Australia’s Debt Dilemma

News

|

Posted 24/02/2017

|

5682

Before we get into today’s news, gold had its biggest jump this year last night. We discuss this in today’s Weekly Wrap podcast and it’s well worth a listen. The Trump Hope Rally is meeting Mr Reality.

We also touch on our RBA’s rate cut dilemma but let’s explore that further as it will touch every Aussie reader’s life soon we think.

We’ve reported previously that Australia has the unenviable title of highest personal debt in the world. A large part of that is property investment and it has ballooned in the low interest rate world we have enjoyed since the GFC. That is all fine and dandy when property prices keep rising and wages grow more than inflation or indeed interest costs.

But as we reported in today’s Weekly Wrap, wage growth has just hit a record low of 1.8%. Real wage growth (after inflation) is therefore perilously close to zero. At the same time, bond yields are rising which will be putting upward pressure on interest rates. Throw in a growing concern about property prices correcting (and indeed in many regions this is already happening) and it’s a pretty nasty set up.

The ‘fix’ is lowering interest rates, but much in the way you ‘fix’ a heroin addiction with more heroin. This is the RBA’s dilemma. Speaking in Canada this week Philip Lowe voiced his concern at how this might affect things more broadly as "there are some signs that debt levels are affecting household spending" because “In aggregate, households are carrying more debt than they have before and, at the same time, they are experiencing slower growth in their nominal incomes than they have for some decades. For many, this is a sobering combination.”

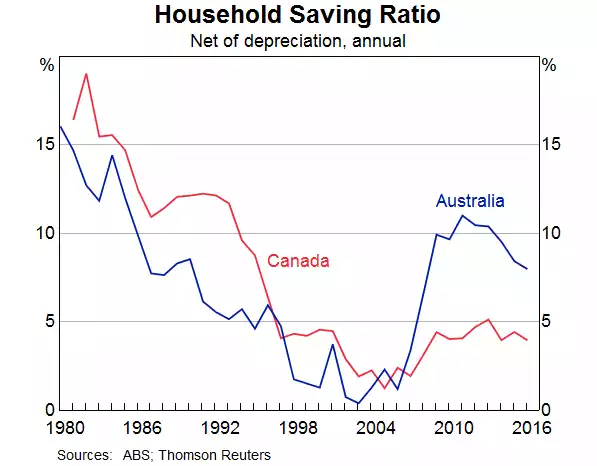

Sobering indeed. You see when the GFC hit we all got a reality check that too much debt can bite and that sometimes house prices fall and all that free money you can draw off your mortgage is not so free. Looking at the graph below you can see the story play out oh so clearly. Savings dropped to almost zero before the GFC. Reality hit and we all tightened out belt. We then realised we relatively cruised through the GFC (thanks entirely to China and the now over mining boom) and commenced our descent back into more debt again. Everything was awesome.

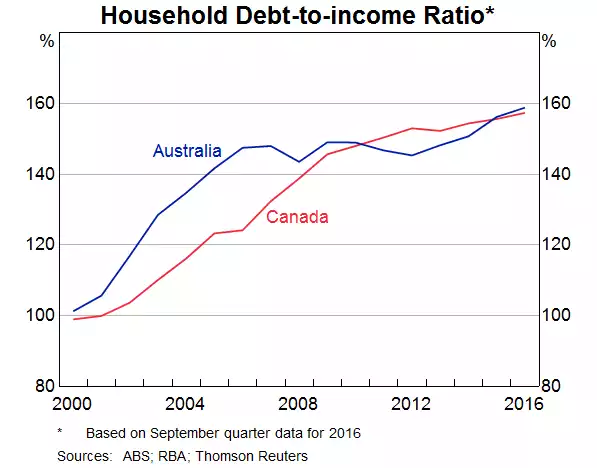

Lowe believes the chart is about to track sideways as reality starts slowly (for now) to hit home. However the debt is already there and he warned we can expect more inflation but wage rises were “not imminent”. It’s that combo that would see the already all-time high household debt to income ratio climb further:

If you aren’t great at math, that chart is saying each household on average has 1.6 times more debt than annual income…

So the RBA’s dilemma is leave things as they are and “households having decided that they had borrowed too much, might cut back consumption sharply, hurting the overall economy and employment.” – putting more pressure on wages and debt servicing. Cut rates and they risk people taking on more debt and inflate the property bubble even more. On the latter he said "At the moment, I don't think these two things are in the national interest."

What an understatement… If property prices inflated further and then inevitably correct, and correct sharply as some predict, it won’t just be a matter of debt interest servicing but potentially an equity shortfall, forcing repossessions and more sales and the whole thing spiralling out of control.