A Trapped Financial System

News

|

Posted 16/08/2016

|

5371

In a void of any ‘thing’ happening in financial markets gold and silver have had the correction many expected after going so strongly this year. This has been particularly so for Aussies as our dollar continues to strengthen in a world of zero and negative rates. The RBA won’t let that continue and the same low rates continue to make gold and silver very attractive. Gold is still up 20% and silver 37% today (26% and 44% in USD) but that is off from mid 20’s and mid 40’s % we saw just recently. So has anything changed?

Unlike any time before, because these are unchartered waters, ‘hope’ seems to be a fundamental market driver. Shares have rallied of late despite no real economic news to justify it. Share prices these days are propped up by debt funded corporate buy backs and central banks both directly buying shares and forcing people into financial markets by depriving them of interest in a bank account. So whilst share owners are enjoying this for now, it’s disastrous for fixed income investors.

The New York Times just ran an article that US life insurance schemes and pension funds can’t maintain promised returns because they were established when actuaries could not see interest rates being below 8% and now those same actuaries can’t see near zero interest rates rising. Insurance companies are now sharply increasing premiums to fill the void, robbing people up front to pay them later because they have promised 4% returns when a 10 year US Treasury bond is paying 1.5%. That is a massive problem when ¾ of the $6.4 trillion life insurance funds are invested in such bonds. In Europe that bond ‘return’ is negative hence the article reporting “This year, the head of Allianz of Germany, the largest insurer in Europe, called the move by the European Central Bank to slash rates to zero “a catastrophe.” ”

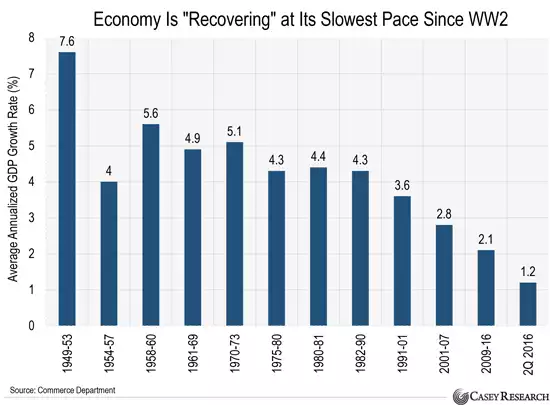

You can’t expect rates to rise when growth is so poor. Pundits selling you into equities will spruke “recovery”. The graph below shows US growth is the worst since World War 2 – not much of a ‘recovery’… The other reason rates can’t rise is quite simply we can’t afford the interest bill if they do. So we are damned if they stay low and damned if they rise… Bill Holter (in response to that NYT article via JS Mineset) summarised it well…

“Yes, there are those out there who believe rates will never rise again in our lifetime …but this poses a problem of its own. Very low …zero …or even negative interest rates do not allow for the 8% growth necessary for retirement plans to perform as promised. Please remember the question Jim [Rickards] continually asks regarding derivatives. “What is a contract worth that cannot perform”? This question can, should, and finally is being asked of retirement plans/the insurance industry.

The above is not ground breaking news, it is however another piece to the insolvent system our central bankers have forced us (and themselves) into. There is no way out of this. They cannot raise, lower or hold rates where they are and make the system solvent again. Solvency was the issue in 2008, they treated it with more and more liquidity. All this did was make the system more leveraged and more vulnerable to collapse. In essence, kicking the can these last 7-8 years did nothing but paint central banks and sovereign treasuries further into an inescapable corner.”

Gold remains strong because history says it is one of the only routes out of this trap for investors with enough foresight to prepare for what now looks inevitable.