3 Big Warning Signs of a Crash

News

|

Posted 16/02/2017

|

6897

Fund trader Jeff Clark has a simple 3-pronged warning system to predict market crashes ahead of the ‘pack’. This system saw him predict both the 2001 and 2008 crashes. Casey Research have recently passed on this system and the warning that this May should see the 3rd and final signal turn red, after the first 2 have already done so.

So lets summarise these 3 signals with a bit more flesh on more recent events. First of all he looks for spiking rates. Since Trump was elected bonds have been crashing and the flipside yields have been rising – i.e. real interest rates. Last night’s stronger than expected CPI figures and surging odds of a March rate hike add to that spectre. Rates have risen before without a crash and indeed we are still relatively low but we are guessing Clark’s concerns are the steepness of the rise and the combination of that happening with all time record high debt levels.

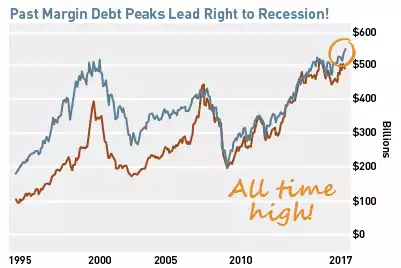

Speaking of record high debt, that brings us to the his next signal, the 2nd, being margin debt on shares hitting a new high of over $550 billion. The herd is piling in and piling in with borrowed money. This is a contrarians dream as it clearly demonstrates euphoric greed in play. You can see the result in 2001 and the GFC.

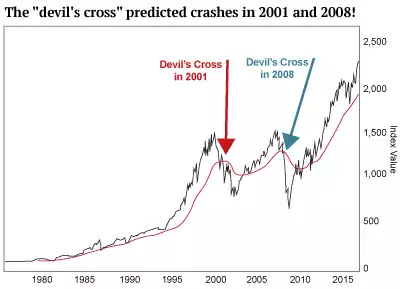

And so we await the 3rd signal and that is a technical one in what they call the “devil’s cross”. This is their name for the occurrence of the S&P500 breaking down through its 20 month exponential moving average. As opposed to usual linear moving averages like we reported recently with the golden cross in gold, Clark’s exponential MA weights more heavily to recent price moves (we’re guessing to capture momentum characteristics). What the chart below shows might seem at first a little obvious as it looks a little 20:20 hindsight-ish, but we think it is important for this reason. There are analysts out there talking of a 10-15% correction coming shortly. That’s not nice but its certainly not a big crash. What these analysts are saying however, is ‘buy the dip’ when that happens. As you can see below, if you had done so in the last 2 crashes you would have gone on to lose half your money as the crash continued after a little bounce. It is certainly one to look out for.

Clark, for reasons undisclosed is calling that 3rd signal to happen in May.

May would fit in with JP Morgan’s chief equities analyst’s fears as expressed to Business Insider last night:

“Business Insider asked the head of US Equity Strategy at JPMorgan what keeps him up at night.

His answer was loud and clear: An ongoing trend of US dollar strength.

"The dollar continues to strengthen," said Dubravko Lakos-Bujas in an interview with Business Insider. The dollar on a global trade weighted basis has increased by about 20-25% over the course of the last 2-3 years, he pointed out. And according to Lakos-Bujas, further strengthening in the dollar could come on the back of President Trump's corporate tax reform proposals like a border tax adjustment.

"If that trend persists, you could see the global economy getting further pressurized. Keep in mind that 60% give or take of the global economy directly or indirectly is linked to the dollar. The dollar plays a very important role."

After the dollar, Lakos-Bujas is worried about higher interest rates and trade.

"There’s a good amount of leverage in the system, especially if you look at corporates," he said. According to Lakos-Bujas, leverage in US corporates ex-financials is in line with all time highs back to the 2007 levels. "There’s less room for tolerating a significant amount of rate increases," as higher rates will make that corporate debt more expensive to pay back.

On the trade side, Lakos-Bujas looks toward the uncertainty around the US adopting significant changes on border taxes and other restrictive trade measures that could end up resulting in "significant" retaliatory effects from big trading partners like China.

So what can investors do to get a good night's sleep?

"If you believe that a strong dollar and rising rates are going to continue tightening conditions, don’t be surprised if at some point the Fed turns marginally more dovish," said Lakos-Bujas. "This means that gold and gold miners might be an interesting hedge to an existing portfolio."”

So simply, Trump moves ahead with tax reform, the Fed could raise rates in March, the markets have a fit on the back of the subsequently rising USD, rates surge further, China uses the USD strength to devalue the Yuan and in turn send a retalitory message to Trump. Kind of fits huh….?