Margin Debt Spikes – What Happens Next?

News

|

Posted 21/03/2018

|

8300

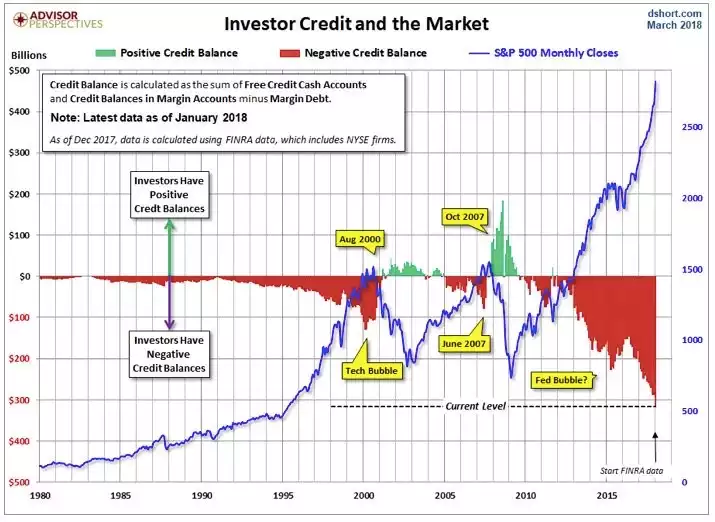

On Monday we wrote about the illusion of growth bought largely with public debt. That, however, is only part of the story because of course there is personal debt in the equation as well. Without even getting into mortgages, car loans, etc there should be no more concerning debt related graph than the following snapshot of the amount of margin loans (red bars) behind this new all-time high US sharemarket…

Not only is that debt at an all-time high, that high is currently spiking, more than 3 times more than before the GFC and well over twice that of the dot.com bubble. Now look again at the blue line of the S&P500 price and ask yourself honestly if that looks to be in the final ‘parabolic’ phase of a meteoric rise… When a market is so leveraged into shares with margin debt, any sizeable ‘shock’ to that market means margin calls against those loans. When people are ‘all in’ because ‘everything’s awesome’ that pretty much leaves shares as their only means of liquidity to pay those margin calls. That means of course they need to sell more shares at the very same time the market is already falling and hence exacerbating the falls. Those that don’t have margin debt calls to pay will still likely be running for the exits, going to cash per the green bars in the chart.

In the context, however of many trillions of dollars exiting the market in a crash, those green cash account bars are relatively very small. It is the rush to gold and silver, the uncorrelated, hard, safe haven assets that makes pre-emptively positioning into them all of a sudden make enormous sense. That’s not to say that gold and silver don’t get sold down in that initial liquidity squeeze; they probably will. We saw that in the GFC where gold fell with everything else. However once that initial liquidity squeeze was over gold went on to finish the GFC almost doubled in price and shares finished it almost halved.

Thinking you might be clever and wait to buy that dip in metals may be harder than you think though. As we saw just in that first market ‘hiccup’ you can see in the graph above in 2015, buying gold and silver at that time was exceedingly difficult as the supply of real, physical bars and coins was very quickly snaffled up in the panic. Refiners were cleaned out and premiums jumped considerably in response.

We are reminded of one of our favourite quotes:

‘Better a year too early than a day too late’