2017 US Recession – History Repeating

News

|

Posted 13/12/2016

|

6354

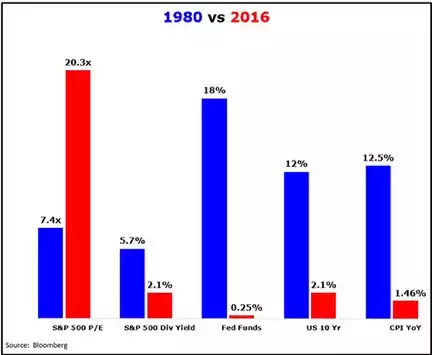

We’ve addressed previously the erroneous direct comparisons between Trump and Reagan. Apart from agendas of tax reform and fiscal stimulus, the environments could not be more different but they may have one common link – a recession within 12 months.

Bill Hall writing for Money & Markets concurs and wrote the following:

“After considering the chart above, even the most optimistic among us would say that Trump and his economic team face some strong head winds. And I haven't even touched on the BIG macro problem facing the U.S economy, which is an avalanche of global debt.

Making things even far more difficult for a Trump administration is that in the last 100 years there has never been a two-term presidency end that wasn't followed, within 12 months, by a recession.

But we do live in interesting times. And it's possible that the world's central banks will make good on their promises to double down on their experimental economic policies in a way that will kick the can down the road on a recession.

So let's say that Trump's policies work. The U.S. economy is still a big ship to steer: It doesn't just turn on a dime. Large government-funded infrastructure projects take time to get started. Time for the funding to come in. Time for the projects to be planned. And time for the equipment to be delivered.

That's why sometime in the next several months, I expect the uncertainty factor that the President-elect and his policies bring, to "trump" the recent market euphoria. And in the financial markets, uncertainty equates to volatility.

With increased volatility, I anticipate the current stock market rally to reverse and the recent sell-off in bonds to be temporary. A heightened level of uncertainty should send investors scrambling for safety, specifically to U.S. treasuries.”

The other safe haven to Treasuries of course is gold. To us it seems a little counterintuitive to be piling in to US debt instruments at a time of volatility in, specifically, US markets after such an unprecedented lead up to the next crash. By that we mean there has never in history been a bubble more over inflated by government stimulus than this one, and that is even before the ‘doubling down’ that Jim refers to (be that helicopter money or negative rates in the US etc). When this thing pops many believe it will completely dwarf the GFC and Great Depression.

Topically that same article says : “Recall, it was the iconic investment advisor Warren Buffett who said: "Price is what you pay and value is what you get." And currently, stock market value has diminished as prices have moved higher.”

In terms of value, real, fundamental, intrinsic value, gold has no peer. A US debt note (Treasury bond) held as a safe haven in a debt borne crisis on the other hand….?