Australia’s Own Subprime Crisis

News

|

Posted 19/09/2018

|

11755

Sunday’s 60 Minutes segment titled Bricks and Slaughter certainly has reignited the great property crash debate. For regular readers there wasn’t actually much new but it certainly brought some facts to the mainstream that have people asking serious questions. Here are the key takeaways:

- Australian banks have a $1.7 trillion loan book to residential property. That is 65% of their total lending, far exceeding that of any country in the western world.

- “There’s probably no country in the world more susceptible to the ramifications of a housing crash than Australia. We are uniquely exposed at the moment.”

- 52,000 loans are predicted to turn bad in coming year. One real estate agent (and validated by unnamed others) claimed foreclosures had risen 600% in their area of western Sydney after the median price had dropped from $1.2m to $1m in just one year. That could be more than the equity in many loans.

- Analysts predicted as much as 40-45% price drops over the next year with Sydney and Melbourne being 40% over priced.

- Some of the pain felt is the banks’ unwillingness to refinance loans or move people from interest only to P&I mortgages when they can’t afford to service the latter. We discussed this quite recently here.

However it was the claims that the banks mislead people into loans they could never afford, only to then tighten and leave them high and dry that have drawn a lot of debate online. The segment presented both sides of personal responsibility and the ‘must have it now’ mentality, together with the claims the banks are at fault through praying on the vulnerable.

Claims that Australia is in the same position as the US was in 2006 and 2007 (before 9 million people lost their homes in the crash) have also drawn hot debate. The US situation was exacerbated by different lending standards where people could literally just up and leave and send the keys back to the bank. The so called ‘jingle mail’, whereas it’s not that easy here. This is often touted as the reason the housing crash and subprime crisis of 2007 could never happen here. But is that correct?

Nick Hubble of The Daily Reckoning undertook research on this for his PhD on Australia’s subprime crisis back in 2012 and the Royal Commission is now exposing the so called ‘robo approvals’ where loan applicants were simply not checked and brokers highly incentivised to get people in come-what-may.

“Consumer advocate Denise Brailey has been saying for years that bank computers automatically approve loans, without questions asked.

That brings into question the quality of the information that mortgage brokers and applicants supply.

Now that borrowers and investors in mortgage backed securities have evidence that the banks approved loans without checking them, the banks could be open to lawsuits.

That’s not all…

According to Australian law, if you can prove your mortgage broker or banker manipulated your loan application form to get it past lending standards, there’s evidence to suggest it can force the bank to cancel your loan…but you get to keep your house.”

And in terms of the extent of the issue of interest only loans expiring to P&I loans, she estimates that Interest Only loans constitute 80% of all loans compared to APRA’s estimate of 30%. Neither is a good number by the way.

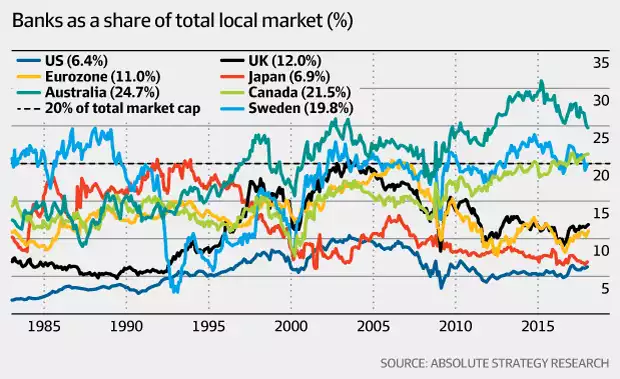

You can well imagine the ramifications on the banks. This goes to the heart of the ‘its just a Sydney and Melbourne problem’ argument. As mentioned earlier housing constitutes 65% of the banks’ loan books. Our banks constitute 25% of our sharemarket, by far the biggest proportion in the world and having reached over 30% in 2015.

That of course is fed by the fact Aussie household debt has doubled since 2004 and handed us the mantle of second largest personal debt per GDP in the entire world. This is not a ‘Sydney and Melbourne problem’, it becomes a national problem.

Yesterday we shared predictions of what will cause the next financial crisis. Whilst they varied they all had the same root cause… too much debt. Australia has enjoyed the longest property bull market in the world. Such a run can lead a whole generation to believe this is just what happens. You borrow to the hilt because you KNOW that if things turn bad for you, you can always sell the house for a higher price and get out of Dodge. But that clearly is changing and all of a sudden the prospect of widespread default risk is becoming very real to the banks.

As Nick concludes his article:

“Thanks to the Royal Commission, bankers have tightened lending standards.

But lending is contracting. Without demand from the marginal borrower, who can’t afford to buy, house price demand is evaporating. The banks are on the hook for their dodgy loans, and for ordinary losses on their loan book.

We appear to be re-enacting the sub-prime crisis. But under Australian law, it could be even worse.”