Czech Republic to boost gold reserves 1,000%

News

|

Posted 03/06/2022

|

10066

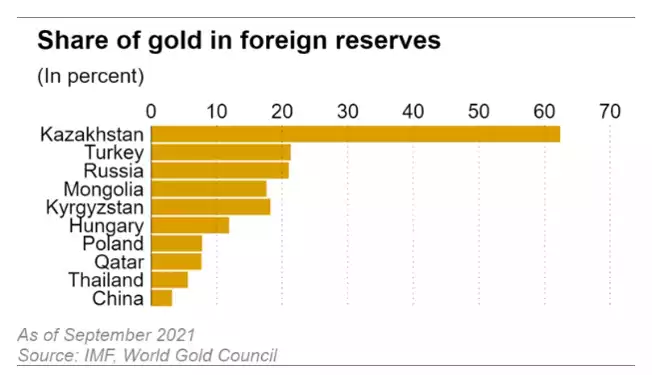

The Czech Central Bank has announced that it will raise holdings to over 100 tonnes from the current 11 tonnes. This still only represents 0.3% of the Czech National Bank’s assets. They join a growing cohort of Europeans nations repatriating or purchasing gold at a rapid rate. Hungary and Poland have increased their gold reserves as a percentage of total holdings to 17% and 8% respectively with Russia and Turkey well over 20%.

Incoming Czech National Bank governor Ales Michl argues that: “Gold is good for diversification, it has zero correlation with stocks." Michl expects peak inflation in the Central European nation to peak at 15% by July, before retracing to the 2% target rate within two years. Since last summer, Czech’s central bank has increased official rates by 550 basis points to 5.75%. With outgoing Governor Jiri Rusnok’s final policy meeting coming later this month, there is a one 25 basis point raise expected. The Czechs, sitting outside the 19 member Euro currency bloc, are moving more aggressively than the ECB which, in the face of 8.1% inflation, are still debating how much to lift rates for the first time in a decade off their famously negative 0.5% deposit rate.

Michl is also calling for an increased proportion of the country’s wealth to be held in stocks to get a better yield, but, somewhat surprisingly, the increased gold holdings are also a part of the race for greater yield. The new governor didn’t comment on how or where the gold will be held, at this stage. Previous audits don’t detail if they will be actively managed with gold loans or gold swaps, or if they will simply be securely held.

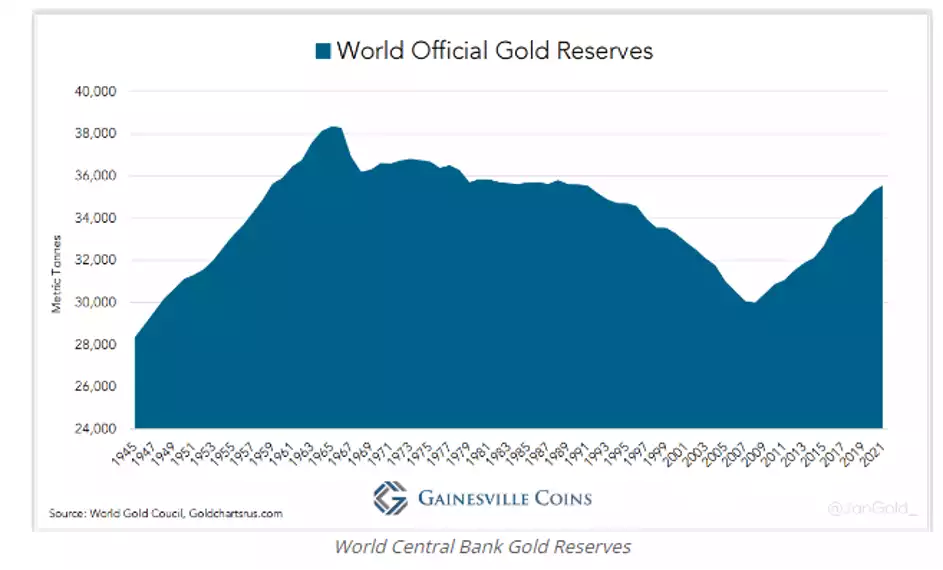

While hardly ‘News’, the French Government revealed that it had repatriated 221 tonnes of gold between 2013 and 2016. It makes a lot more sense to tell people long after the fact that you have done something, rather than let everyone know you are about to buy. 2014 saw 120 tonnes transferred from New York and Paris in Germany’s repatriation. The 2008 Global Financial Crisis seems to be the turning point in Central Bank net purchases of gold. They have increased holdings on a net basis of 400 tonnes a year.

Central Banks have certainly been aware in the past of the power of gold. In 1933 the Bank of International Settlements was desperately trying to get the world back to the gold standard: "the gold standard remains the best available monetary mechanism." Alan Greenspan wrote in his tome “Gold and Economic Freedom” (1967): “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. … The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves”.

Our guess is that Central Bankers are remembering their old gold-bug ways.