Q1 Bitcoin Perspective

News

|

Posted 09/04/2018

|

7311

Since inception, there have not been many times where Bitcoin has seen an extended period of negative growth like we experienced in the first three months of 2018. In fact, this first quarter of 2018 has broken records and registers as the worst first quarter in the history of Bitcoin, and the second-worst quarter ever.

As we are now in the second week of Q2, several leading crypto analysts and experts are approaching the next few months with optimism despite what has gone before. There are a couple of reasons for this, and if history is to be followed and noted, then Q2 holds a lot more promise and optimism. Some key pressures that drove Q1 prices down are starting to ease, regulators are finding some balance, and even more unusual things like the end of Chinese New Year and people scrambling to take profit at the last minute before submitting their tax in the U.S. being behind us can influence the second quarter positively.

Bitcoin dropped 50 percent in the first three months of 2018. The price of the cryptocurrency has fallen from $13,412.44 USD on Jan. 1 to $7,266.07 USD on March 31. By the end of the quarter, $114.9 billion of market capitalization had been wiped off.

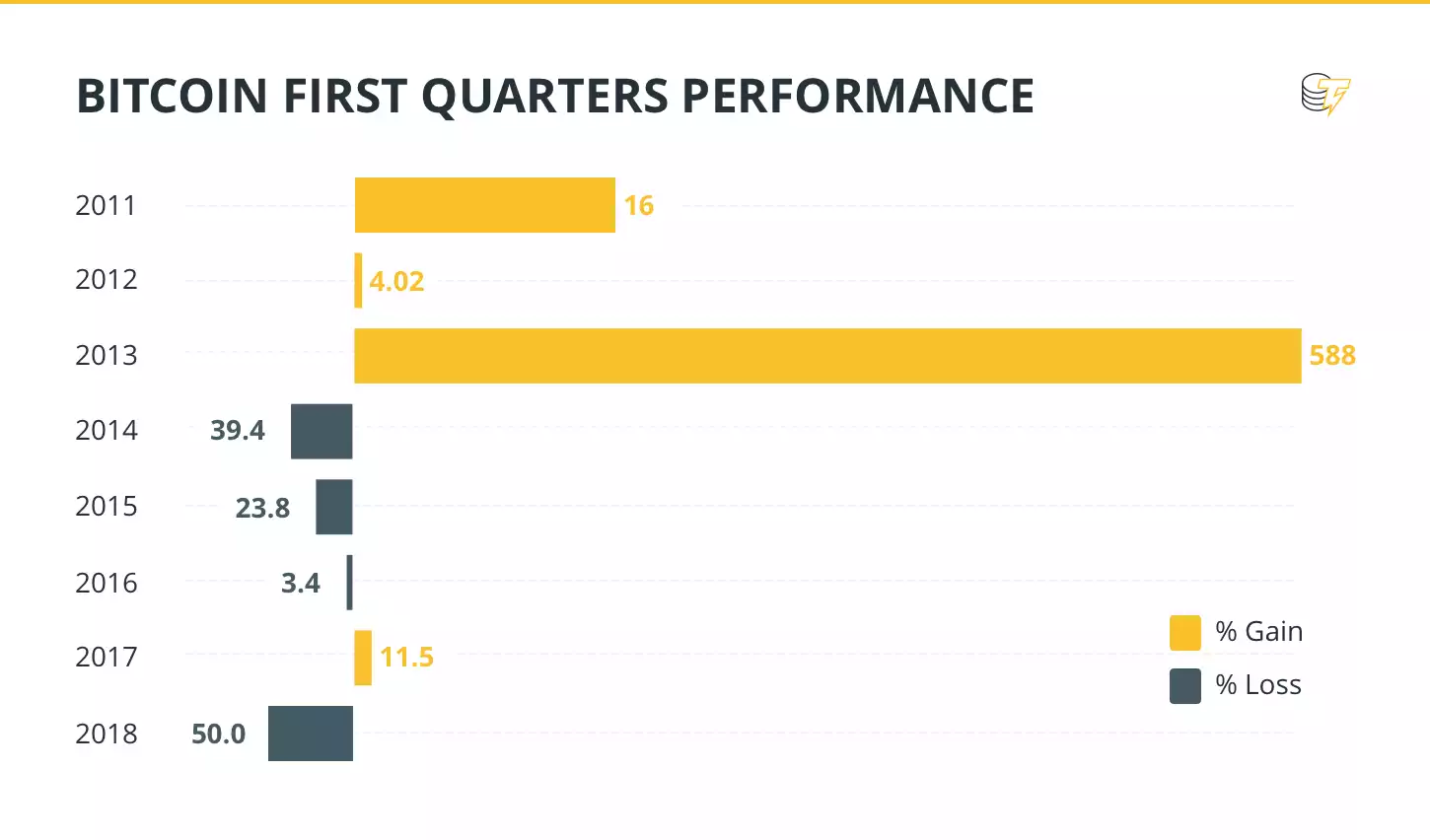

To put it in context, Bitcoin has historically done poorly over the first quarter of the year in its seven years prior. In it’s now eight first quarters, Bitcoin has had four negative starts to the year with 2018’s 50 percent loss being the worst, followed in second by 2014’s 39.47 percent loss. However, those losses pale in comparison to the growth of some years, such as 2013 which saw Bitcoin grow by 588 percent in three months.

2018 was always going to be an interesting year for Bitcoin, and other cryptocurrencies, following up from 2017 which was such an historic one in terms of price and mainstream adoption. Bitcoin reached its all-time high of $20,000 USD in late December as the cryptocurrency market thrust itself into the mainstream.

This caught the interest of regulators and governments who realised that this was more than a fad and that they had to step in to try and institute some sort of control over this decentralised form of finance. As a result, there has been a slew of different rules, laws and recommendations from different countries as to how Bitcoin and other cryptocurrencies should be governed. Some have been stricter than others, and this has had its effect on the growth and interest for investors. However, the regulators, for the most part, have been trying to find a balance for this form of ungoverned currency to fit into the financial regulation that currently exist.

Despite this, there is still optimism heading into Q2 from some leading market analysts and cryptocurrency experts. Firstly, the bad news that drove the price of Bitcoin down, notably, the regulatory pressure, seems to be fading. Secondly, the remaining bad news, like the South Korean “ban”, the misinterpretation of the Indian ban, and more pressure from China, has had its effect, so any more bad news cannot do as much damage. Furthermore, Q2 seasonal tailwinds include historical data showing a better performance in the second quarter, as well as a number of big conferences coming up, that usually inspire positive sentiment.

It is easy to look at a small section of Bitcoin’s history in isolation and start to panic - after all it is such a new, and volatile, commodity that when it is up, it is rocketing up, and when it is down, the same applies. Bitcoin’s Q1 may be a poor performer but zooming out a little bit shows the perspective of things. August 5, 2017 was an important day as they cryptocurrency community celebrated Bitcoin breaking the $3,000 USD mark. That is less than half of where it is today, and that was also only eight months ago!