Gold & Its Miners Technical Update

News

|

Posted 16/04/2018

|

6409

Gold is now approaching key near-term resistance and a decision point for enthusiasts and agnostics alike. This 1356 to 1366 USD level has been approached several times in the past six months, but has struggled to break through. The logic of trading a breakout is usually the more times the price has touched the resistance, the more valid the level is and the more important it becomes. At the same time, the longer the resistance level remains in play, the better the outcome when the price finally breaks. With this in mind, the 12 month daily chart looks appealing.

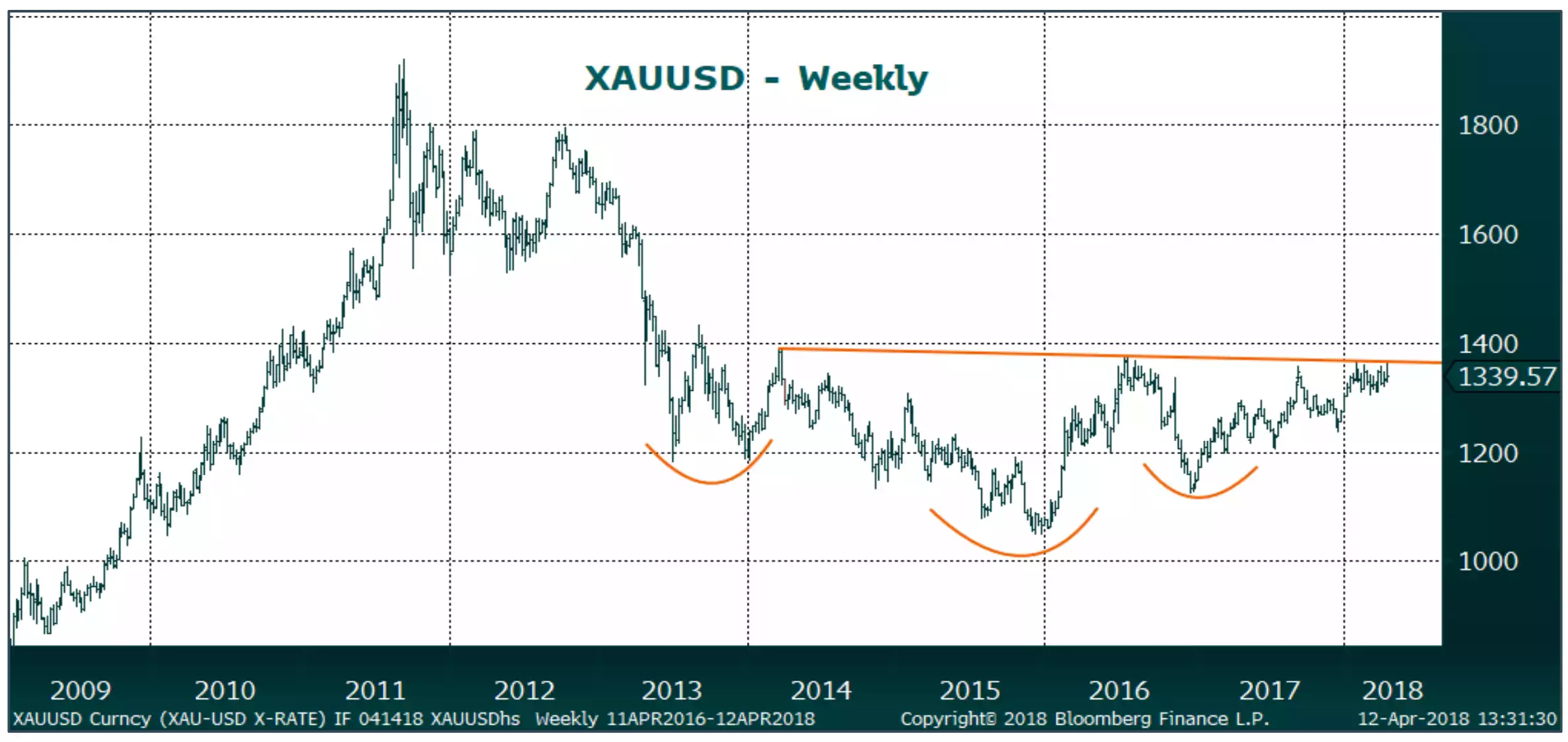

Longer-term we have a large inverse head-and-shoulders pattern in place that has been noticed by the market, but has yet to break. The pattern in the weekly chart has significant resistance in the 1366 to 1375 area, which includes the neckline and the mid-2016 high.

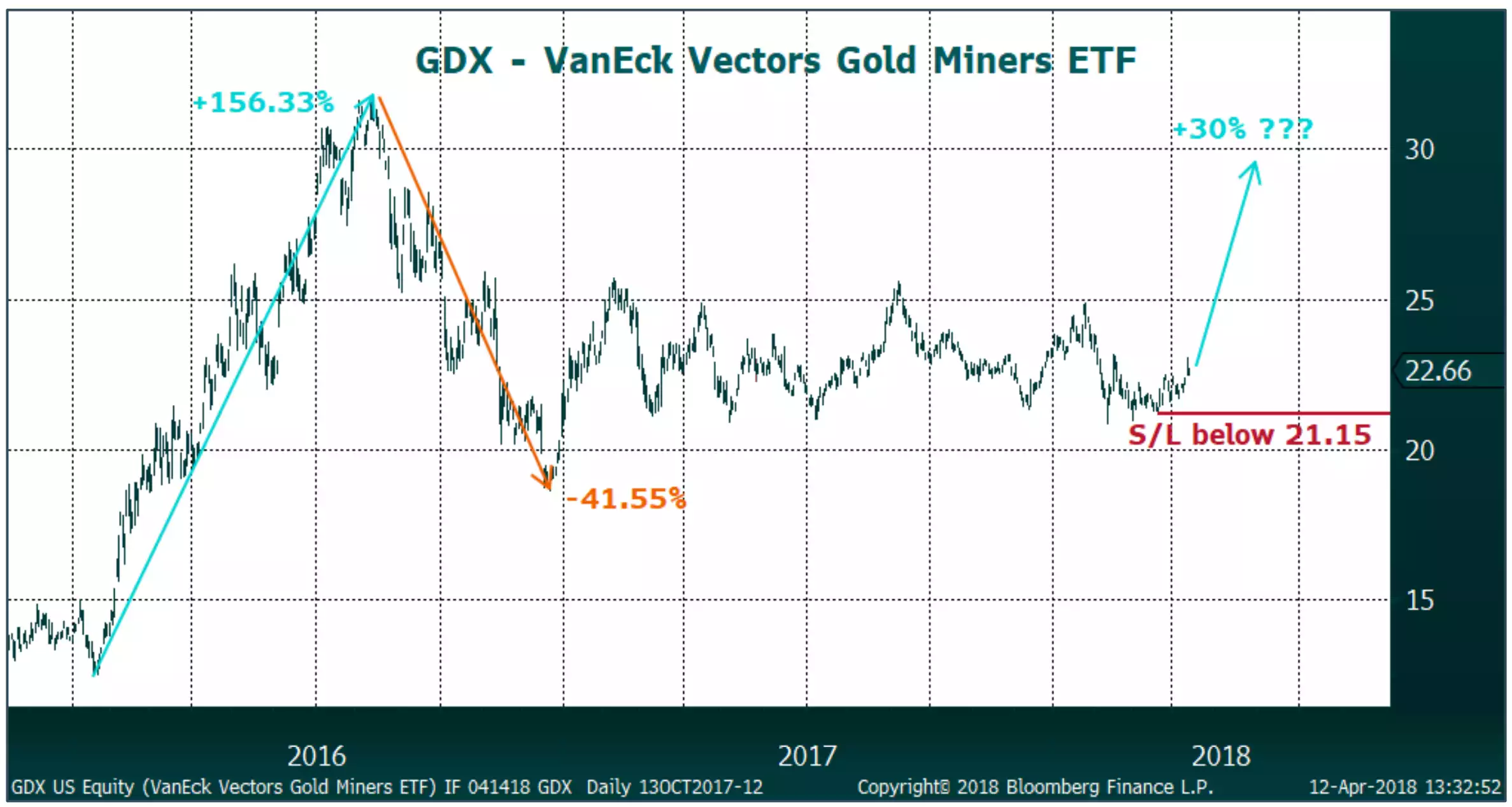

It is certainly possible that this resistance zone holds, but when gold can get moving of its own accord, that is when things can get exciting. If this is correct and a rally plays out in the near-term, the gold mining sector is due a re-rating. Using GDX as a proxy for the gold miners, we can see that the miners are very susceptible to over-reaction (both up and down). For example, they had a spectacular run from the beginning of 2016. Gold had sunk below 1100 and was dangerously close to the marginal cost of production for the higher cost producers. As gold moved away from the disaster zone, GDX took off. It then went too far to the upside.

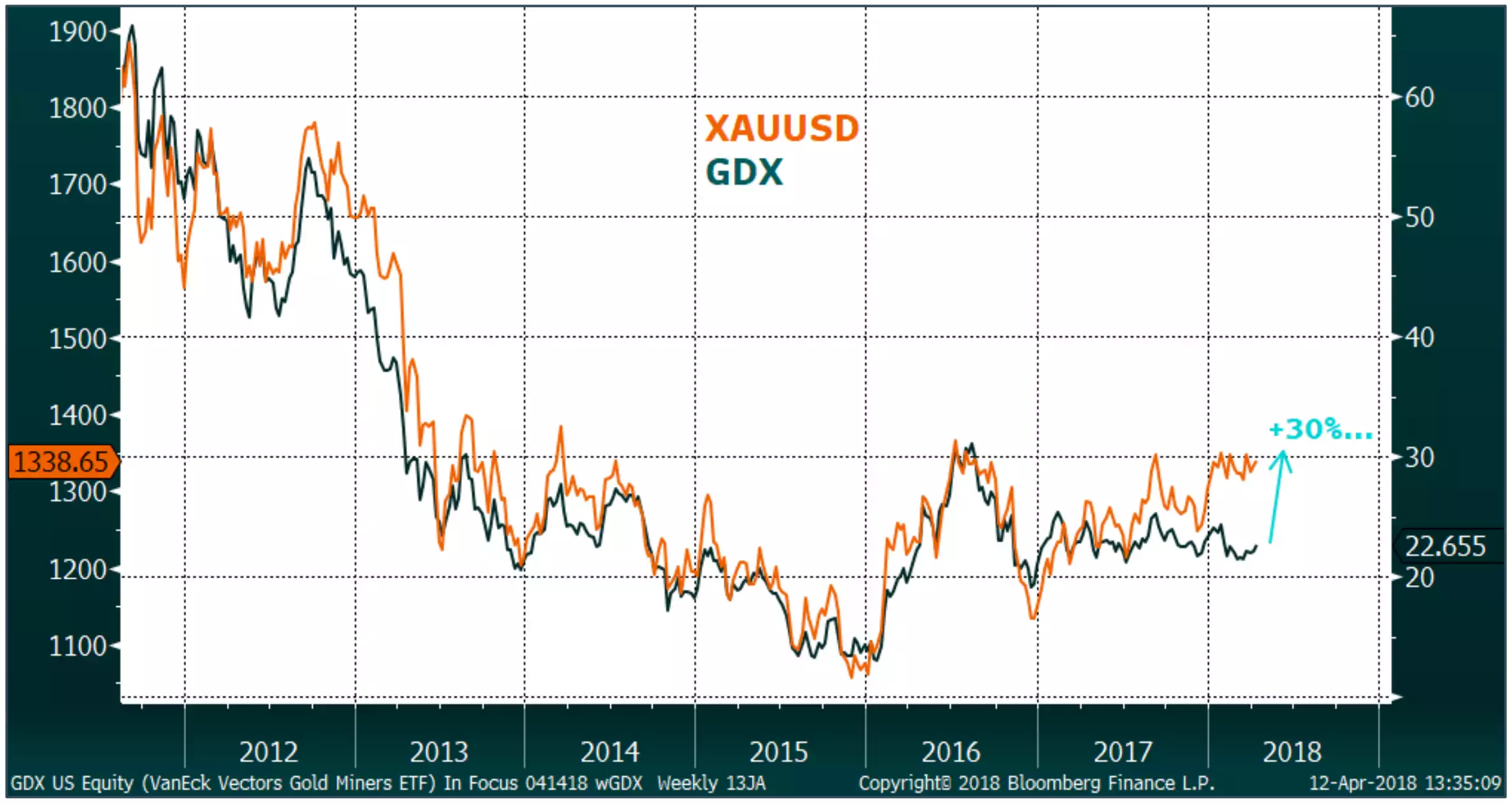

Today gold is back close to the 2016 highs, but GDX is sitting stagnant 30% below its own 2016 high. A spark in the form of a break by the underlying metal price could be just what it needs for a quick, sharp rally back to those highs.

The multi-year time and price correction may not be over, but a break of these key levels will spark a sector rotation that will see money flowing back into the miners, which will further encourage momentum in physical gold, which will further encourage momentum into the miners. A genuine virtuous cycle. The risk relative to reward looks increasingly positive.