Australia’s Double Hit of Unemployment and Immigration

News

|

Posted 20/04/2020

|

19010

Whilst anecdotal sentiment seems to exhibit a feeling of the worst having been behind us as infections plateau and initial talks of easing restrictions gain traction, the economic reality is far, far different. The challenges facing the Aussie economy amid this virus crisis are amongst the worst in the world on some measures. On Friday we discussed the initial data on our housing market and the weekend has revealed more evidence to back up the reality.

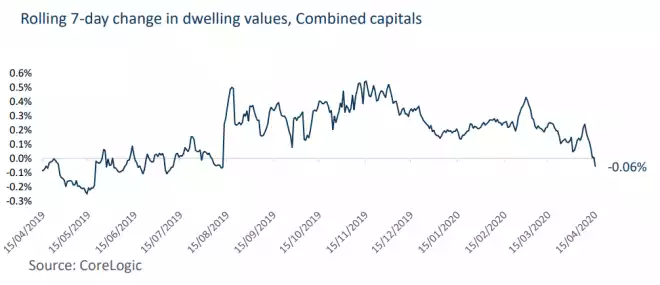

CoreLogic’s hedonic index rolling 7-day dwelling values for capital cities slipped back into negative territory:

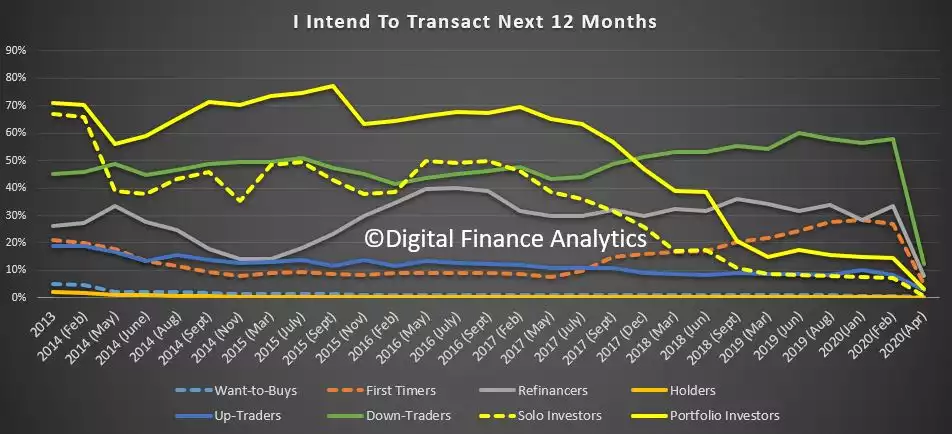

Digital Finance Analytics’ survey of 52,000 Australians shows a nosedive on the all important “I intend to transact next 12 months” question after what has been a general downward trend since 2017:

That may be the early evidence but let’s look at the structural drivers. Arguably 2 of the biggest influences on house prices are immigration (new participants are vital to any Ponzi scheme) and unemployment. It is often said that property really only falls in value in large order if employment drops and mortgages can’t be paid, forcing sales. Otherwise why would you sell? This virus has seen both these key determinants in property values simultaneously hit, and hit hard.

CBA are now predicting 10-20% falls in residential property prices.

“The usual underlying demand pulse from net overseas migration has evaporated because the border is shut.

“New lending is expected to contract, buyer expectations have adjusted downwards from exuberance to pessimism, rents are likely to fall, auction clearance rates are expected to remain weak and turnover will be lower than usual.

“The net result means that price declines are inevitable.”

Domain’s George Megalopolis states:

“…More than half the nation’s population growth since 2005 has come from overseas migration, and the skilled program has been the dominant driver of the economy for the past decade.

Even a single year without migration could unleash an economic and social catastrophe, as country towns see their populations decline in absolute terms and the growth rates of capital cities are reduced to near zero. For a conservative government this poses both a practical and ideological challenge. The absence of new arrivals this year will deny them a valuable tool of intervention to reinforce the health systems of regional Australia. A second year without new arrivals would thwart any plans to promote decentralisation in recovery.

The view across the Morrison government is that overseas travel and mass migration will be the very last things to be restored to our way of life, long after public infrastructure projects resume in our cities and regions, workers return to their factories and offices, restaurants reopen, students are back in the classroom, and adoring crowds once again fill the theatres and sporting stadiums.

…Either way, Australia faces the prospect of two, or even three years without the stimulus of mass migration.”

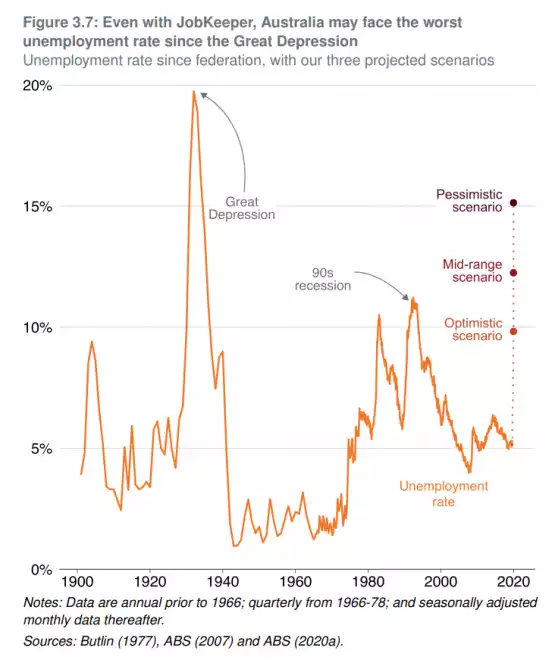

We then see the headlines today of the respected Grattan Institute predicting unemployment far in excess of the government’s already bad 8% prediction. They are predicting 10% to 15% unemployment, some 1.9 to 3.4m people, and note that this is understating it as the $1500 JobKeeper program will mask the true numbers as people are kept on the employer’s books even though they are not working. In real terms they are seeing 14% to 26% out of work in the coming weeks.

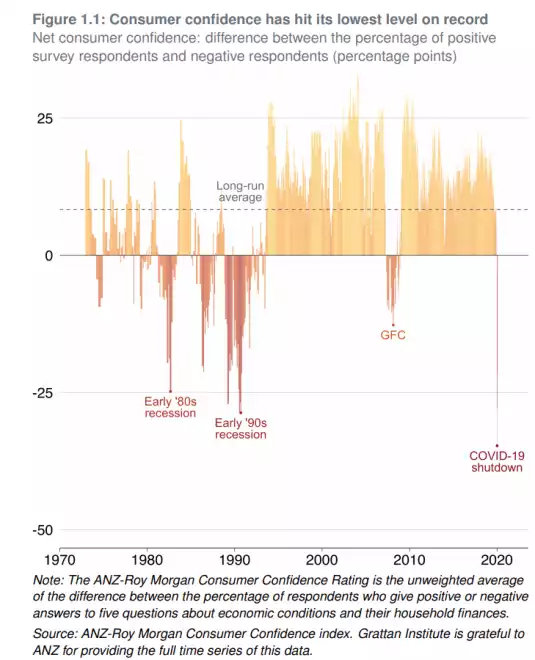

To put this into perspective they map a consumer confidence picture, the worst on record:

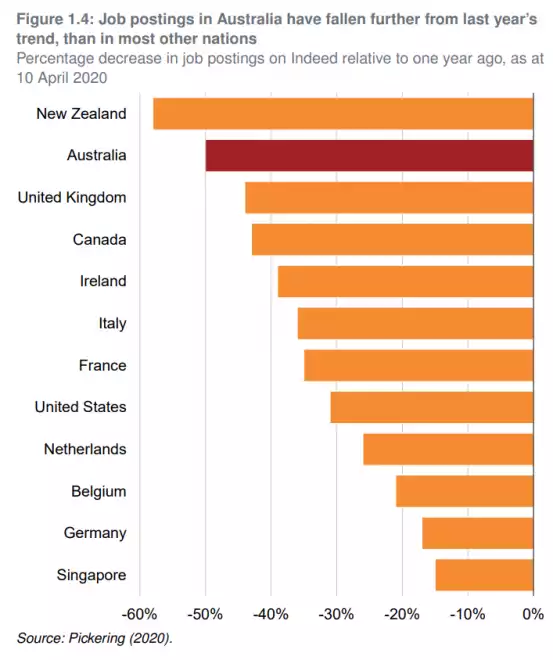

Falling job ads worse than nearly any other country other than full shut down NZ:

For perspective that puts all but their optimistic 10% as the worst unemployment rate since the Great Depression.

And even their pessimistic scenario could be underestimating the severity:

“And the ultimate effect of the COVID-19 crisis on employment, and economic activity, could well be larger than we estimate. Firms and households not initially affected by public health measures will scale back their spending to preserve cash flow in the face of an extended downturn. Meanwhile Australia faces a synchronised slowdown among our major trading partners, adding to the economic hit from COVID-19.”

Last time in the GFC China came to our rescue. Well China just printed its worst GDP since records commenced in 1992, down 6.8%. To paint the broader picture; Industrial Production fell 8.4% YTD YoY, Retail Sales fell 19.0% YTD YoY, Fixed Asset Investment fell 16.1% YTD YoY, and Property Investment fell 7.7% YTD YoY. Don’t look to China to get us out of this.

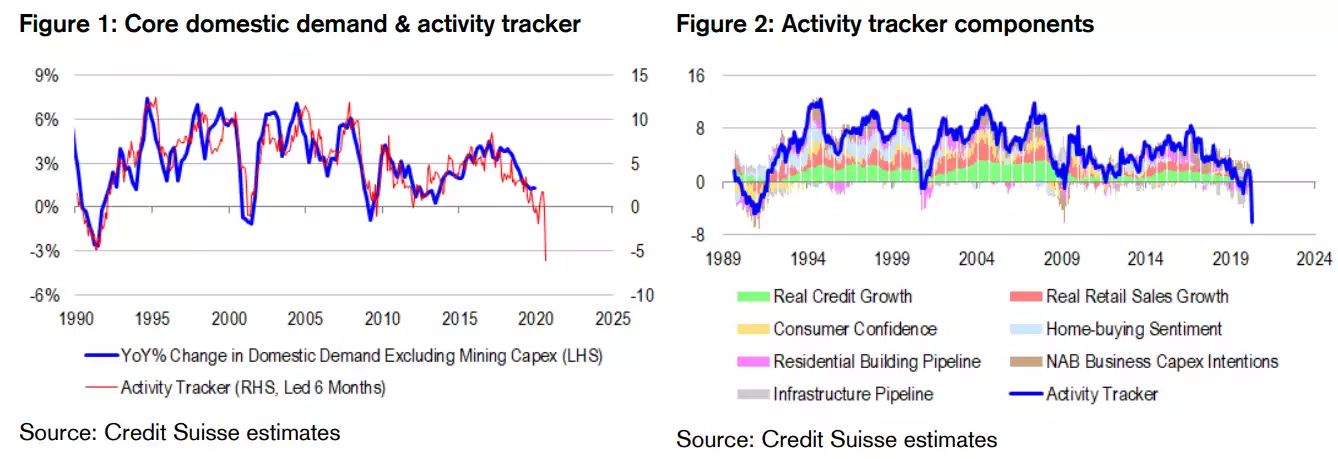

Credit Suisse have their proven predictive proprietary domestic demand tracker and it confirms an ugly picture ahead:

In line with what we have been writing of late the implications on the macro side of things are very concerning where we get growing insolvencies, loads of newly printed money injected to save the patient, but then that awful stagflation picture of poor economic growth mixed with high inflation.

“Productivity and potential growth rates are slowing. The really bad news in our view is that potential growth is slowing sharply. Applying a mathematical filter to the data, updated for information in our activity tracker, trend growth in domestic demand has slowed towards zero and may have even turned negative. To be sure, filters can often be wrong in real time, because they lack perfect foresight. But we are not totally in the dark here. Interestingly, the inflation-indexed bond yield is a powerful leading indicator of trend growth in the interest rate-targeting era, with a lead time of roughly 5 years. It provides us with some of the missing foresight we need. And it currently points to negligible potential, or supply side growth. Bond market investors are saying that this recession could easily destroy productive capacity by bankrupting businesses. Moreover, if and when demand stabilizes or recovers, we do not get these bankrupted businesses back. We could easily find ourselves in a situation where too much money is chasing too few goods and services, bringing back inflation ahead of time.”

Property in the past has been an effective inflation play but that does not look good going forward. Years of Ponzi like activity relying heavily on introduced growth and government stimulus programs bringing forward demand may be coming home to roost. You can only outperform the fundamental of wage growth so long. Our banks and broader economy are asymmetrically exposed to any sizeable correction.

Gold on the other hand had been the safe haven and inflation hedge of choice for 5000 years and looks primed to benefit from this situation more than any other asset.