Double Win for Aussie Gold Investors

News

|

Posted 21/07/2021

|

7209

After the heavy losses on Wall Street on Monday night last night saw a bounce back to ‘normal’. Move along, nothing to see here. However there are growing concerns that this was the first warning sign of a market looking decidedly ‘toppy’ and without the safety net of corporate buybacks during the lockout of reporting season. That said, for longer term investors, arguably the more important consideration is the real state of the economy and the Fed’s response to any market correction rather than the correction itself.

In his latest Macro Insiders report, Raoul Pal is doubling down on his call for a global economic slowdown in this second half of the year and the inevitable acceleration of central bank stimulus that will surely ensue. The ‘market of truth’, the bond market, is certainly appearing to agree with his call. To wit “Back in 2019 when the curve was inverted, everyone suggested that it was a false signal (just as they did every other time it inverted!). It wasn’t. By the end of 2019, it was clear to me that we were going into recession (regardless of Covid). The trade wars, driven by Trump, had most likely been the catalyst as global supply chains fractured. Bond markets have a habit of sniffing out economic change well before the market understands what is happening.”

In April of this year we saw the ‘peak’ of early signs of much higher inflation and the economic recovery narrative, and bond yields were accordingly on the rise. That rise in yields from lows in August coincided with the fall in the gold price from its then peak to low in March/April.

The reversal was read by many as the result of the Fed reassuring the market that inflation would be transitory and they had the situation under control. Pal points out that we have seen this EVERY time after a recession:

“As I have shown, following the end of every single recession since 1962, there has been a spike in yields. The market over-extrapolates the effects of monetary and fiscal stimulus and, as the stimulus effects wear off, bond yields usually plummet again...”

“Not only do they plummet, but they have historically gone to new all-time lows! The Fed always stimulates two more times, and the government passes a few more fiscal stimulus packages too.

The market soon realises that an economy that is laden with debts, economic scars and aging demographics, cannot support either higher prices or higher rates. This results in the repricing of yields to new lows, and from there the proper recovery can begin to be priced.

With a near 100% track record of success of an early peak in yields post-recession, I don’t want to bet against this trend. If humans always get too bullish on the economy too early, then they are most likely doing it again now.”

Pal goes on to highlight many factors and existing evidence that this is already playing out. With respect to his paying subscribers lets just look at a few key ones.

Firstly the “credit impulse”, which tracks lending growth as a share of GDP and has been described as one of the most precise leading indicators for predicting GDP growth is plummeting in the world’s top 3 economies and indeed is negative in the US:

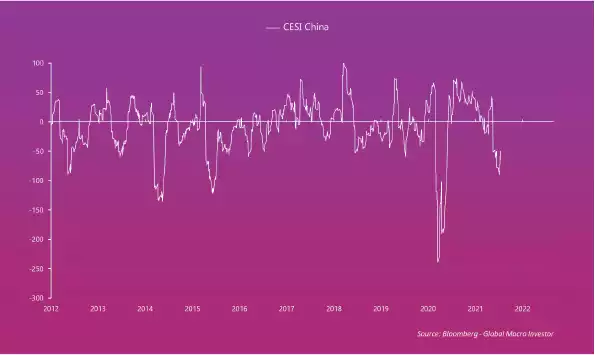

Whilst the US looks to be worse than China, it is the extent of the China slowdown YET to hit the US and indeed the rest of the world that is maybe the most concerning. Citi Banks’ Economic Surprise Index is a measure of the extent to which economic data is either beating or missing expectations. As you can see below, China is now deeply into negative territory and to levels (looking past last year’s recession) not seen since before the crash in late 2015 / 2016.

And going back to the Credit Impulse, Pal overlays the Chinese data with a 12 month lead against the ISM manufacturing index, one of the key measures of the health of the US economy. “And as economic conditions deteriorate in China, it will knock through to the rest of the world, and of

course, the US. The ISM is peaking now and will fall sharply... creating the growth scare I’m expecting..”

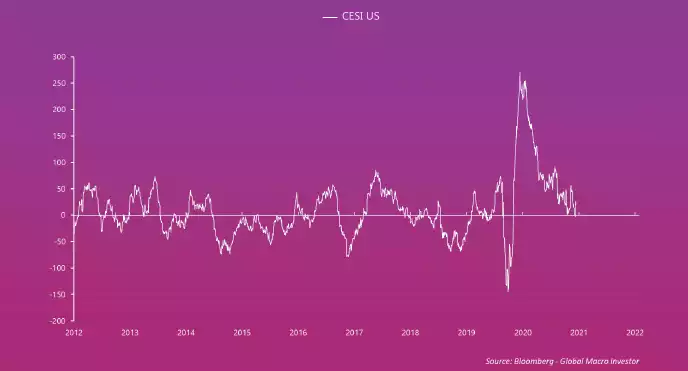

Indeed the Citi Surprise Index for the US appears to be about to break into negative territory after testing the zero line a couple of times already. The ‘experts’ are learning repeatedly that everything is indeed not awesome…

Pal then goes on to share many charts painting a picture of deteriorating sentiment, an indebted aging population, structural disruption to employment, and rising prices without wage growth leading to less consumption stalling this ‘recovery’. And so…

“It cannot be any clearer to me that the US and global economy is going to face a very real growth scare that will become rather apparent over the next six months. This is what the bond market is picking up. I see no evidence of sustained growth or sustained inflation.

So how do we trade this?

Remember the Fed reaction function – if the data gets weak, they stimulate. If the stock market gets hit (because of fears over economic weakness), the Fed stimulates. We also know that if credit begins to try to price in economic weakness, the Fed will buy credit to stimulate.

That means that we might see some sharp corrections in equities and credit, but they simply cannot last. That makes shorting those asset classes a low-quality trade.

Buying bonds makes a lot of sense, but it’s likely to be a slow grind and therefore is not super exciting for me.”

Pal goes on to talk up the US dollar rallying into this weakness. One of the easiest and cheapest ways to buy the USD is to buy USDT off us at Ainslie Wealth. Give us a call to discuss on 1800 987 648 or go to our new website at https://www.ainsliewealth.com.au/

Whilst not covered in this piece, Pal has of late been talking up gold in this environment despite what would traditionally be the headwinds of a rising US dollar. But it is the reason for the rising USD that breaks that trend, as it has done many times. The USD strengthens as the business cycle weakens. This time we are seeing the prospect of a weakening US economy in the context of already zero bound rates, amid already strong QE and with an already massive debt burden. i.e. nowhere to go.

With the prospect of more stimulus from central banks in this setup we head to deeper negative real rates and indeed more outright negative nominal rates and that is very bullish for gold. Despite the Aussie economic custodians jawboning efforts to talk up the AUD as an alternative to raising rates in Australia, the reality is a stronger USD will continue to put downward pressure on the AUD particularly in unison with a weakening China and inevitable correction in ore prices. You may already be seeing the double win now for Aussie gold holders. An increasing USD spot denominated gold price together with a falling AUD sees even greater gains in the local currency. If Pal’s thesis plays out, and the evidence is hard to ignore, that makes now a perfect entry point for gold investors.