2022 Global Risks Report – “looming debt crisis”

News

|

Posted 02/02/2022

|

6816

Each year the World Economic Forum survey 1000 global experts and leaders to produce their Global Risks Perception Survey (GRPS) and this year the Global Risks Report also draws on the views of over 12,000 country-level leaders who identified critical short-term risks to their 124 countries. At 117 pages long we will just present those sections we feel most relevant to investors in regard to economic risks.

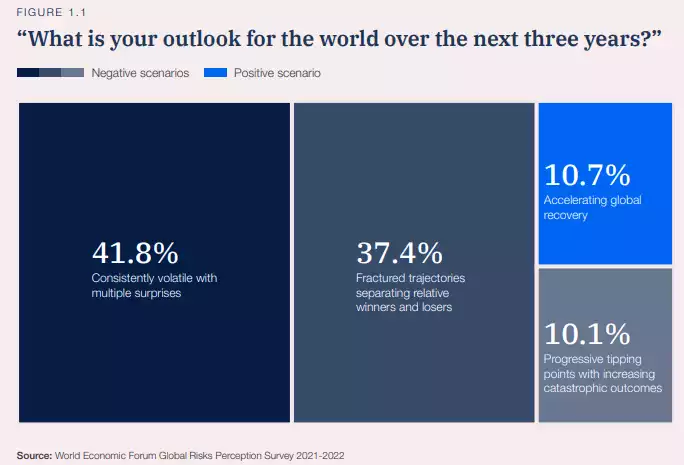

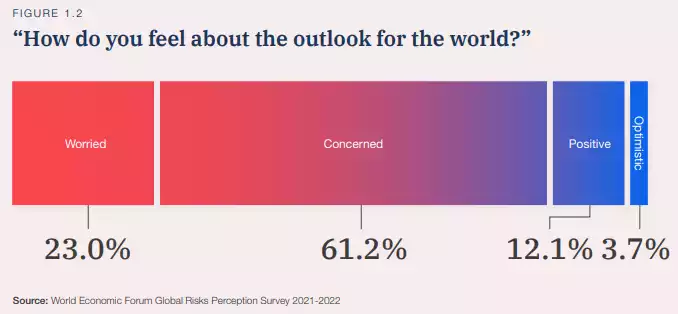

In short there is a clear concern about the trajectory of the recovery from COVID.

“At the start of 2022, the COVID-19 crisis is still ongoing and its economic ructions continue to be felt. Disparities in progress on vaccination are creating a divergent economic recovery that risks compounding pre-existing social cleavages and geopolitical tensions. These tensions and the economic overhang of the pandemic will make it difficult to ensure a coordinated and sufficiently rapid approach to global challenges—most notably climate change.”

“Risks to economic recovery

The global economic recovery from the recession caused by responses to the COVID-19 pandemic continues but is slowing. After a contraction of 3.1% in 2020, global economic growth is expected to reach 5.9% in 2021 and slow to 4.9% in 2022. By 2024, the global economy is projected to be 2.3% smaller than it would have been without the pandemic. Risks to economic growth are considerable, including risks from a potential resurgence of COVID-19 as new variants emerge. The previous edition of the GRPS identified “commodity shocks”, “price instability” and “debt crises” as critical medium-term concerns. These are already emerging to some extent. At the time of writing, commodity prices had increased nearly 30% since end of 2020; they could remain volatile because of growing tensions between Europe and Russia, China’s energy shortage, continued supply chain disruptions and transition challenges from disinvestment in fossil fuel reserves. Inflation has accelerated in many countries as a result of pandemic-related disruptions to supply chains combined with resurgent consumer demand and higher commodity prices. This will dampen consumer sentiment—which has been fundamental for recovery—and will increase risks from central bank interest rate rises. In advanced and developing economies alike, higher prices and more expensive debt would impact lower-income households especially hard, while small and medium sized enterprises (SMEs) that are still trying to avoid bankruptcy would suffer from weakening consumption.

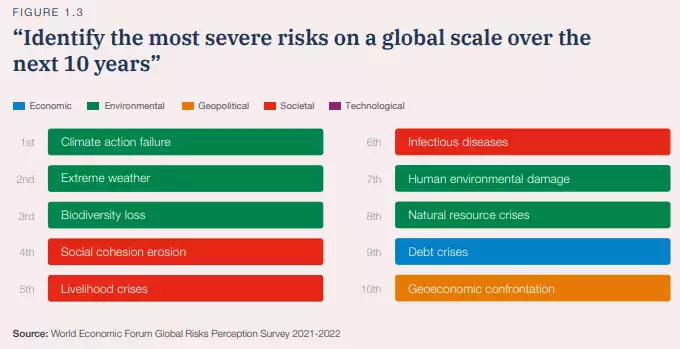

Moreover, sovereign debt has spiked because of the pandemic. Government debt globally increased by 13 percentage points, to 97% of GDP, in 2020. Already strained public finances in developing countries are at heightened risk from debt deleveraging and an appreciation of the US dollar—the US Dollar Index had risen 7% since the start of 2021. GRPS respondents identified “debt crises” as a critical short- and medium-term threat to the world, and one of the most potentially severe risks over the next decade (see Figure 1.3). Debt overhangs will make it more difficult for countries to deal with the economic impacts of COVID-19 and finance a socially just, net zero transition.”

Regular readers will know we have been highlighting the debt burden piece for some time. Whilst the terminal effects of it keep getting pushed out, it is being pushed out by ever more debt hiding the bigger problem. At some stage, and many believe we are about to see it, central banks will lose control, have to raise rates or the bond market will simply raise it on them, and we will see the impacts of servicing all that debt with higher rates…

“Looming debt crises

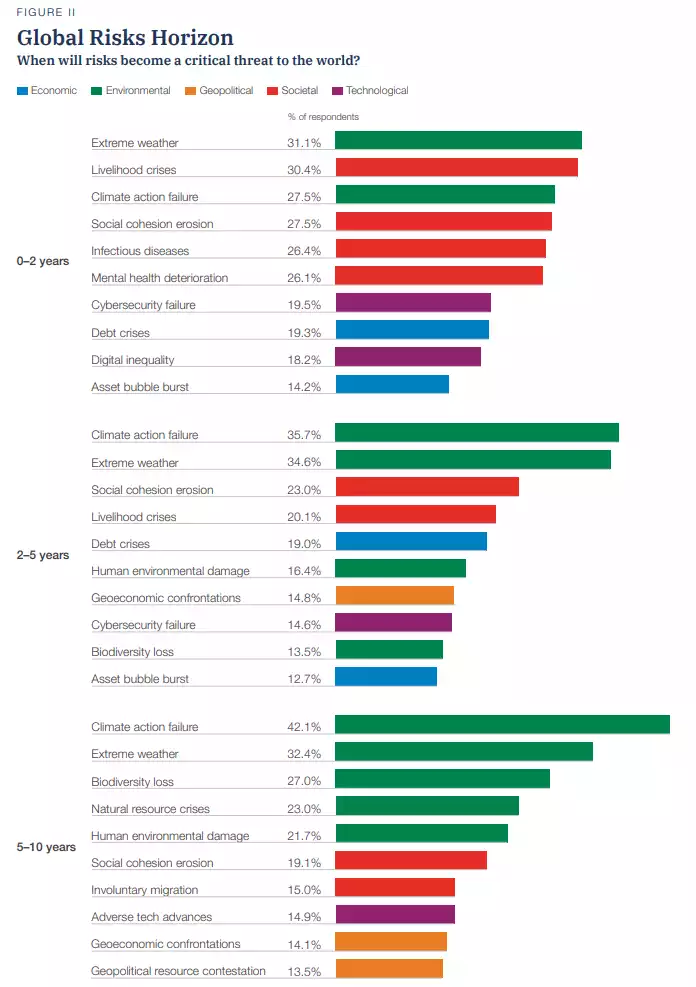

“Debt crises” were identified as an imminent threat to the world for the next two years, but GRPS respondents believe they will reach their most critical point in three to five years. Government stimulus was vital to protect incomes, preserve jobs and keep businesses afloat, but debt burdens are now high and public budgets will continue to be stretched after the pandemic, even as they are needed for financing just and green transitions.”

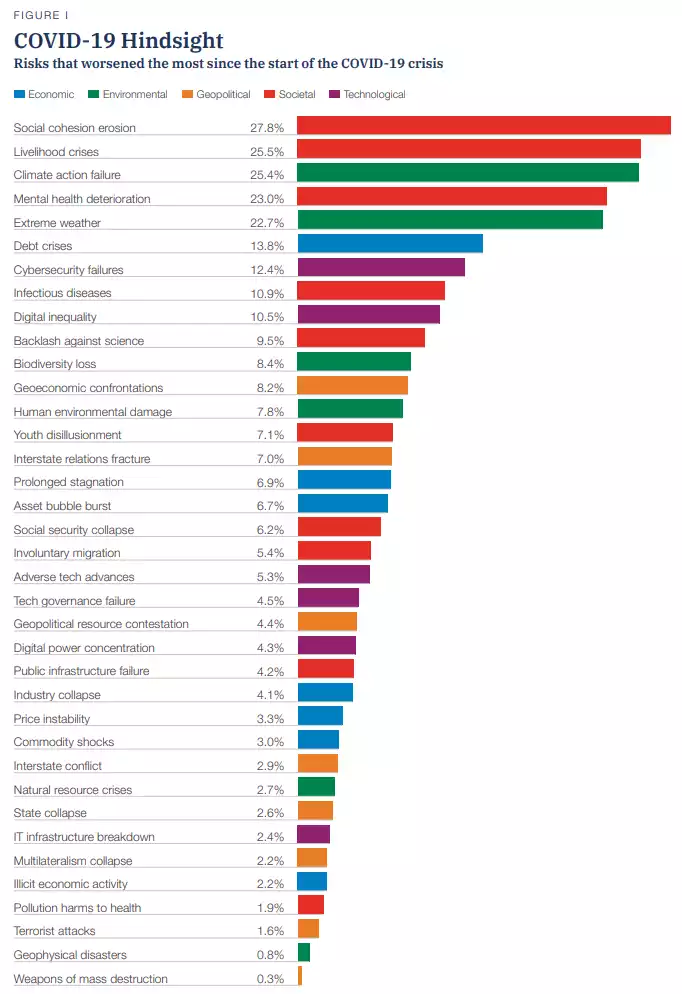

COVID has simply made it much worse and it sits high in the list of risks that have worsened since the start of COVID:

The above economic risks are defined in the survey as follows:

This is yet another warning of the need to hold a sizeable part of ones wealth in hard assets of limited supply like gold, silver platinum Bitcoin and Ethereum. Precious metals have proven throughout millennia to protect against such macro shocks and large cap cryptocurrencies are early in their journey to do the same.