Did Futures Kill Bitcoin?

News

|

Posted 02/07/2018

|

8604

Did Futures Kill Bitcoin?

At the start of the year we discussed the beginning of the bear market for crypto and how insignificant the price drop is when put in perspective. You can read it here.

Bitcoin futures were met with much fanfare in December 2017. Chicago Board of Exchange (CBOE) launched on December 10th and Chicago Mercantile Exchange (CME) December 17th. Anticipation of the respective launches had spread through cryptosphere in advance of CME and CBOE filings with the Commodity Futures Trading Commission (CFTC) on December 1st.

Futures contracts give buyers the opportunity to bet with or against Bitcoin. Yet there is no direct exposure to the underlying asset as contracts are cash settled. However, many lauded the move and took this as a sign of institutional acceptance. Futures gave Bitcoin an air of legitimisation and were one step closer to exchange traded funds (ETFs). More money would come in. Prices would go higher.

The peak on December 17 coincided with CME’s first futures contracts and subsequently the price began its collapse.

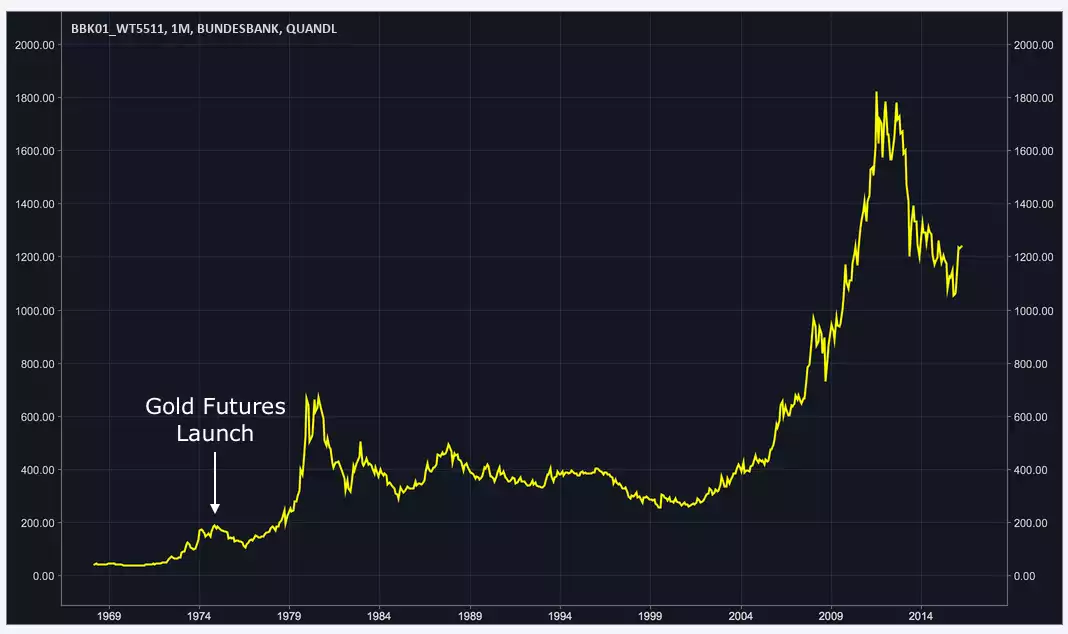

Bitcoin is likened to “digital gold.” There is a limited supply of approximately 21 million coins. Mining becomes more difficult, costly and rewards fall over time (block reward halving). Like gold, Bitcoin aims to become a store of value, unit of account and medium of exchange. And like Bitcoin, gold futures were launched at a time of great interest and all-time highs.

Did Futures Kill Gold?

We recently read some excellent analysis by blogger “OwiWan Kenobit” who drew some very interesting comparisons with what happened after gold futures were introduced back in 1974.

Gold futures were introduced on December 31, 1974 a day after gold reached a new all-time high of nearly $200/oz. Over the subsequent two years gold prices fell reaching a low of $102 on August 31, 1976 representing nearly a 50% loss in value.

The futures launch seemed to have a profoundly negative impact on the price of gold. But futures didn’t kill gold.

Gold’s all-time high at futures launch is now just an insignificant dip on the chart. After the initial correction price rapidly appreciated leading to two clear major sets of peaks. One cluster in early 1980 and a series of peaks in 2011-2012.

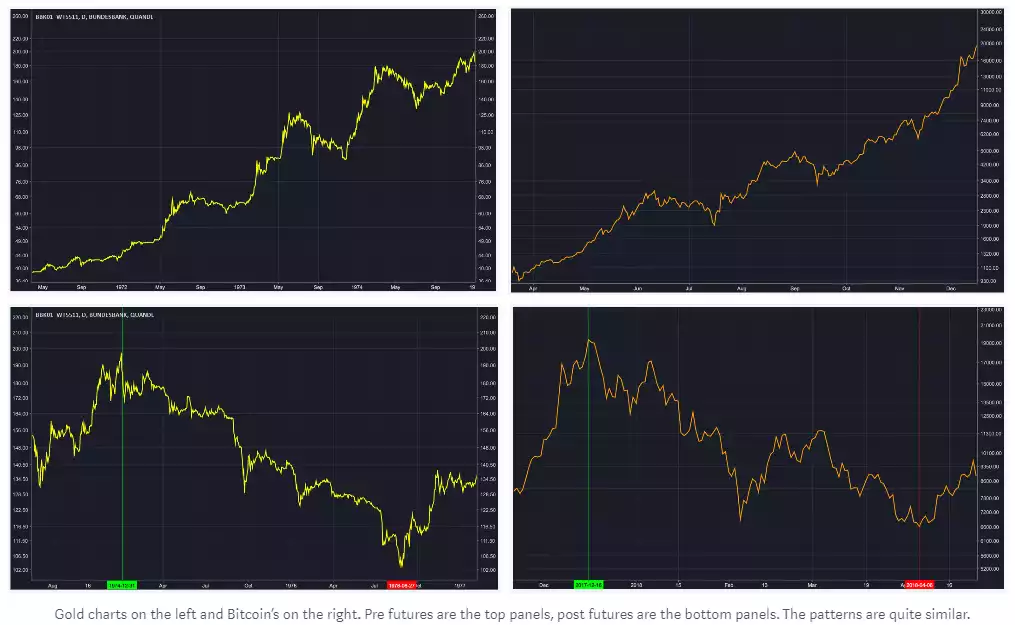

In the Bitcoin chart below we see a pattern similar to the post futures gold chart playing out over a much shorter time period. Price peaked on the day the first CME futures contracts traded and over the next 117 days fell to a low of $6700 representing nearly 70% loss of value.

Here are the charts side by side (gold on the left):

If Bitcoin continues to follow this script as closely as it has in these charts then it may well exceed its all-time high in the not-too-distant future as well.