Big Tech Insider selling on Wall Street breaking records in 2021

News

|

Posted 10/12/2021

|

6700

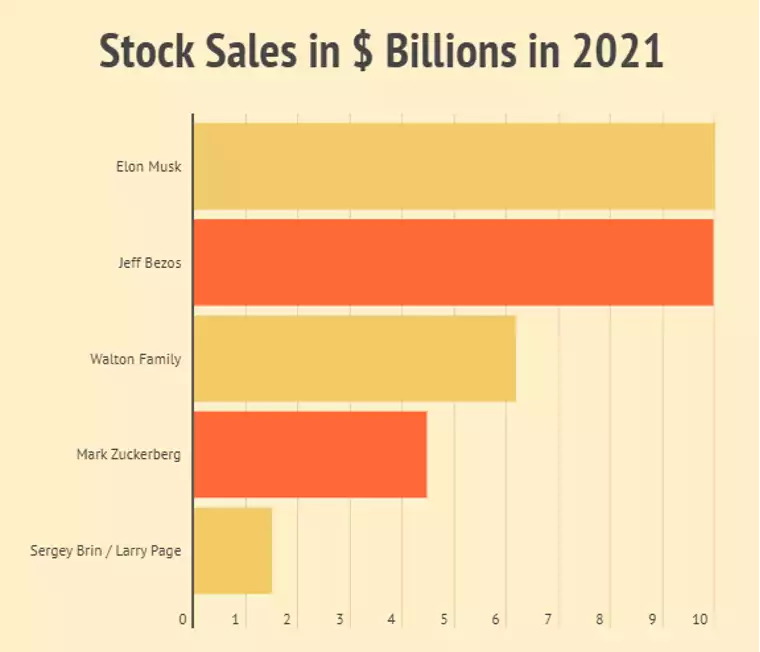

Corporate insiders have sold a record US$69 billion in stock in 2021. Big names include Elon Musk selling $10 bn in Tesla shares, Bezos parting with $9.97 bn of his holdings and Facebook founder cashing in $4.47bn. This comes as net credit balances in margin accounts shatters all time records. Where is the smart money moving as we close in on Christmas?

Other noteworthy sellers were Microsoft’s CEO Satya Nadella, who liquidated just under half of his MSFT holdings. The total amount sold is expected to continue to gather steam as tax season picks up. Investors often sell in December for tax purposes which adds additional selling pressure to most equities. As it stands however, the 2021 total has put on 30% above and beyond the 2020 year total.

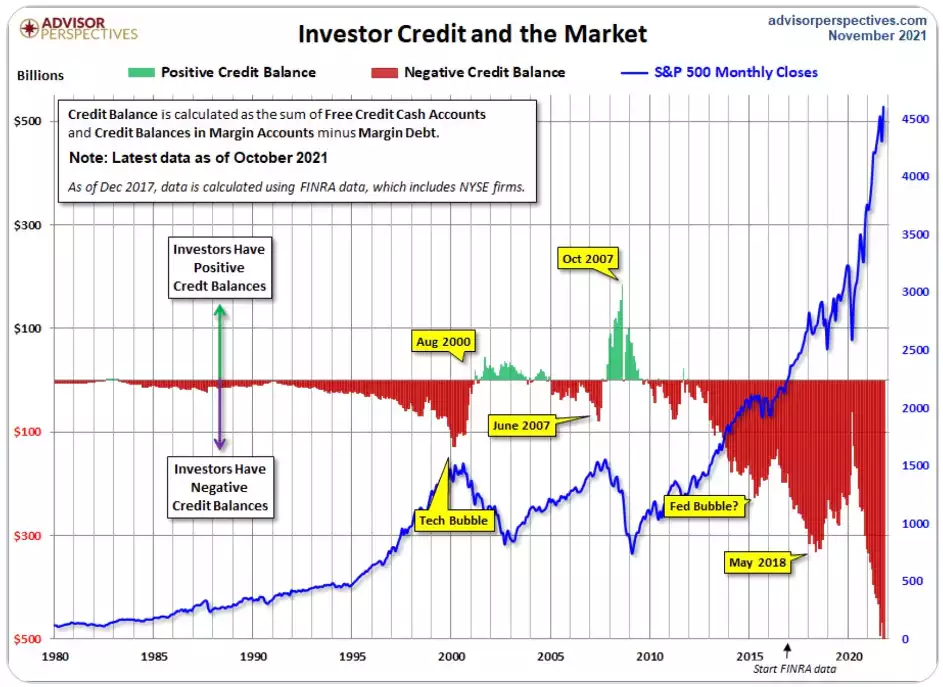

While insiders may sell for a variety of reasons, such as funding new ventures or giving to charitable causes. Avoiding new capital gains taxes set to be introduced from 1 Jan, such as the 7% increase on CGT gains above $250,000 in Washington, are likely to weigh on investors in that state. However, it’s also impossible to ignore market timing, with the stock market sitting at record highs with record PE multiples, a major correction, if not crash, could well be on the cards.

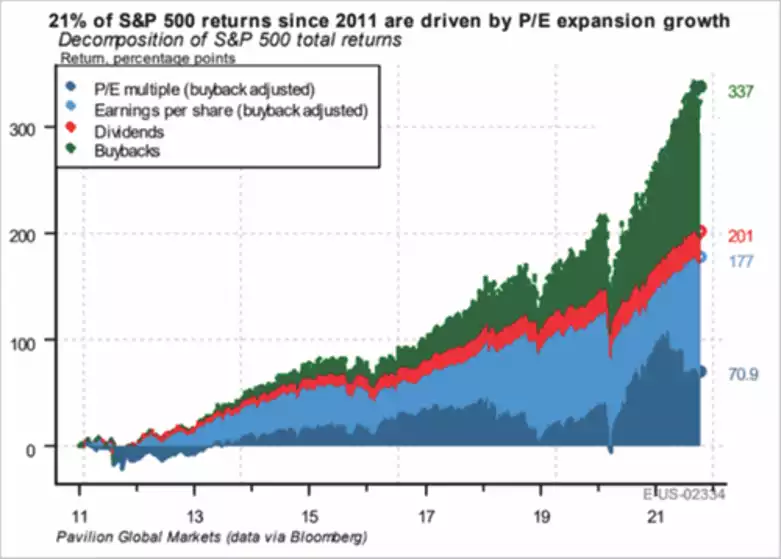

What makes this a little harder to digest is that at the same time these companies are using shareholder cash to buy up their own shares, further inflating the price and no doubt helping those fat bonuses… Pavilion Global Markets have calculated the 40.5% of the S&P500’s returns have been courtesy of buybacks!

Earlier this week we saw the damage that can be done when leveraged longs get cleared out. Traditional markets look precarious with new records of Negative Credit Balances in Margin Accounts lining up nicely with the movement of the major indices. Major short covering and margin calls in March of 2020 briefly brought the balance closer to parity, but as leverage in the system has ramped up since then, we can see how the stock market has pumped.

Smart money selling out of the big tech names may be looking at charts like these and deciding to cash in on some of their hard earned paper gains. If you take these top 5 tech companies out of the S&P500, it would be DOWN 25% this year! That is how much they are dominating and that is how distorted their price is. If you can take profit and put the unwitting in deeper via buybacks, well then….

Some of the funds may be rotating to counter cyclical plays. In November, gold ETFs saw net inflows in November of 14t (US$838mn), the first since May.