Gold - “Trust Anchor” when “whole system collapses”

News

|

Posted 14/10/2019

|

7689

The Dutch have joined the likes of Germany and Austria in re-securing their central bank gold holdings but breaking from the ‘everything’s fine’ narrative of other central banks, outlined exactly why.

Where Germany and Austria had most of their holdings offshore in New York and London and repatriated it home to have better access and control, De Nederlandsche Bank (DNB) already had most of their 615 tonne in Amsterdam but tellingly are moving it to a military installation in a new vault contained within. Why are they doing this? In their words, gold is:

“…the trust anchor for the financial system. If the whole system collapses, the gold stock provides a collateral to start over. Gold gives confidence in the power of the central bank's balance sheet."

This of course all comes as the Fed launches “Not a QE” or “QE4ever” of $60b per month and a Repo market continuing to need the Fed’s support. Whilst central banks are doubling down with stimulus they are quietly preparing for the repercussions of such practices. You will recall that last year was a record year for central bank gold purchases and moves like the DNB just highlight their intent.

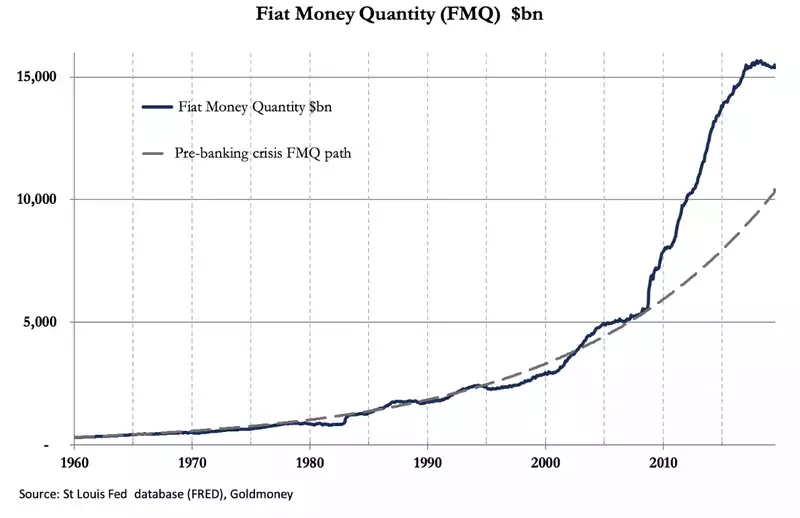

Below is a chart of the total FMQ or Fiat Money Quantity. You can see from the departure of the gold standard in 1971 it grew at a steady 5.86% compounding. Since the GFC that nearly doubled (and compounding) to 9.45% including the respite from the beginning of 2017. As we have mentioned, that expansion has now recommenced to the tune of $60b / month. FYI China is increasing at 12%!

As Alasdair Macleod noted over the weekend:

“FMQ is still $5 trillion above where it would have been today if the massive monetary expansion in the wake of the Lehman crisis had not happened. If there is a shortage of money [in reference to Repo markets], it is because the process of debt creation to fund current expenditure is spiralling out of control.”

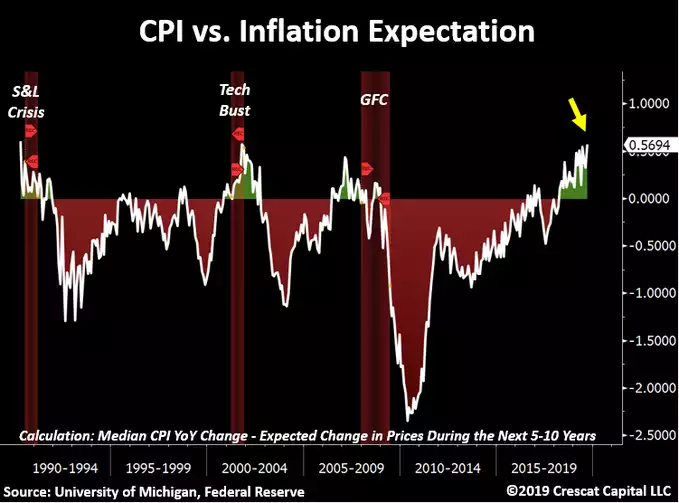

The elephant in the room whenever there is such an expansion of money is of course inflation. To date that inflation has been contained in the financial markets where most of this QE has gone. To date it hasn’t hit Main St, only made Wall Street rich, and no one is expecting it. But the chart below from Crescat’s Otavio Costa shows how history tells us this often ends badly. As Tavi says:

“Outlook for rising prices is at a fresh 40-year low while core & median CPI are at decade highs.

Inflation tends to surprise investors at the top of the business cycle.

I mostly agree with the deflationary concerns, but is inflation the most underrated risk out there?”

The prospect of stagflation where we have increasing inflation but low growth is becoming very very real. Hyperinflation seeing the demise of Fiat currency is also a real threat.

DNB are getting ready.