“Unbacked” currency v Gold

News

|

Posted 12/03/2014

|

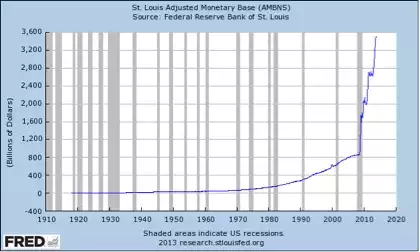

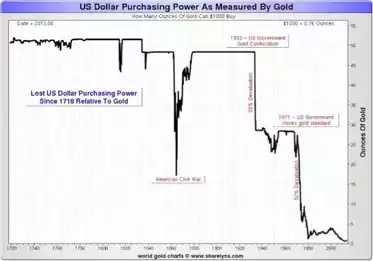

4278

Yesterday we showed how the USD has lost 95% of its purchasing value over the last 100 years. Another way to look at it is how much gold you can buy for your US dollar (or inversely, how much more your gold is now worth). The first graph below shows what happens when you default on bonds or leave a gold standard for Fiat currency. The second graph shows what the government can do when its currency is not tied to gold…. just print more currency. Does that second graph look sustainable to you? Gold is real money, period. 10-20% of your wealth in gold and silver can be your hedge against all this printing and debt, and balance your investments.