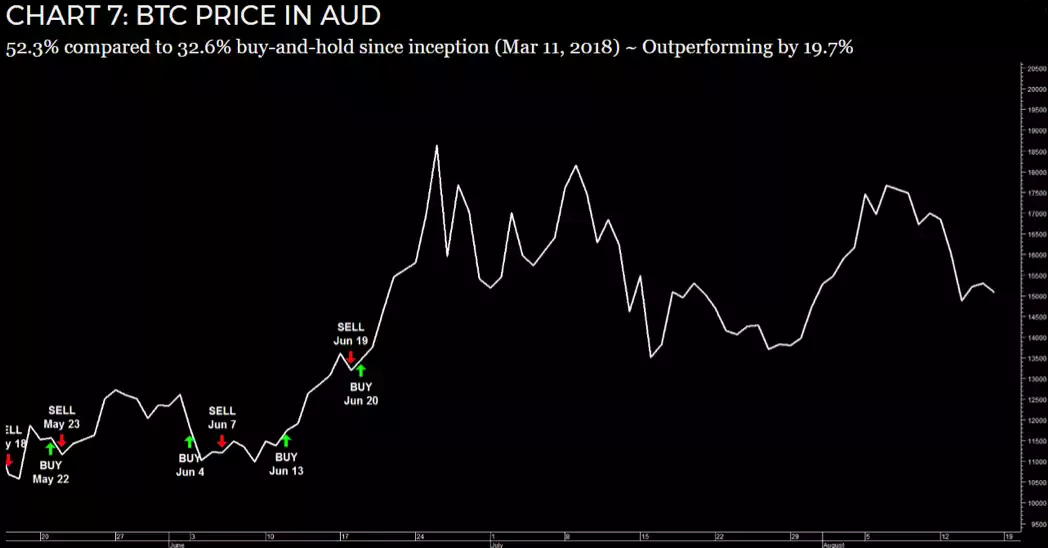

The Bitcoin price has consolidated after making excellent gains throughout 2019. We've seen the price increase from roughly $5,000 at the start of the year and nearly reaching $20,000 at the end of June. The rapid development seemingly piggybacked the positive and negative sentiment surrounding Facebook's Libra cryptocurrency. Consolidation periods after the strong expansion is always healthy for the market and the price remains above key targets. The AI has been able to successfully predict the price bouncing off support levels and has found a 52.3% profit overall in this market now.

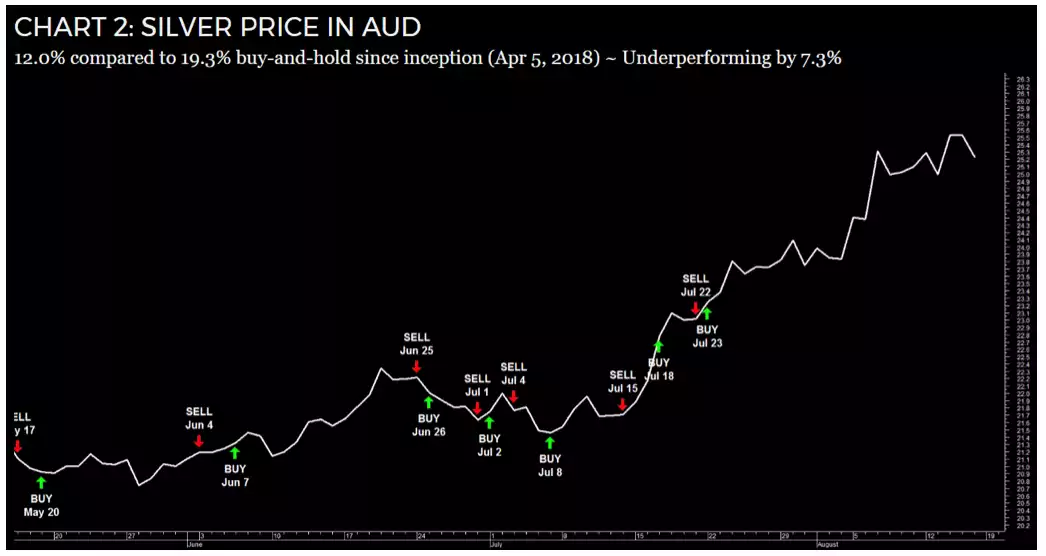

Silver prices have lagged gold prices since 2017 which has pushed the gold-to-silver ratio to all-time highs. The value of global silver stocks is much smaller than that of global gold stocks, which is the result of silver industrial demand. Also, a rise in the monetary demand for silver has a disproportionally large effect. Simply put, when demand for metals increases as another option to fiat currency, there is simply less silver to exchange.

Not only did investor demand for silver ETF’s hit a record high on the 16th of August but The World Silver Survey 2019 report also states that “global silver demand hit a three-year high in 2018, surpassing more than one billion ounces, an increase of 4% from 2017.”

“At the same time, global silver mine production fell for the third straight year, dropping 2% in 2018 to 855.7 million ounces,” poising the precious metal to expand further upon its current bull run.

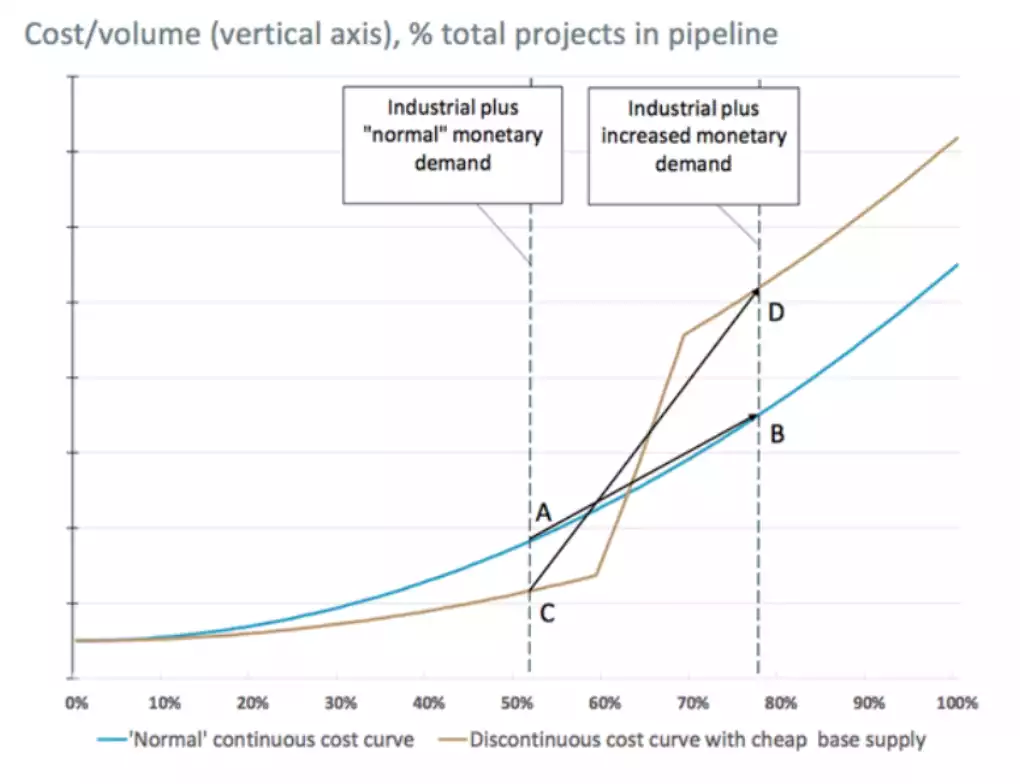

The majority of global silver production is a by-product of other mining activities. Under normal conditions, the “by-product” production rate is enough to keep up with monetary demand. The nature of silver’s production creates a discontinuous cost curve - base production is cheap but to increase supply prices must increase to make mining operations economically viable. Thus, when we see a sharp increase in monetary demand, we also see the cost curve shift, tending to lead to equally sharp price increases. To see this visually, see below…

Furthermore, the rise of cryptocurrencies may have deflated and swayed some investors away from silver over the last few years. Demand for gold and silver increase when real interest rate expectations decrease. The reason being that market participants are switching from fiat currencies to protect purchasing power. For many, silver is a great option because it can be bought in small increments – a trait which crypto like Bitcoin has. With the silver market being smaller than that of gold, the effects of losing market volume would weigh heavier on silver.

All factors are aligning to start seeing the metal start outpacing its yellow counterpart and even supporting further increases for gold. The AI is currently long silver and shorts the GSR supporting the idea that it is silver's time to shine.

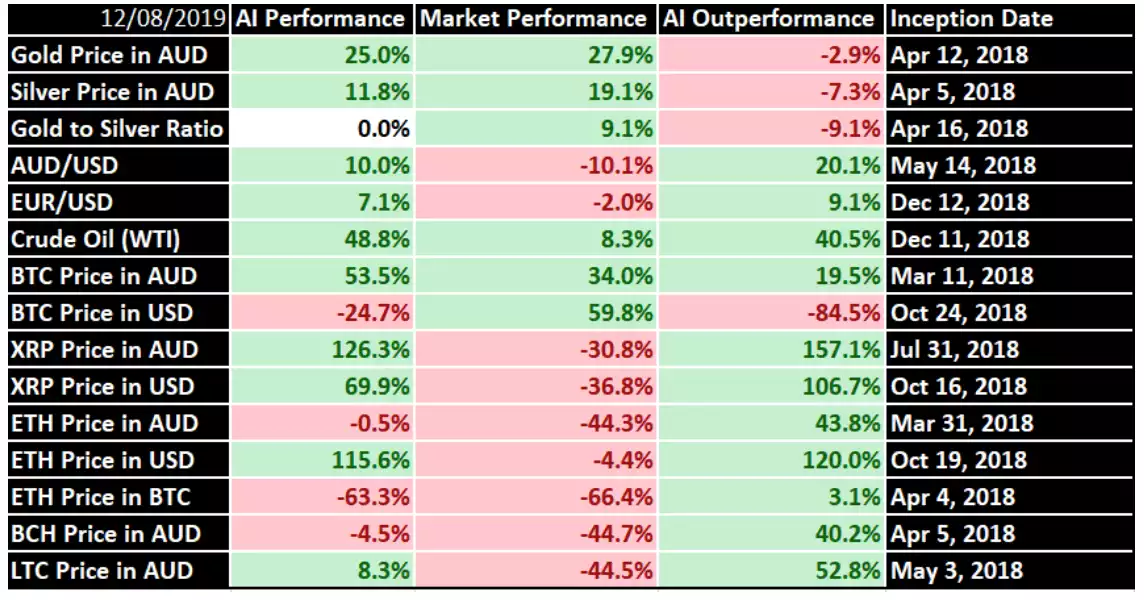

Here are our updated performance figures (as of 19/08/19):