Bitcoin Correction – What You Musk Know

News

|

Posted 18/05/2021

|

6036

Bitcoin fell to a three-month low on Monday, confirming the biggest price pullback of the current bull run. BTC printed a low of $42,212 US last night, a level not seen since the 8th of February, marking a 35% drop from the record high of $64,880 reached on April 14.

BTC has now been through four corrections from new price highs so far this year, out of which the latest 35% retreat is the biggest. The reason for the latest pullback can largely be pointed at Elon Musk’s recent tweets.

The Tesla boss' tweets, which had helped drive some of the gains in bitcoin in recent months, triggered a 17% slide in the value of the cryptocurrency when he said his company's customers would no longer be able to use bitcoin to buy its cars – citing concerns over Bitcoin mining’s environmental impact due to its high energy usage.

Elon’s quick criticism seems to be somewhat short-sighted, however. Square has put some thought into this problem, releasing a report a month ago claiming that Bitcoin can play a key role in delivering “an abundant, clean energy future.”

The study says the energy demand profile of cryptocurrency ‘miners’ is well-suited to helping balance intermittent power supply. The report suggests bitcoin mining could help accelerate the transition to renewable power by acting as a flexible load option and easing wind and solar deployment bottlenecks. It also notes that this means bitcoin miners can complement clean energy production and storage technologies and allow electricity grids to deploy “substantially more renewable energy”.

The report states: "Bitcoin miners are unique energy buyers in that they offer highly flexible and easily interruptible load, provide a payout in a globally liquid cryptocurrency, and are completely location agnostic, requiring only an internet connection.

“These combined qualities constitute an extraordinary asset, an energy buyer of last resort that can be turned on or off at a moment’s notice anywhere in the world.”

The report highlights that by removing bottlenecks caused by grid constraints and intermittency, more solar and wind can be deployed, reducing the cost of renewable power and “bringing them closer to zero marginal cost energy production”.

“The bitcoin and energy markets are converging and we believe the energy asset owners of today will likely become the miners of tomorrow.”

“Utility executives, sustainable infrastructure funds, and grid-scale storage developers are well-positioned to expedite this future by aligning their strategic roadmap and deploying large scale investments into the emerging synergy between bitcoin mining and clean energy production.”

Despite Elon’s criticisms, experts still maintain a bullish long-term outlook – believing that the pullback will only set the market up for a more robust rally within the months to come.

“After the weekend FUD fest and s–t fighting, let’s get back to the important stuff. BTFD,” Raoul Pal, tweeted. “BTC is forming a wedge most likely … perfectly normal correction and healthy.” A wedge, in this case, is a bullish pattern in price charts.

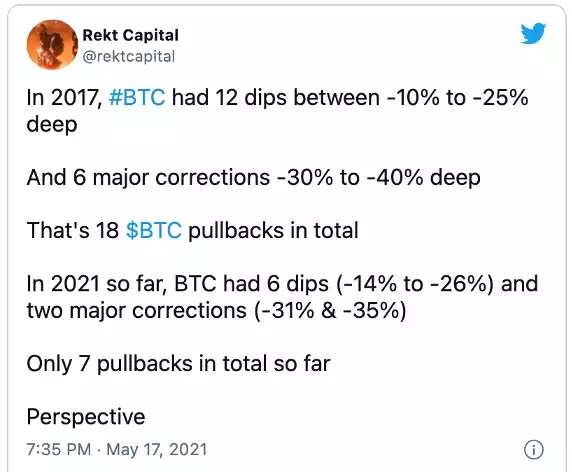

The pullbacks and criticisms from influences are just removing the weak hands from the market. What people forget is that dips and pullback are all a part of the BTC bull run process - this tweet puts the recent pullbacks in perspective too: