The Slow Growth Lower Inflation Case

News

|

Posted 24/01/2022

|

6524

On Friday we wrote of the misconception that gold goes down when rates go up. Indeed the opposite is the case. Part of this is the reality of market behaviour after a recession. Friday night dished up another salient reminder of how these easy money markets are taking to just the threat of tighter policy with another sea of red across all markets except precious metals.

Late last year we shared Raoul Pal’s views that we are about to see slow growth, inflation quickly revert, and the Fed yet again caught out tightening too late and too far and ultimately reversing. Late last week Morgan Stanley’s US Chief Equity Strategist, Michael Wilson, who has been predicting what he calls the Fire and Ice scenario for some time, had this to say as we enter the ice scenario:

“The good news is that markets have been digesting this tightening for months. Despite the fact that the major US large cap equity indices are down only 5-10% from their highs, the damage under the surface has been enormous and even catastrophic for many individual stocks. Expensive, unprofitable names – i.e., the most speculative parts of the equity market – have been hit the hardest, down 30-50%. This is appropriate in our view, not just because the Fed is pivoting but because these kinds of valuations don’t make sense in any investment environment. In short, the froth is coming out of an equity market that simply got too extended on valuation.

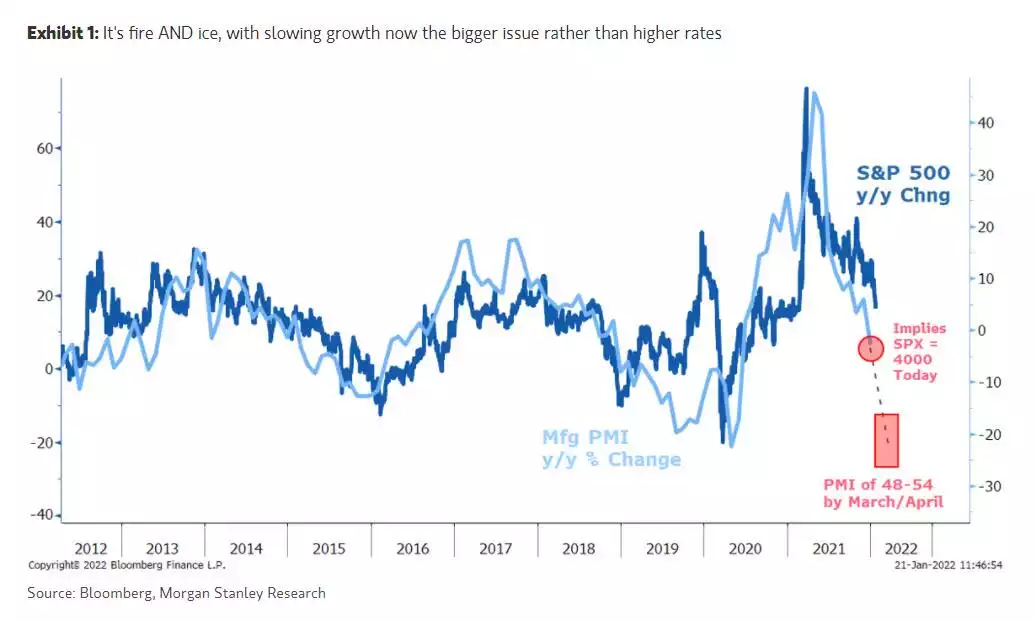

But attention should now turn to the ice part of our narrative – slowing growth. As we’ve been writing for months, we view the current deceleration in growth as more about the natural ebbing of the cycle than the latest variant of Covid. Indeed, there are reasons to be optimistic that Omicron will prove to be the final wave of this pandemic. However, that also means the end of extraordinary stimulus, both monetary and fiscal. It also means looser supply chains as restrictions ease and people fully return to work. Better supply is good for fighting inflation but may also reveal the degree to which demand has been supported and overstated by double ordering. Weaker PMIs are already leading stocks in this regard (Exhibit 1).

In Pal’s latest ‘In Focus’ for Macro Insiders he again points out that this is a well trodden road that the market seems to forget each time.

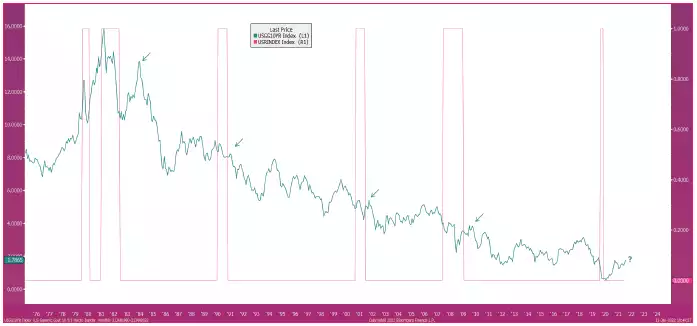

“You can see this in the chart below of 10-Year Yields since 1982 – after each recession we saw a rise in rates that didn’t stick, followed by new yield lows...

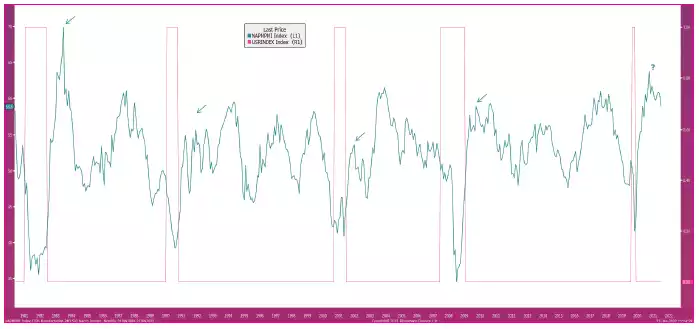

You can also see it in ISM, which is a proxy for GDP growth. Growth slows rapidly after the initial recovery and only gets real traction later in the cycle...

Pal then goes on to share a number of charts indicating that growth has started to slow and about to accelerate down. With respect to his paid subscribers the following is one that highlights most. The ECRI is the respected Economic Cycle Research Institute’s index that identifies turning points in the economic cycle and the ISM manufacturing index, also known as the purchasing managers' index (PMI), a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. Both are dipping sharply..

So that’s growth, what about inflation. Whilst acknowledging the huge CPI print we reported on last week, he goes on to state:

“But if this is driven by supply issues then it should slow as growth slows and the global economy reopens. The ECRI suggests the peak in inflation is in and that it will fall fast. ECRI has CPI at 2% this year... that takes the Fed entirely out of the equation, most likely by the summer...”

Pal is laying out the framework for a volatile year ahead but one where the Fed will predictably tighten too hard too late and then later be forced to reverse after doing so into a slowing economy and inflationary environment suggesting you “buy gold, as such a long consolidation tends to lead to fast advances. Gold loves slow growth and slow inflation.”

You will note this is, in the initial stages the opposite of Julian Brigden’s thesis we wrote of here. And herein lies two salient points. With due respect, no one knows exactly what will play out evidenced by two industry stalwarts at odds. These are truly unprecedented times testing all the theory and (by definition) historic precedent. However on each scenario, both stress the need for gold and silver in a portfolio, and these are expert macro economic analysts not gold bugs. That is because gold thrives in the abnormal and does little in ‘normal’ economic conditions. There are 3 broad scenarios before us right now, Brigden’s, Pal’s and ‘normal’. We’d suggest ‘normal’ was left behind in the wake of the GFC, has been craftily hidden with monetary stimulus, and the unavoidable repercussions are our immediate future. Whether its Brigden’s growth and strong inflation or Pal’s low growth, low inflation, both result in an abrupt reversal by the Fed, negative real rates and a flat to negative yield curve flagging that trouble ahead. That is gold’s sweet spot.