‘Risk on’ Returns – Italian Banks ‘Risk Failing’

News

|

Posted 29/11/2016

|

5324

There was a somewhat predictable change in mood in markets overnight as the so called Trump Trade was overcome by some global realities. Shares and the USD came off and bonds and gold rallied all around the world as fears mount on the outcome of Italy’s referendum. With the No vote looking certain to be the victor, attention again turned to Italy’s banks as the most immediate victims. The Financial Times reported that eight Italian banks were at risk of failing on refinancing concerns that could evaporate with a No vote. Italian bond yields spiked further and the Risk Premium, which is the difference between their 10 year yields and the 10 year Bund (German bonds) hit a 2 ½ year high.

We reported on the Euro banking crisis most recently here (with links to previous) but the core issue with Italy’s banks is non performing (bad) loans (NPL’s) at a time of inordinate banking stress courtesy of EU negative interest rates and a stagnant economy. To clearly quantify this for you, they have $600 billion of NPL’s but only $375 billion of equity on their books. They have been unable to fix this with capital raisings and the EU rules say the Italian government cannot ‘bail out’ the banks. That leaves bail in’s which is political suicide given Italy’s extraordinarily large number of domestic ‘mum & dad’ depositors and bank bond holders in Italy.

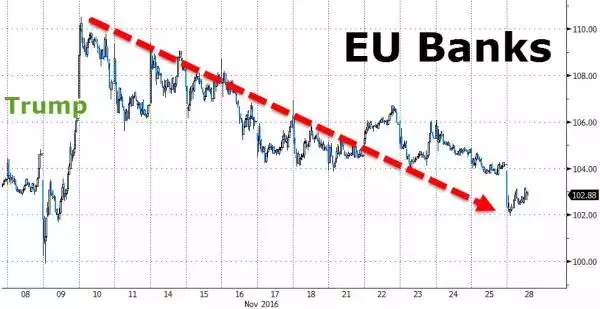

It also of course would see enormous pressure to bear on other EU banks. The graph below clearly shows the ‘everything is awesome’ Trump jump in EU banking shares is now over and heading south.

A No vote has no immediately obvious outcome, with many scenarios that could play out. Uncertainty could reign for some time yet which is just as toxic for these precarious banks. And then we have the French elections in April….