Warning Signs of a Bear Market

News

|

Posted 01/06/2018

|

9303

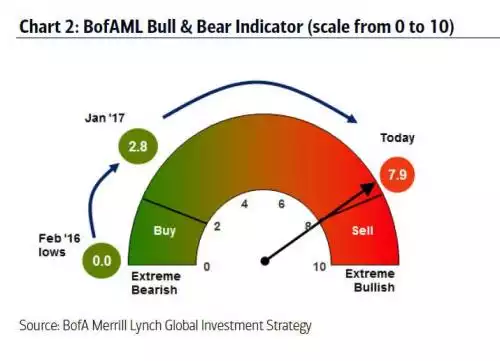

Markets rarely give you clear signals around tops and bottoms. Hindsight is the only accurate predictor… Bank of America Merrill Lynch do however have what they call their Bear Market Signposts and their Bull & Bear Indicator and it has had a pretty good record. In January that Bull & Bear Indicator hit the magic sell indicator for Feb/Mar and the market duly dropped by 20% over that period. That keeps intact its 11/11 record since its inception in 2002.

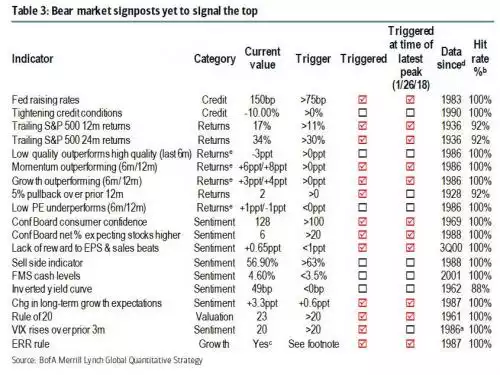

From the 7.9 warning in January the indicator peaked at 8.6 before that big correction and currently it’s settled down to a neutral 4.6 and not flashing red. So rest easy…. for now. But don’t get too comfortable as their other indicator, the ‘signposts’, just added another 2 to take it to 13 out of their 19 now triggered.

That means 68% of the signposts have been triggered when at least 80% have been triggered before each of the bear markets since the 1960’s. In other words if another 2 are triggered we are in the red zone….

So we are clearly in that period in the market when everything is awesome but the signs of the party coming closer to an end are building. That explains in part why those hedges against that party ending, gold and silver, are languishing. Languishing means they are also ‘on sale’. 2 signposts were jusr added to this indicator without notice, as will the next 2. 2 more put it into the imminent danger zone. This indicator, like all such indicators, can only look backwards and tell you what has happened. What you most certainly can’t do after the fact is buy your gold and silver at ‘yesterday’s prices’ and ‘yesterday’s availability’. It is at times like these we must remind ourselves of Financial Maths 101 and the adage ‘better a year too early than a day too late’.