Alt Coin Market – Ready for take-off

News

|

Posted 24/11/2020

|

5385

There’s no denying that Bitcoin has been the dominant force for the latter part of 2020. Large-cap cryptocurrencies such as ETH, XRP, BCH, LTC, and LINK delivered relatively modest gains in October, but have failed to break new highs as trading activity shifted away to Bitcoin. For many months, altcoins have been the key driver of returns for crypto traders.

Thus, it is no surprise that altcoins have appeared to be losing steam as Bitcoin rallied. However, Ethereum 2.0, due for launch in just 6 days (1 Dec) promises to be an important catalyst for the altcoins market.

The upgrade is expected to have a positive impact on ETH as it will significantly boost the network’s compatibility, scalability, and security.

Additionally, the upgrade will shift Ethereum’s consensus mechanism to a Proof-Of-Stake, incentivising investors to keep and lock-up their Ether for staking rewards. This will then reduce the supply of ETH tokens while demand continues to grow strong as large investors flood in seeking steady gain. Proof-of-Stake is also seen to be more environmentally friendly than the more energy intensive Proof-of-Work mechanism used by Bitcoin and Ethereum currently at a time when the environment is directing many people’s investment decisions.

Considering these catalysts, the upgrade could drag out ETH from its recent slump and potentially inject more positive sentiment into the altcoin sector.

Just yesterday we saw the first sign of this swing in sentiment with alts picking up some steam… Ethereum rose 6% to $597 US, XRP has almost doubled in price in November alone. This morning Ethereum’s price has reached $600, the highest it’s been since June 2018. This comes just three days after the cryptocurrency broke the $500 barrier on November 20.

Despite this upward trend, the last few months have not all been plain sailing. After starting September at a price of $486 US, Ethereum looked set to break the $500 mark only to dip down to $327 on September 6. However, this reversal has come alongside strong performances by Bitcoin.

Ethereum has actually grown faster than Bitcoin over the last few months. Today, Bitcoin’s price is up by 37% from its price of three months ago. In contrast, Ethereum has grown at a rate of 54% in the same period.

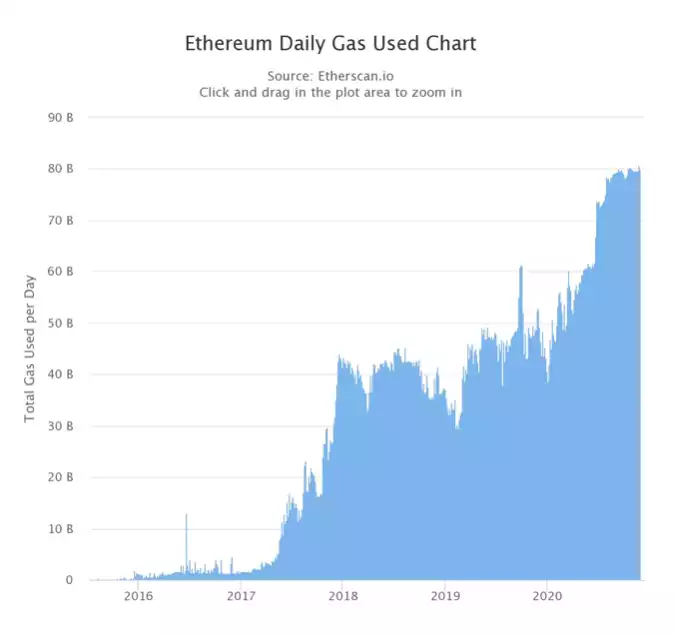

Much like Bitcoin, on-chain data show that whales are continuing to accumulate Ether. This trend coincides with a drop in Ether exchange reserves, particularly as more holders deposit the digital asset to the ETH 2.0 deposit contract. On-chain data also shows that the daily gas usage is hovering at an all-time high. “Gas” refers to the transaction fees on the Ethereum network – thus, if gas is high, user activity is high.

Additionally, Ether seeing renewed momentum in 2021 would go in line with the trend it saw in the 2017 post-halving cycle. Although there is little historical data to suggest that Ether and altcoins will follow the same trend as three years ago, the narrative of a January 2021 altcoin rally remains strong.

For Ether to see a prolonged uptrend, it would first need to reclaim the $600 US resistance level as many analysts view this level as the biggest near-term threat. Based on key resistance levels, if ETH surpasses $620, the next high time frame resistance levels are found at $784, $915 and $1,200.

Alt season may be upon us. You don’t want to miss this boat because history tells us it can be extremely explosive once the market decides to start accumulating alts, especially as retail FOMO kicks in.