2019 & 20 Gold, ETFs v Fully Allocated Tokens

News

|

Posted 24/01/2020

|

15456

Today we discuss gold ETF’s hitting ATH’s in 2019, gold’s 2019 performance, 2020 predictions and share our interview on Trader Cobb putting those ETF’s into perspective.

Earlier this year the World Gold Council released their figures for global gold ETF holdings which saw a 14% increase in 2019 to reach all time highs. From WGC:

“Global gold-backed ETFs and similar products had US$19.2bn, or 400 tonnes(t), of net inflows in 2019 in almost all countries, after holdings rebounded in December. Collective ETF holdings reached all-time highs of ~2,900t in the fourth quarter. Overall, global gold-backed assets under management (AUM) grew 37% in US dollars during the year as a result of positive demand combined with an 18.4% increase in the gold price.”

In their summary of 2019 performance they summarised:

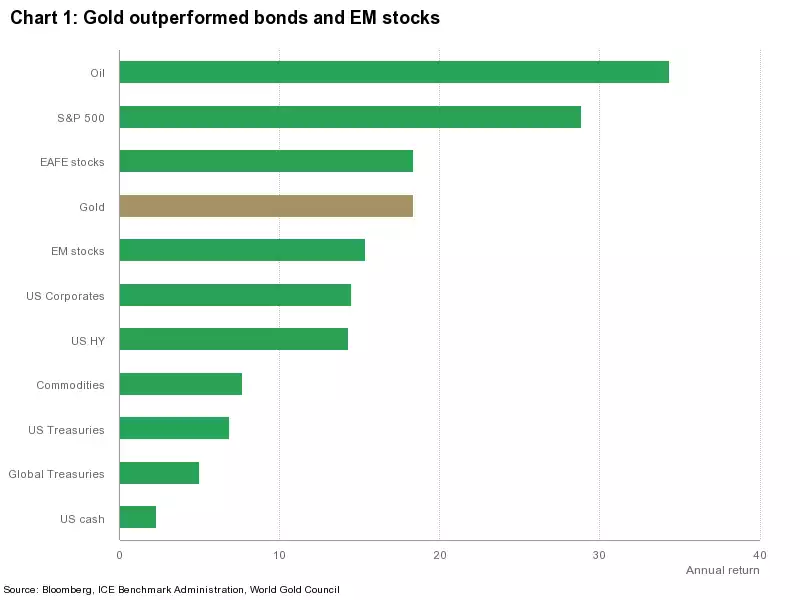

“Gold had its best performance since 2010, rising by 18.4% in US dollar terms last year. It also outperformed major global bond and emerging market stock benchmarks in the same period (Chart 1). In addition, gold prices reached record highs in most major currencies except the US dollar and Swiss franc (see Table 2 in the Appendix).

Gold prices rose most between early June and early September as uncertainty increased and interest rates fell. But investors’ appetite for gold was apparent throughout the year, as seen by strong flows into gold-backed ETFs, growing gold reserves from central banks, and an increase in COMEX net longs positioning.”

And in terms of their forecast for 2020:

“We expect that many of the global dynamics seeded over the past few years will remain generally supportive for gold in 2020.

In particular, we believe that:

- Financial and geopolitical uncertainty combined with low interest rates will likely bolster gold investment demand

- Net gold purchases by central banks will likely remain robust even if they are lower than the record highs seen in recent quarters

- Momentum and speculative positioning may keep gold price volatility elevated

- And while gold price volatility and expectations of weaker economic growth may result in softer consumer demand near term, structural economic reforms in India and China will support demand in the long term.”

We will expand on their 2020 forecast on Monday, but there are a couple of things above to consider now.

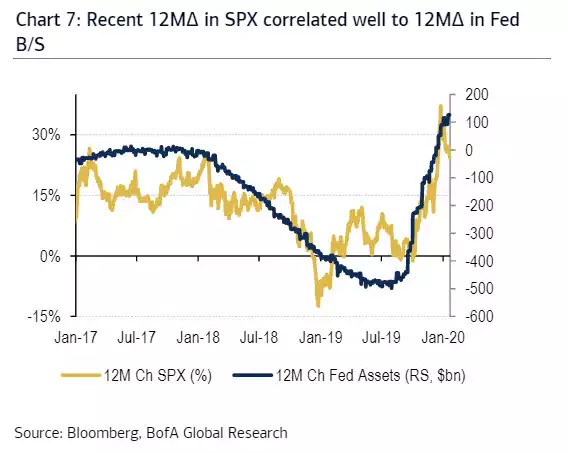

We have written a bit this week of the aforementioned ‘momentum and speculative positioning’ dynamic at play at the moment. US shares in particular at the moment are all about momentum and speculation of continuing Fed stimulus, not fundamentals. We came across the following chart which really puts this clearly into perspective. It’s the 12 month change in the S&P500 against the 12 month change in the Fed’s balance sheet (remembering their balance sheet ‘expands’ with the ‘assets’ being bonds (debt) they buy with freshly printed money… without any nasty liability being recorded of course….).

The other point we will make, yet again, is the growth of ETF’s as a means of buying gold, particularly to buy and sell easily if you want to play that aforementioned price volatility. We won’t go over the dangers of ETF’s again, this was well covered in our article here, but when you are buying one of the few assets without counterparty risk, we query why enter the opaqueness and unaccountability of ETF’s to do so.

Topically, we recently did an interview with the trading guru Trader Cobb and discussed our Gold Standard and Silver Standard tokens as an alternative as well as security, drivers of the markets etc. This aired yesterday and you can listen or watch on each of the following links.

Podcast

Apple Podcast

YouTube