Australia’s New Debt Record Portends Trouble Ahead

News

|

Posted 20/11/2019

|

17899

A NAB survey has revealed that old habits die hard. After reigning in debt fuelled spending post the ‘wakeup call’ that was the GFC, it seems Aussies are piling back into debt again at a record rate. That this comes amid low wage growth (as we reported yesterday) has seen debt to income levels reach a new all-time high. Australian households now have more than twice the debt than their annual income (202%), up an eye watering 66% on the 120% it was just at the beginning of this century. Only the Swiss exceed this, and not by much. By quantum we’ve borrowed an incredible $2.5 trillion.

The latest ANZ-Roy Morgan survey has consumer confidence at a 2.5 year low on concerns about the economy, and yet borrowing increases? Apart from piling more into property, that contradiction of fear and yet more debt also indicates a drawing down of equity against the home to fund consumption. So what could possibly go wrong?

NAB senior economist Kieran Davies notes "High debt levels leave households vulnerable to any shock to the labour market and underpin high debt-servicing ratios,"

ABC’s 7.30 Report this week has been running a 4 part series by their economist Alan Kohler on the dim state of the Australian economy. Gerard Minack, economist and principal at Minack Associates, told 7.30:

"Why are Australians so in debt? Because we went out and bought houses.

Not built houses, went out and bought them and pushed the prices up to among the most expensive in the world.

It is literally a house of cards.

Ultimately, now, the best way is a slow and steady decline in house prices relative to income. I guess a benign scenario would be perhaps small little corrections, not unlike what we've had.

I think we would be pretty lucky to get away with that, because these house prices are now at such a high level.

So you better have your fingers crossed and hope we don't have another recession for the next 10 years because that's how long it's going to take.

If we do have a recession in that interim period, wow, housing is really a risk."

The threat doesn’t just come from within either. The fact is, a lot of our debt is sourced from overseas. Dr Ian Manning from National Economics, via ABC warns:

“Dr Manning says the ultimate flow-on from continued high debt levels is the risk of a financial and economic crisis if Australia's overseas creditors get nervous about our ability to repay what we owe them on time and in full.

"If foreign lenders begin to take a dim view of Australia and, particularly, its banks, they'll be reluctant to reinvest, they may require a higher interest rate, they may, in the last instance, simply refuse, in which case you've got big problems," he says.”

The point above about buying existing homes not new ones is critical to the broader economic equation. Our government continues to try and push more and more people into housing and the RBA, who look set to cut rates again in February and possibly even next month, are happy to facilitate that with lower debt costs (for now). The government’s agenda is to support our property sector, our second biggest, but if people aren’t buying new homes that does nothing more than push up prices. SQM Research just reported too that we are seeing a decline in both dwelling commencements and approvals (meaning less in the pipeline):

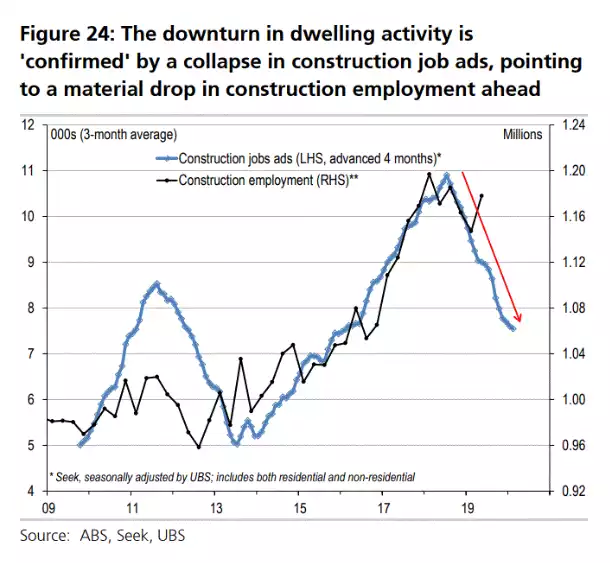

“To make matters worse, building approvals are still tracking south and are considerably lower than commencements. This means even more housing construction job losses are on the way over the course of 2020 and likely, 2021. This will happen despite the interest rate cuts, tax cuts and easier lending standards. As the building approvals illustrate, there has been no response as yet in the form of higher demand for new housing.”

This is a relatively fresh move and one not being fully appreciated or reported on. The canary in the coal mine however is job ads for construction:

So what does all this mean for investors? As we showed yesterday, traditional hard assets such as property and gold have been safe havens for economic turmoil over centuries. However one is now coming off lows and one is looking perilously at the top. One can be bought and sold in small, more liquid amounts, and one must be bought and sold in whole. One can be bought and sold in minutes, one can take months in a difficult market to offload. One is available to anyone on any budget wanting to protect their and their family’s future and one has a high barrier to entry.

Commentators increasingly talk about the broader population ‘sleep walking’ into the coming crisis. It’s time to wake up and protect your future.