Ainslie Wealth Adds Polygon (MATIC)

News

|

Posted 07/09/2021

|

6368

Last week we added Polygon (MATIC) to our Ainslie Wealth listed products. Polygon’s unique features and exciting roadmap make it an opportunity for those looking to diversify their crypto portfolios into some non-top-10 coins. Let’s jump into what the Polygon network does and is attempting to achieve…

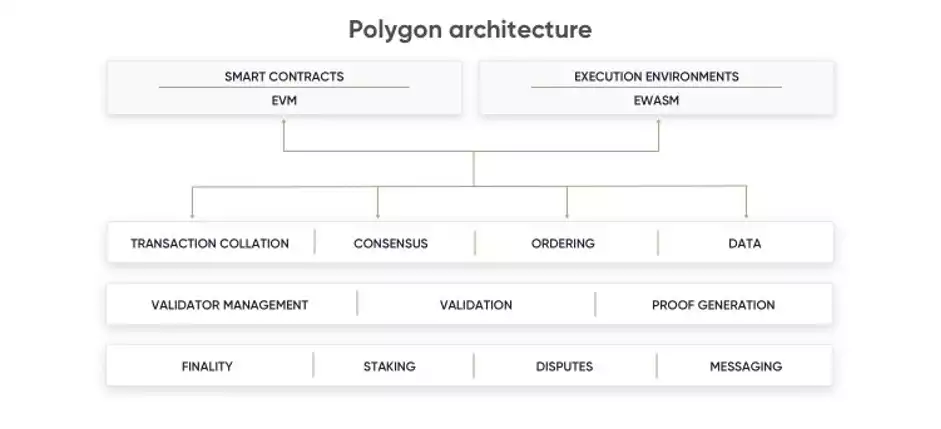

Polygon (previously Matic Network) is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications. Using Polygon, one can create rollup chains, ZK rollup chains, or stand-alone chains. Polygon effectively transforms Ethereum into a full-fledged multi-chain system (aka Internet of Blockchains).

Instead of participating in divisions between crypto factions, Polygon enables cross-chain communication. Blockchains have been traditionally siloed and unable to communicate with each other. What it means is that the ethereum blockchain remains at the centre and what Polygon are building, however they have unlimited development opportunities as they aren’t constrained by Ethereum’s code. Essentially, Polygon is a developer friendly framework aiming to help build real world decentralised and secure applications.

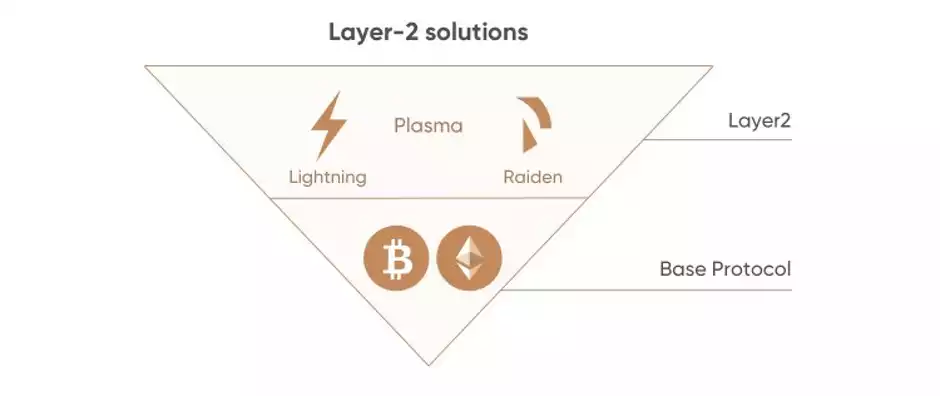

The $MATIC token will continue to exist and will play an increasingly important role, securing the system and enabling governance. Polygon (formerly Matic Network) is a Layer 2 scaling solution. The project seeks to stimulate mass adoption of cryptocurrencies by resolving the problems of scalability on many blockchains.

Polygon combines the Plasma Framework and the proof-of-stake blockchain architecture. The Plasma framework used by Polygon as proposed by the co-founder of Ethereum, Vitalik Buterin, allows for the easy execution of scalable and autonomous smart contracts. Nothing will change for the existing ecosystem built on the Plasma-POS chain. With Polygon, new features are being built around the existing proven technology to expand the ability to cater to the needs of developers. Polygon will continue to develop the core technology so that it can scale to a larger ecosystem.

Polygon boasts of up to 65,000 transactions per second on a single side chain, along with a respectable block confirmation time of fewer than two seconds. The framework also allows for the creation of globally available decentralised financial applications on a single foundational blockchain. The Plasma framework gives Polygon the potential of housing an unlimited number of decentralised applications on their infrastructure without experiencing the normal drawbacks common on proof-of-work blockchains. So far, Polygon has attracted more than 50 DApps to its PoS-secured Ethereum sidechain. MATIC, the native token of Polygon, is an ERC-20 token running on the Ethereum blockchain. The tokens are used for payment services on Polygon and as a settlement currency between users who operate within the Polygon ecosystem. The transaction fees on Polygon sidechains are also paid in MATIC tokens.

So, what makes Polygon unique?

Polygon is self-described as a Layer 2 scaling solution, which means that the project doesn’t seek to upgrade its current basic blockchain layer any time soon. The project focuses on reducing the complexity of scalability and instant blockchain transactions. Polygon uses a customised version of the Plasma framework which is built on proof-of-stake checkpoints that run through the Ethereum main chain. This unique technology allows each sidechain on Polygon to achieve up to 65,536 transactions per block. Commercially, the sidechains of Polygon are structurally designed to support a variety of decentralised finance (DeFi) protocols available in the Ethereum ecosystem. While Polygon currently supports only the Ethereum base chain, the network intends to extend support for additional base chains, based on community suggestions and consensus. This would make Polygon an interoperable decentralised Layer 2 blockchain platform.

Polygon was the underdog for the first half of the 2021 bull run but as time passed, more investors within the space realized what Polygon had to offer as a Layer 2 scaling solution, and rushed to purchase MATIC tokens, which resulted in exponential growth of its market value.

The total value locked (TVL) can provide an understanding of the driving force behind MATIC's exponential rise. The TVL for MATIC hovers around $4.45 billion. Although this number is nowhere near Ethereum’s, which is $90.83 billion, it is relatively close to taking a jab at Binance’s TVL, $15.34 billion. Interestingly, Polygon has surpassed Solana, which stands at $1.47 billion and $0.19 billion for Avalanche. The sudden uptick in TVL comes as popular DeFi blockchains like Aave and Sushi are continuing to embrace Polygon due to its scaling solution capabilities.

Further supporting a steady climb in TVL for Polygon is the growth of the Daily Active Addresses (DAA) metric. The DAA for Polygon increased from 487 on January 1 to 4,396 currently, an 803% increase.

The number of MATIC tokens held on exchanges has also decreased from 1.414 billion to 146 million. This 90% reduction indicates that investors are moving their holdings off centralised entities (where they can easily sell the tokens), revealing that they are confident in MATIC price performance.

If you are interested in getting your hands on some Polygon (MATIC), feel free to get in contact with us to place an order. We can put MATIC onto an Ainslie Cold Wallet, your existing ERC20 compliant wallet, or into an Ainslie Storage Account where we look after all of it for you.

Of course if there are other projects that take your fancy, Ainslie can buy almost any coin or token for you with the same ease and security as those we list.