Indian Silver Demand Surging

News

|

Posted 22/03/2019

|

5456

Whilst India is performing better than most countries in terms of economic growth its government is not immune to the same spending bribes to get re-elected and so is wooing the country’s 120 million struggling farmers with 750 billion rupee in cash handouts.

The proposal sees 6000 rupees every year in 3 equal instalments. In AUD terms that is only around $122. Last month around 10m farmers got 2000 rupee as an initial launch of the program. Because of the relatively modest amount and because that gold:silver ratio is still at a nose-bleed 85:1, it is seeing near record buying of silver over gold given the relative value.

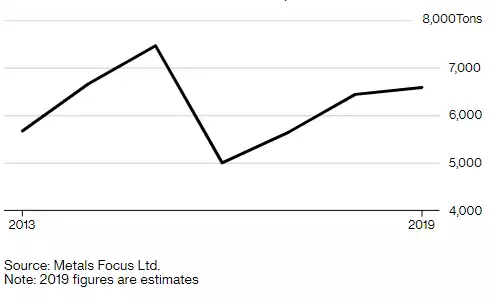

Metals Focus Ltd just released a report saying 2019 silver demand in India is set to hit 6,590 tonne, its second highest level in history and up from an already high 6,442 tonne in 2018. 2015 saw an all-time record of 7,461 tonne of silver as the world’s previous biggest consumer of gold turned to silver.

From Bloomberg

“Chirag Sheth, an analyst for the London-based research firm, said in an interview in Mumbai. The demand recovery will continue over the next few years “because of economic growth, higher income, and relatively low silver prices and penetration of sterling silver,” he said.”

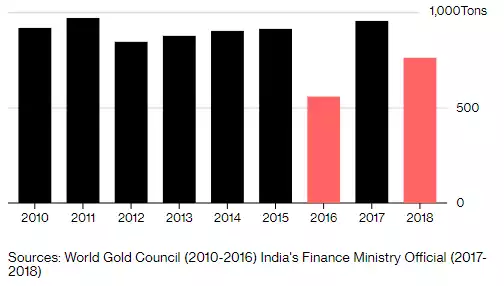

As prices of gold rise this trend could be exacerbated as the ‘cheaper’ metal becomes more attractive. Last year saw a drop in gold consumption in India.

From Bloomberg:

“Demand for gold, almost all of which is imported, has been declining in India as a slump in the rupee made the metal more expensive in the price-sensitive market. A liquidity crunch and government measures to curtail consumption have exacerbated the decline. In dollar terms, bullion has recovered since August as global investors seek protection from equity market volatility, risks of slower growth, and the chances of fewer U.S. interest rate hikes.

“The trend has been weak as far as demand is concerned,” said Gnanasekar Thiagarajan, a director at Commtrendz Risk Management Services Pvt. Ltd., referring to Indian consumption. However, the outlook may change in favor of gold in the first half of 2019, with demand expected to rise up to 20 percent as purchases for investment may pick up, he said.”