20% of Aussie Debt Held by China

News

|

Posted 02/10/2015

|

3703

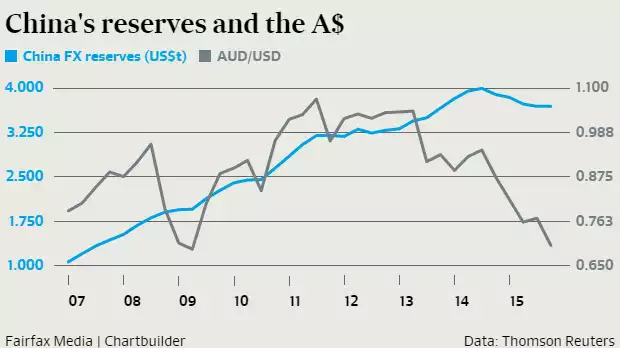

In today’s weekly wrap, we make reference to freshly released research from Canada’s RBC suggesting that China looks to hold an approximate 20% share of all Australian government and semi-government bonds. There has been much media discussion about the liquidation of China’s US denominated debt and the implications thereof in recent times and many of those arguments are now largely applicable to Australia. China’s willingness to utilise foreign reserves in support of their currency and in support of their continued gold acquisitions has been amply demonstrated of late. We reported on the latter just yesterday. In an even larger indication of China’s financial importance to Australia, if considering only the bonds that are held offshore, China represents a 1/3 holding. What’s of additional interest is the fact that at around 3.5% of total reserves, China’s AUD holdings are disproportionately high when compared with those being held by other central banks which generally target the 2% mark. This could indicated a greater risk of AUD denominated liquidation if China attempts to shift its portfolio allocation towards global norms; a point illustrated by noting the current liquidation of their reserves plotted against the value of the Aussie below.

In early September we reported on analysis that predicts a steeply lower Aussie dollar in the future and this revelation adds support to such suggestions as a lowering in the value of the Aussie is a potential consequence of any further liquidation of China’s $US3.7 trillion foreign reserve pool. At the time, we surmised that such currency movements could see significant gains for Australian bullion holders as they benefit from the weakening currency demand. See Monday’s news article for a better understanding of the benefits of holding bullion in this environment.

Higher yields on Australian bonds should also be expected as a key source of demand begins to falter. This is based on the premise that large institutional investors will be unwilling or unable to compensate for any large scale repositioning in China’s foreign reserve allocation. The low yield debt environment has been of key assistance in maintaining Australia’s moderate deficit and has eased budget pressures federally. According to the ABC, “the Australian Office of Financial Management (AOFM) needs to borrow around $70 billion a year to cover maturing government debt as well as a federal budget deficit which is forecast to be around $25 billion next year.” Such figures highlight the importance of the availability of Australian debt demand to our political and economic landscape; both of which are not known for their stability at the present time.