Still Early Days for Cryptos

News

|

Posted 28/03/2018

|

8654

Is it too late to enter the cryptocurrency markets? Have you missed the boat? Is the current dip the opportunity to get on board? These are the questions on many lips.

With the end of the first quarter of the 2018 calendar year drawing to a close Bitcoin and cryptocurrencies are still very much in the very early stages of overall market acceptance and adoption.

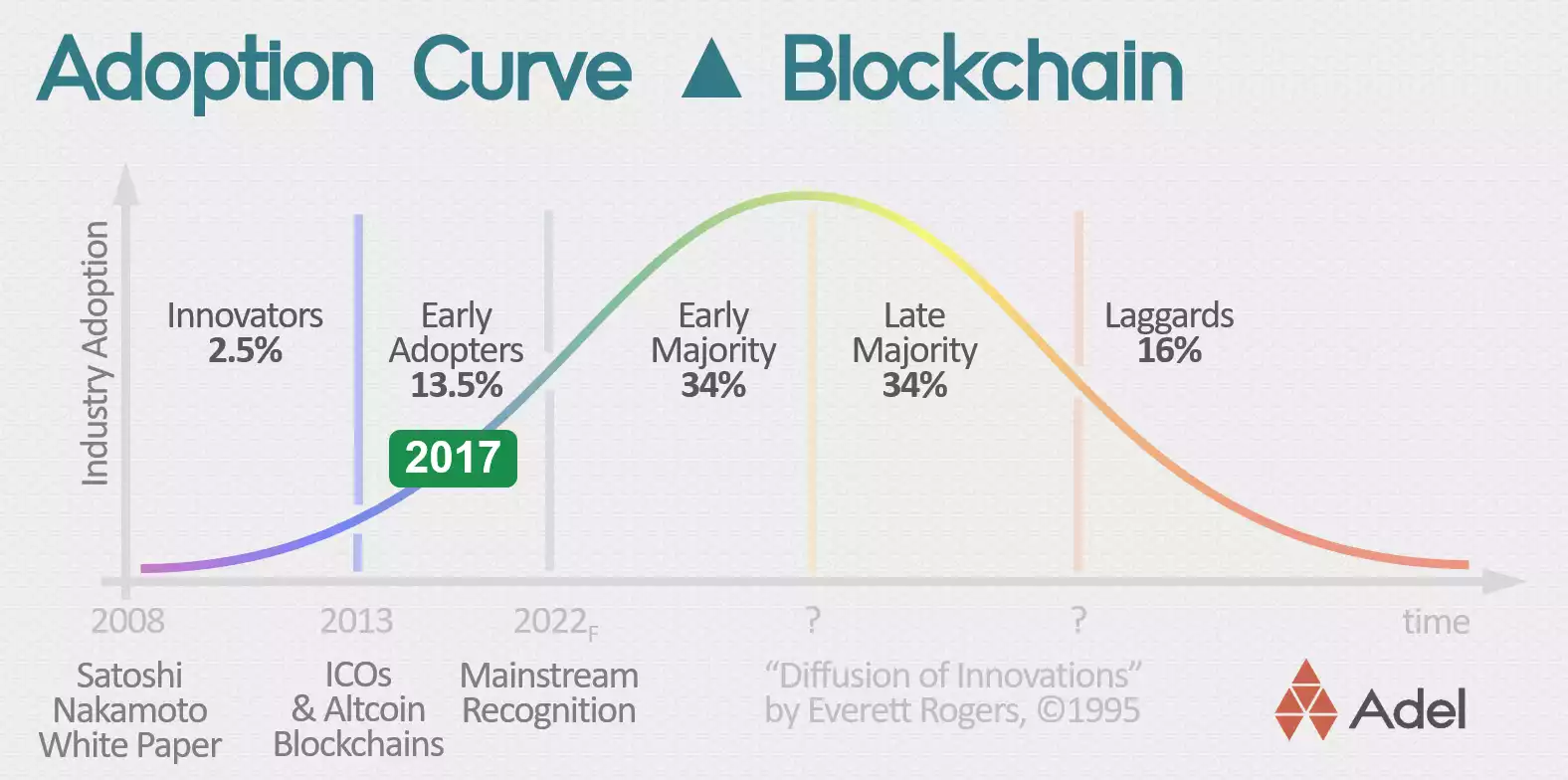

The S Curve or Adoption Curve is a common analysis tool and as defined on Wikipedia stems from the theory of Diffusion of Innovations. The theory seeks to “explain how, why, and what rate new ideas and technology spread”. The Diffusion of Innovations was made popular by Everett Rodgers with the publication of his book of the same name. Adoption Curves are used to describe how new innovations and ideas are accepted and adopted by groups and cultures.

The following graphical representation is some analyst’s view of where we are currently placed on the Adoption Curve for cryptocurrencies which clearly shows how much growth may yet come in this space.

Innovators would be the technology enthusiasts who took a risk with a little known new technology soon after the Bitcoin whitepaper was released. The innovators would also include the bitcoin miners who support the network and began development of the many cryptocurrencies we now have in the market.

The Early Adopters or Visionaries as stated by Techopedia, are usually ‘the ones who mostly dictate the acceptance of a product for the early majority, the late majority and even the laggards (the very late adopters).’

Do you remember back to the DOS days? The green screen with the blinking cursor? You could get the computer to do something for you, so long as you knew the programming language. It certainly wasn’t particularly easy and definitely not intuitive. Now fast forward to those wonderful little rectangle objects we all religiously carry around with us – yes smart phones. Our smart phones these days are 100’s of times more powerful than those old green screened computers of over 25 years ago. And how easy is it to setup a smart phone or a new laptop these days… And why is that? Because the software and interfaces are in place, making what used to be a labourious and tiresome exercise virtually painless.

Sound familiar…………interacting with cryptocurrencies at the moment can be quite laborious and time consuming. Exchanges, paper wallets, hardware wallets and not to mention huge long addresses which look like a toddler has been up to mischief and created it. However, history shows that as adoption increases so will the ease of use. Early adopters’ perseverance is sure paying off though – Bitcoin is up over 1000% from this time last year.

For those who can stomach the roller coaster like, adrenalin fuelled peaks and troughs; it certainly appears that the opportunity for huge gains is well and truly only beginning.

The scarcity factor with Bitcoin must also be taken into account – there will only ever be 21 million Bitcoin. There is not enough bitcoin for each of the current millionaires to have one each. Scarcity also fuels demand which in turn, more times than not, leads to increases in valuation of the asset.

As we alluded to in our report on 27th March 2018 – we are currently living through a time of massive change, a whole new paradigm as our global monetary system transitions. Industries are being disrupted at a fast pace. The banks don’t want you to use cryptocurrencies just the same as the postal services such as Australia Post did not want you using emails or more recently just like the taxi drivers did not want you to use Uber. The banks can see the writing quite clearly on the wall – it is their time to be disrupted.

The question is at which section of the Adoption Cycle will you make the “shift”?

As the Greek philosopher Heraclitus famously quoted, “the only thing that is constant is change”.