3 Things: The Fed’s Missed Window & Failed Realizations

News

|

Posted 23/09/2016

|

4612

The Window Is Closed

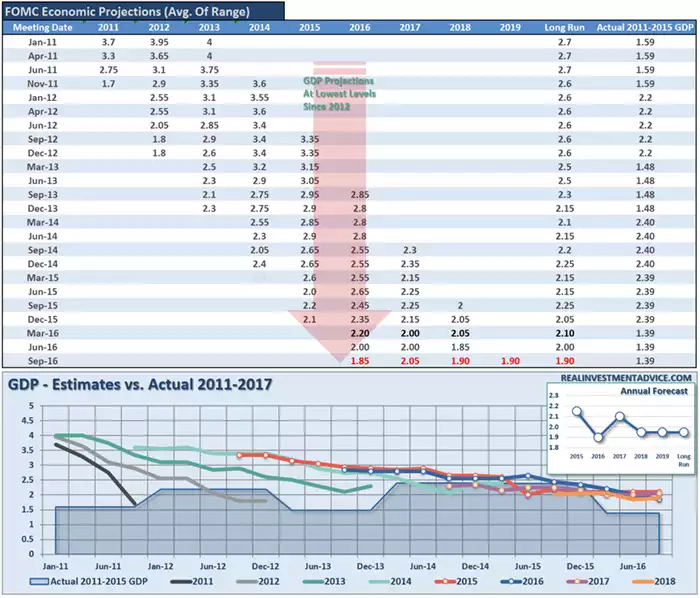

I have previously written a series of articles has to the Fed’s inability to hike interest rates this year. In each of these articles, I discussed the ongoing problems plaguing the Federal Reserve and the continued flawed economic predictions of stronger economic growth that continues to fall short.

Yesterday’s meeting was no different. Once again, the Fed not only failed to raise interest rates due to ongoing economic instability, but once again lowered forecasts for future growth and interest rates.

This should surprise no one. The Federal Reserve has continued to hope for the last several years that extremely “accommodative” monetary policy, near zero interest rates, would spark stronger levels of economic activity leading to a rise in broad-based inflationary pressures. Unfortunately, this has yet to be the case. This is due to a monetary policy phenomenon known as a “liquidity trap” which is described as follows:

“A ‘Liquidity Trap’ is a situation described in Keynesian economics in which injections of cash into the private banking system by a central bank fail to lower interest rates and hence fail to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels.”

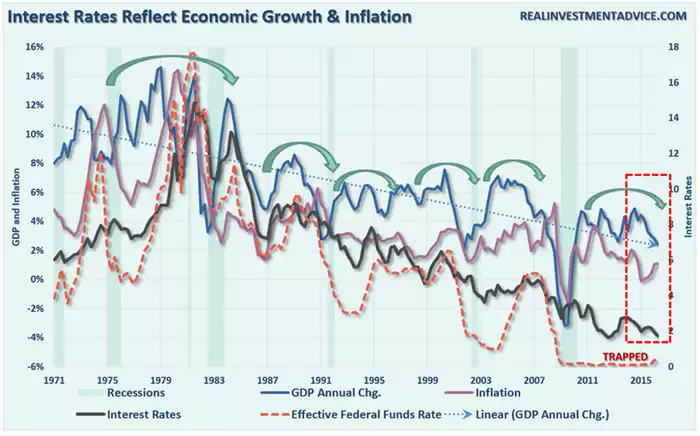

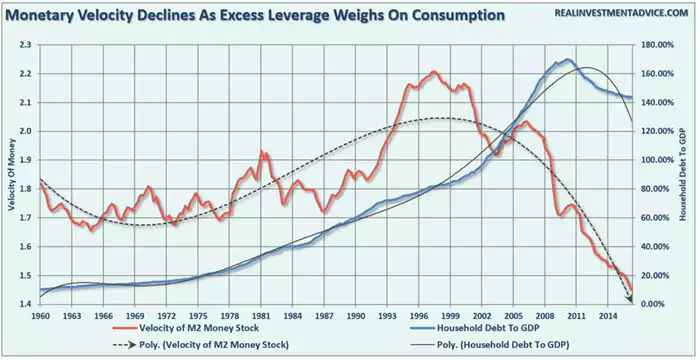

The problem for the Federal Reserve is that getting caught in a liquidity trap was not an unforeseen outcome of monetary policy, but rather an inevitable conclusion. As shown in the chart below the more active the Fed has become with monetary policy, the lower the eventual rates of GDP, inflation, and interest rates has become. As stated, the current low levels of inflation, interest rates, and economic growth are the result of more than 30-years of misguided monetary policies that have led to a continued misallocation of capital.

The lack of productive inflationary pressures (inflation caused by rising wages and increased economic activity that leads to higher prices) has been a construct of the underlying structural dynamics of the economy.Home ownership rates have plunged, technological advances and productivity increases have fostered wage suppression, and high levels of uncounted unemployed (54% of the 16-54 aged labor force) drag on economic strength.

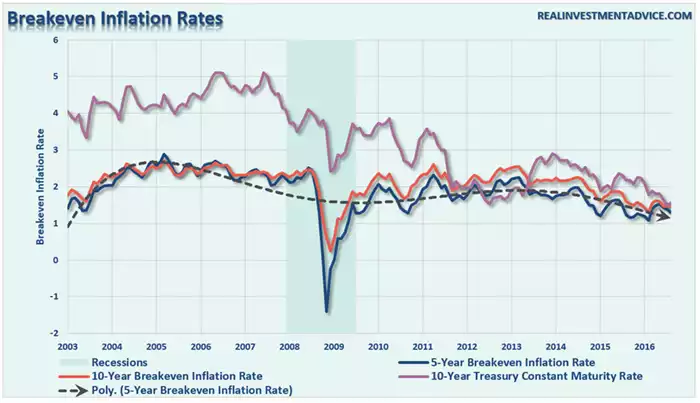

The 5 and 10-year breakeven inflation rates currently give little impression that real inflation is present in the economy. As I stated above, inflation driven by rising healthcare, insurance, and rent IS NOT THE SAME as inflation arising from rising wages, rising prices and increased economic activity. The former acts as a cancer reducing levels of household liquidity and consumptive capacity.

The exceptionally low yields on government treasuries are clear evidence that inflation is not a threat.For all the money that has been spent trying to ignite the engine of economic growth; it has all remained a futile effort at this point. Now, after more than seven years of an economic expansion, interest rates remain near zero, and the velocity of money continues to plummet.

You Can’t Go Home Again

From the Washington Post:

“Two years ago, top officials at the Federal Reserve mapped out a strategy for withdrawing the central bank’s unprecedented support for the American economy.

The official paper was titled “Policy Normalization Principles and Plans,” and it was supposed to serve as a rough outline for the tenure of newly installed Fed Chair Janet L. Yellen. Essentially, it consisted of two basic parts: Raise interest rates and shrink the central bank’s massive balance sheet.

But now, both of those steps are being called into question as Fed officials grapple with an economy that appears to be stuck in first gear. Instead of executing its exit strategy, the Fed is confronting the possibility that the dramatic measures it took to safeguard the recovery will remain in place indefinitely.

‘Maybe this is one of those cases where you can’t go home again,’ former Fed chairman Ben S. Bernanke wrote in a recent blog post arguing for a shift in course.”

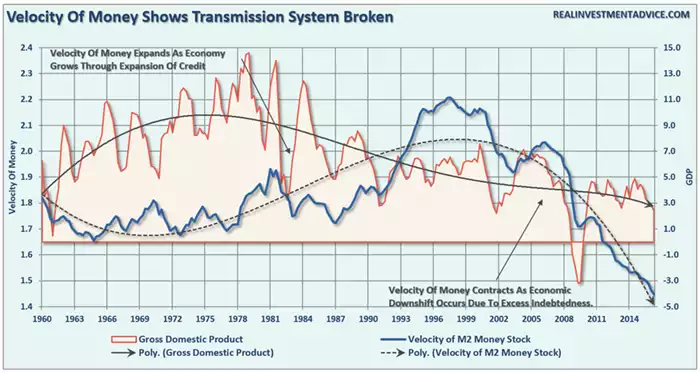

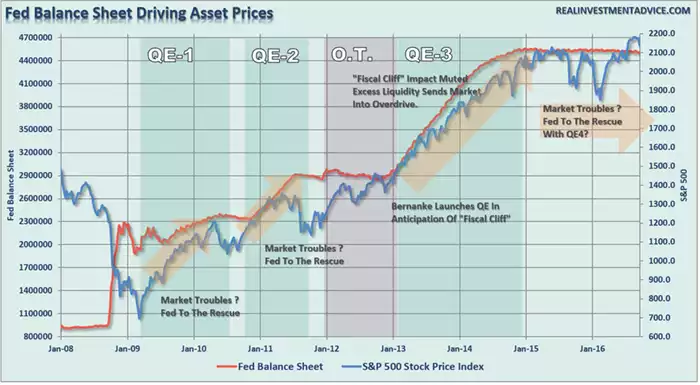

The problem for the Federal Reserve remains the simple fact there is NO evidence that “Quantitative Easing”actually works as intended. The artificial suppression of interest rates was supposed to spur economic activity by encouraging lending activities through the banks. Such an outcome should have been witnessed by an increase in monetary velocity.

As the velocity of money accelerates, demand rises and inflationary pressures increase. However, as you can clearly see, the demand for money has been on the decline since the turn of the century.

The surge in M2V during the 90’s was largely driven by the surge in household leverage as consumers turned to debt to fill the gap between falling wage growth and rising standards of living. (For more on the problem with incomes read “The 80/20 Rule.”)

The issue for the Fed is the decline in the “unemployment rate,” caused solely by the shrinking labor force, is obfuscating the difference between a “real” and “statistical” full employment level. While it is expected that millions of individuals will retire in the coming years ahead; the reality is that many of those “potential” retirees will continue to work throughout their retirement years. In turn, this will have an adverse effect by keeping the labor pool inflated and further suppressing future wage growth.

For the Fed, they remain trapped between “policy fantasy” and “economic reality.”

“Indeed, the Fed has repeatedly pushed back plans to reduce its stimulus in the years since the 2008 financial crisis. The first version of its exit strategy was released in summer 2011 and called for the Fed to start shrinking its balance sheet before raising interest rates. Just over a year later, the central bank was moving in the opposite direction, pumping money into the economy and strengthening its commitment to not raising interest rates.

Such shifts have threatened to undermine the central bank’s credibility, particularly when paired with frustratingly weak economic growth. Both inside and outside the institution, economists and academics are debating whether the Fed needs an entirely new approach.”

It may be too late for that.

Fed & Market Are Now Co-Dependents

From The WSJ:

“Recent developments in financial markets underscore how dependent they have become on central banks, the chief economist of the Bank for International Settlements said Sunday.

‘It is becoming increasingly evident that central banks have been overburdened for far too long,’ said Claudio Borio, chief economist at BIS, a Switzerland-based consortium of central banks.

The BIS has for years warned that the global economy is too dependent on its central banks, whose money-printing power allows for a rapid response to crises. The result is that central bank money boosts asset prices even if underlying economic conditions haven’t changed.”

It is an interesting point with respect to the entire discussion. It is quiet evident the financial markets, and by extension, the economy, have become tied to Central Bank interventions. As shown in the chart below, the correlations between Federal Reserve interventions and the markets is quite high.

Of course, this was ALWAYS the intention of these monetary interventions. As Ben Bernanke suggested in 2010 as he launched the second round of Quantitative Easing, the goal of the program was to lift asset prices to spur consumer confidence thereby lifting economic growth. The problem was the lifting of asset prices acted as a massive wealth transfer from the middle class to the top-10% providing little catalyst for a broad-based economic recovery.

Unwittingly, the Fed has now become co-dependent on the markets. If they move to tighten monetary policy, the market sells-off impacting consumer confidence and pushes economic growth rates lower.With economic growth already running below 2%, there is very little leeway for the Fed to make a policy error at this juncture.

Therefore, the Fed remains trapped between keeping the financial markets happy and trying to resolve their monetary dilemma. The problem is that eventually something has to give and it will likely not be the outcome the Fed continues to hope for.

The Window Has Closed

What is clear is the Federal Reserve should have chosen to increase rates long ago where such tightening of monetary policy would have been somewhat offset by the continued floods of interventions. The Fed is now trapped in a difficult position.

The Federal Reserve has a very difficult challenge ahead of them with very few options. While increasing interest rates may not “initially” impact asset prices or the economy, it is a far different story to suggest that they won’t. In fact, there have been absolutely ZERO times in history that the Federal Reserve has begun an interest-rate hiking campaign that has not eventually led to a negative outcome.

The Fed surely understands that economic cycles do not last forever, and after eight years of a “pull forward expansion,” it is highly likely we are closer to the next recession than not. While raising rates would likely accelerate a potential recession, and a significant market correction, from the Fed’s perspective it might be the “lesser of two evils.” Being caught at the “zero bound” at the onset of a recession leaves few options for the Federal Reserve to stabilize an economic decline.

For Janet Yellen, the “window” to lift interest rates appears to have closed which could potentially be a policy nightmare for the Fed, the economy and you.

Just some things I am thinking about.

____

Article by Lance Roberts, on realinvestmentadvice.com.