Gold Industrial Demand Turns

News

|

Posted 07/12/2017

|

7777

Jeff Gundlach, head of the $100 billion DoubleLine fund and who Barron’s famously called the “King of Bonds”, yesterday gave his public address to investors and the following slide maybe sums up his view:

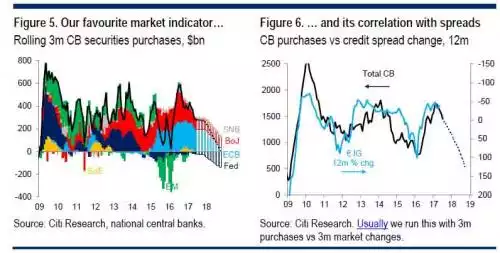

What he called his “chart of the webcast” was not new to our regular readers and we won’t go over old ground (read here for more). He put up Citi’s recent warning of how the market will react when the central banks unwind:

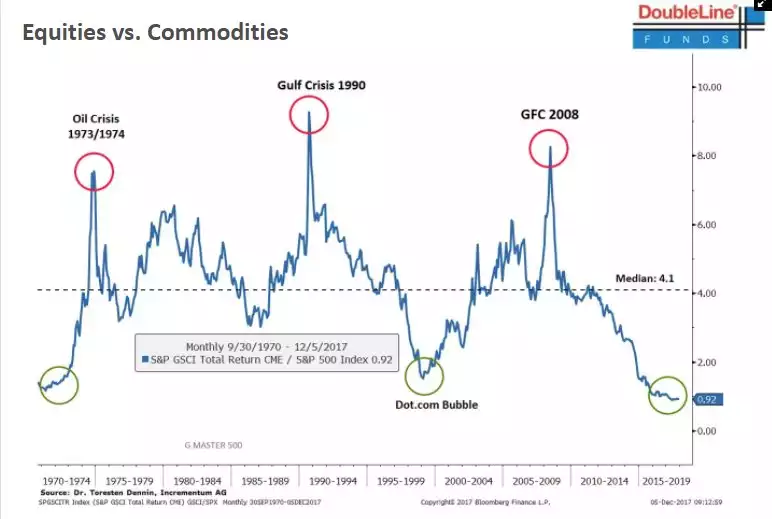

However one of his big tips for going forward was to buy commodities as supported by the following chart:

Pretty compelling stuff.

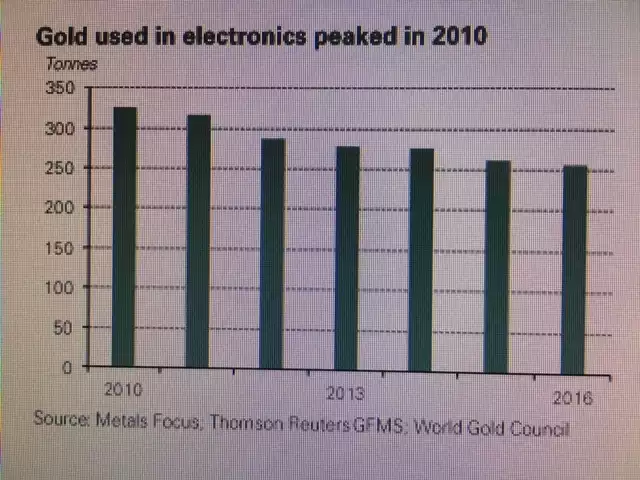

Now whilst we are on record as being loath to call gold a commodity (as opposed to a monetary asset) given the relatively small amount actually used in industry, a recent report by the World Gold Council showed the trend of falling industrial demand has just turned. Firstly the following graph puts in to context usage just in electronics and the decline since the peak in 2010

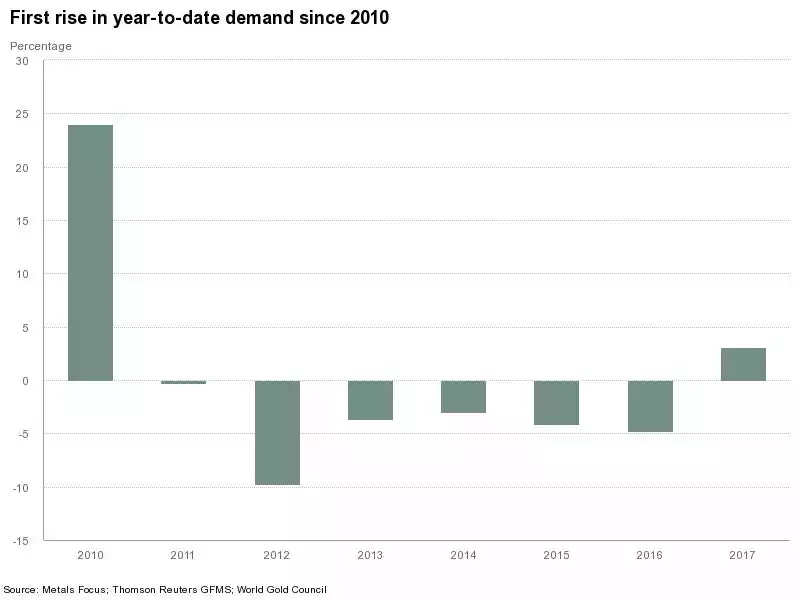

This last quarter saw that turn:

From WGC:

“Changes are afoot in the technology sector. Smartphones are becoming increasingly powerful, electric and self-driving vehicles could revolutionise the automotive industry, and emerging nanotechnology could transform solar energy. All of this could have a positive impact on gold demand.”

Specifically it is the emergence of nanotechnology that brings gold into its own given its ability to be easily drawn into incredibly narrows wires or plated into thin coatings whilst have excellent electrical conductivity like silver.

That first graph above shows the demand, whilst small in a total global gold demand context, is still large when you consider Australia is the second biggest producer in the world at tonnages close to the total electrical use last year alone.

To be clear, it is the very first 3 pictures/charts of today’s news that will inevitably drive the gold price more than any other, however this reversing, growing industrial demand for the metal adds a supporting base to the demand and price, adding to the bullish fundamentals we often write of.

‘What about silver’ you say? That’s tomorrow.....