US NFP print glitters, but is not gold.

News

|

Posted 08/08/2016

|

5228

Friday’s NFP print of 255,000 jobs for July was met with jubilation with the US spot gold price dropping as a consequence. The official unemployment rate stayed at 4.9% with a minor upward revision to the June figure and a significant upward revision to the intoxicatingly dismal May print of 11,000.

Wolf Richter of wolfstreet.com points out an interesting perspective regarding the jobs data from a per-capita perspective. The US population has grown from a little over 308 million in mid 2010 to a little over 324 million currently according to the US Census Bureau. In 2010 there were 130.1 million NFP compared to today’s 144.4 which represents an increase of only 14.3 million when the population increase over that time was just under 16 million. Mr Richter points out the reality that the US requires a continuous stellar NFP print of a little over 205,000 simply to keep pace with the upward population trajectory. The previously mentioned May print (even after its upward revision) is a glaring indicator of how far short of this benchmark the employment situation in the US is.

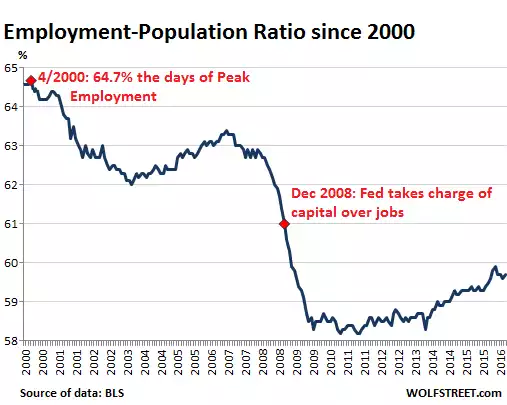

Interestingly, Mr Richter cites the post-dot-com Employment-Population ratio metric as published by the BLS as an indicator that the US is now in a state where population permanently out-paces jobs. The EPR typically and expectedly falls during recessions but classically is restored to top the pre-recession high during recovery periods. Since the turn of the century however, the ratio has never recovered in this fashion with EPR recoveries failing to come anywhere near the pre-recession highs as pictured below. Note that in the last year or so, the ratio recovery has faltered at below 60%

Keep in mind that these observations are based on official BLS figures, the accuracy of which is a topic of contention. John Herrmann of Mitsubishi UFJ Financial Group was one to attribute the unexpectedly high payroll number last week on the ardent and inappropriate use of seasonal adjustment, claiming that the result “overstates strength of payrolls”. In support of this, he cites that July saw a seasonally adjusted private payroll figure 2.5 times that of the unadjusted figure. The ever increasing decoupling of financial markets and economic indicators from observable reality highlights the growing need to reduce reliance on traditional financial vehicles when considering how to allocate private wealth. In support of this idea, we leave you with a recent quote from Mark Leibovit, chief market strategist at VR Trader. “Despite the rosy picture we may hear from financial television and economists, things really aren’t that great out there... I like to hold some gold and silver for diversification, I think that’s a key and I’m big on keeping money out of the financial system as best I can”.