Big Gold Outflows, Big Bitcoin Gains – “Hedging Goldilocks”

News

|

Posted 23/11/2020

|

6161

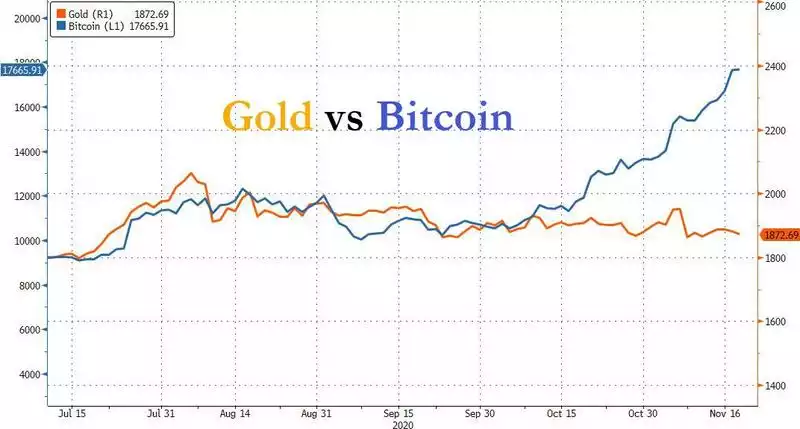

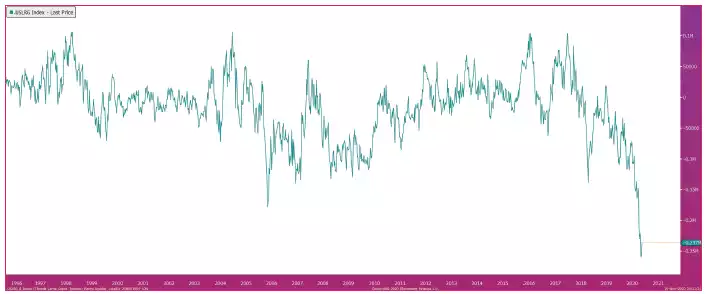

As gold has tracked sideways for the last few months Bitcoin has been grabbing attention since it started taking off last month with the weekend seeing it a whisker off taking its December 2017 all-time high of US$20,000, sitting at US$18,500 at the time of writing. Since hitting its all time high of US$2060 in August this year, gold has come off slightly and held strong above $1850 since. You can see this disconnect playing out in the chart below:

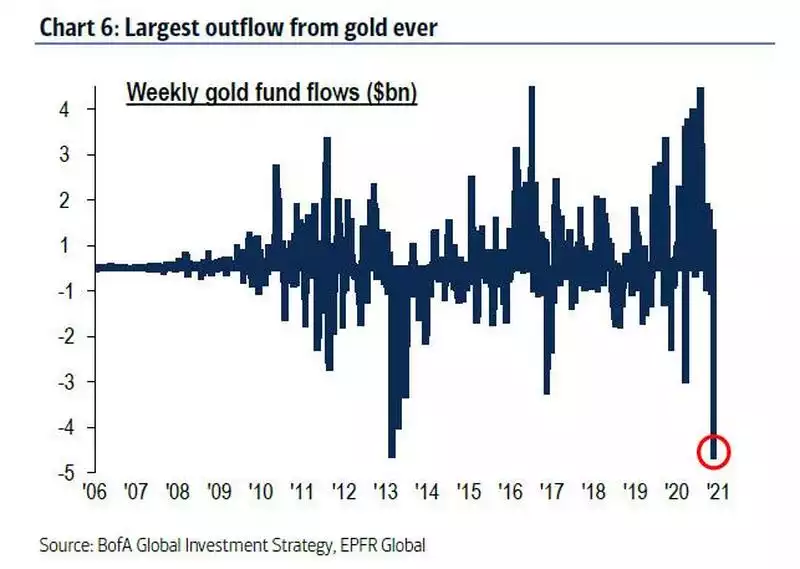

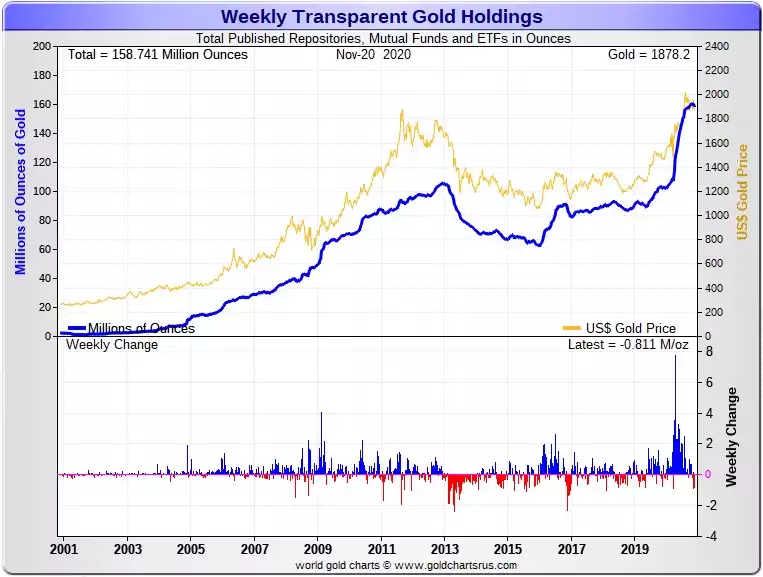

Whilst flows of gold into ETF’s had slowed in the most recent WGC report, Bank of America Merrill Lynch (BofAML) just reported what they calculated as the biggest weekly outflow (by value) from gold ETF’s on record last week at nearly $5b.

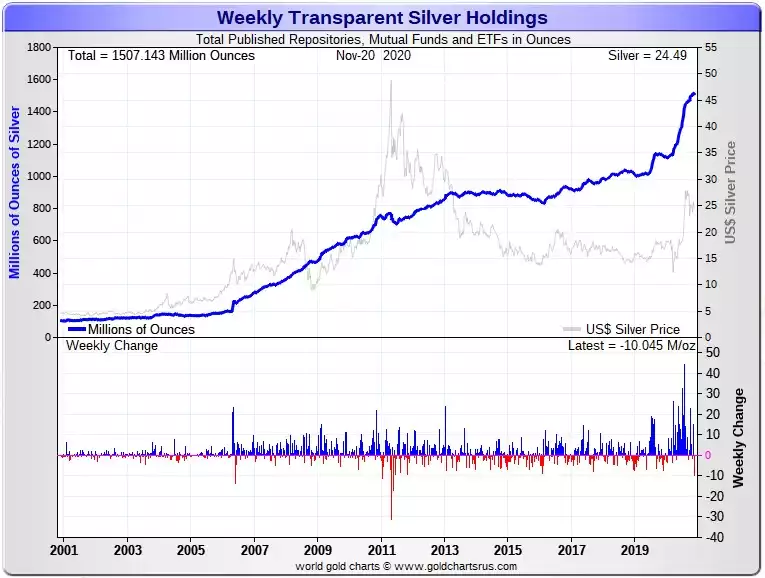

By weight it was nowhere near the highest but still significant per the charts below of weekly gold and silver flows in ALL transparent holding which include ETF’s and COMEX and other reporting entities.

In presenting that gold outflows chart above, BofAML warn this is likely transitory as the realisation that the “uber-Goldilocks” scenario (playing out through gold outflows) where the market believes in 2021 being “a year of vaccine not virus, a year of reopening not lockdown, a year of recovery not recession” is unlikely to materialise. Instead they see what they call the “Hedging Goldilocks" scenario with both metals and bitcoin surge higher on the realisation of:

- supply bottlenecks in goods, services, labour fails to keep up with an unexpected surge in demand,

- excess debt (global debt now $277tn or 365% GDP) causes US dollar debasement,

- Fed desperation to prevent disorderly rise in bond yields sparks self-defeating/disorderly asset price inflation;

JP Morgan joined in predicting a double dip scenario of a negative 1% GDP print next quarter on the back of the second wave in the US. Their chief economist, acknowledging purely monetary stimulus and pent up demand had powered the US economy through the July coronavirus wave went on to say:

"at that time the reopening of the economy provided a powerful tailwind to growth. The economy no longer has that tailwind; instead it now faces the headwind of increasing restrictions on activity." and "the holiday season—from Thanksgiving through New Year’s—threatens a further increase in cases. This winter will be grim, and we believe the economy will contract again in 1Q, albeit at “only” a 1.0% annualized rate."

Whilst optimistic of a bounce thereafter it is on the assumption of more fiscal support, which given the impending political tie up between the house and senate and last week the US Secretary of the Treasury controversially ending the Fed’s crisis lending tools, looks more and more unlikely and hence their proviso:

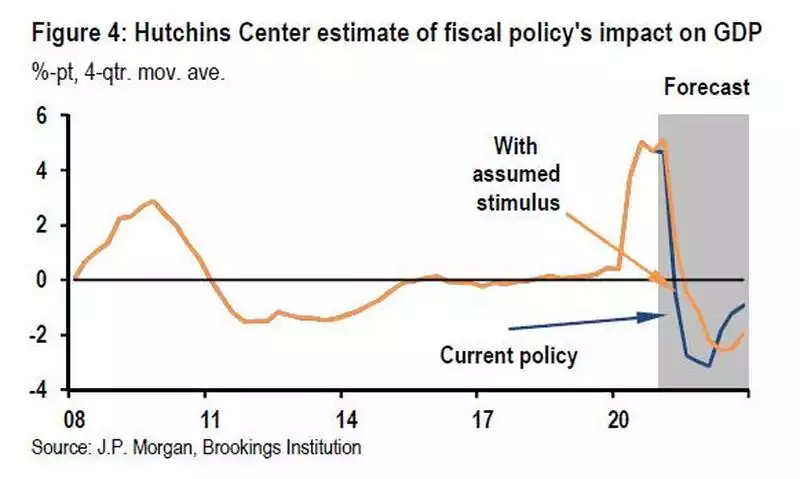

“If instead we get no further fiscal support, this year’s massive fiscal thrust is set to turn to fiscal drag. For example, Figure 4 [below] presents the fiscal impact measure developed at the Hutchins Center at the Brookings Institution. If we get the fiscal support we expect, that drag gets dampened and pushed back, allowing a vaccine more scope to boost growth.”

Interestingly it was only a month ago that JP Morgan said that Bitcoin could double or triple in price which at the time was US$13,000. They also saw the potential for younger people to be more likely to buy Bitcoin over gold as their hard asset play.

Ainslie Wealth makes swapping between bullion and crypto extraordinarily easy, seamless and well documented for your accountant or SMSF and there certainly has been a rotation happening of late. Of course we also just as easily and securely trade crypto for and with AUD up to any amount and by bank or cash.

What is clear however is that whilst Bitcoin, Ethereum et al are shooting the lights out now, there appears little on the horizon to suggest gold and silver won’t again join the party of “Goldilocks Hedge” that BofAML talk of. When you see such big market sentiment moves with so many obstacles in the way it is often good to think contrarian. Raoul Pal summed it up nicely in his latest:

“Just remember, the speculative short position in bonds is the largest in all recorded history. If those speculators are wrong and reflation isn’t coming, there will be a blood bath as short positions get stopped out...”

Concluding:

“It’s going to be an ugly winter. Let’s try to make some money in a bad situation.”