“The End of Easy” and the USD

News

|

Posted 19/07/2018

|

6627

There are growing questions about just how committed and for how long the US Fed will proceed with QT, the Quantitative Tightening process of reducing its balance sheet of that $4.3trillion of bonds it bought to print all that money post GFC.

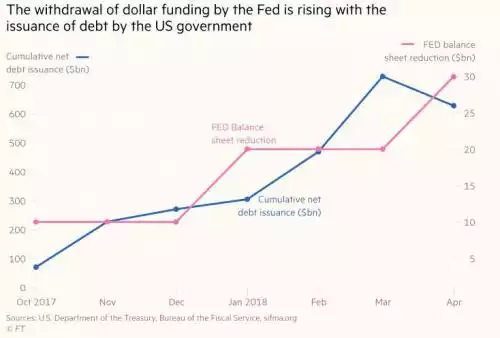

The US Fed are currently unwinding $40b/month and have stated intentions of increasing that to $50b/month later this year. What they are now experiencing however is a US administration running a deficit of historic proportions as Trump makes America great again with yet more debt when they already owe $22trillion. Both this year and next he will spend around $1 trillion more than income. That can only be facilitated by selling more US Treasuries at a time that the US Fed is also effectively selling theirs. It is sucking an enormous amount of USD out of the global system simultaneously. Not surprisingly, when in concert with the rising rates, we are seeing USD strength and corresponding weakness in gold.

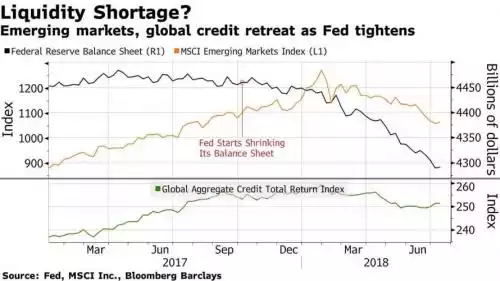

This USD liquidity squeeze is particularly painful for emerging markets. India’s Reserve Bank chief explained:

"given the rapid rise in the size of the US deficit, the Fed must respond by slowing plans to shrink its balance sheet. If it does not, Treasuries will absorb such a large share of dollar liquidity that a crisis in the rest of the dollar bond markets is inevitable."

And indeed we are seeing the effects already:

Accordingly we are starting to see more questions asked about how long they can proceed on this course. Morgan Stanley recently said “"We believe that the Fed will halt the normalization of its balance sheet by September 2019 and start growing it again in 2020 to ensure that the effective fed funds rate remains within the range the Fed targets." And last night Macquarie Bank said “financial markets are flashing a warning to the Federal Reserve that the global economy cannot withstand its monetary tightening, and will in coming months force a halt to the campaign…..The problem is the Federal Reserve right now is destroying money, destroying roughly $50BN every month….They will be forced at some point in time over the next three to six months to stop reducing the size of their balance sheet.”

That this is coinciding with the effects of the Trump trade wars only adds to the concerns. Overnight the US Fed Chair in the 2nd day of his testimony repeatedly (though carefully given the boss was watching) warned that the trade wars posed a real threat to US economic strength, not just its trade partners:

"we hear from our extensive network of business contacts a rising chorus of concern. As you pointed out, lots and lots of individual companies have been harmed by this. We don't see this in the aggregate numbers yet because it's a $20 trillion economy, and these things take time to show up, but we hear many, many stories of companies that are concerned and are now beginning to make investment decisions, or not make them, because of this."

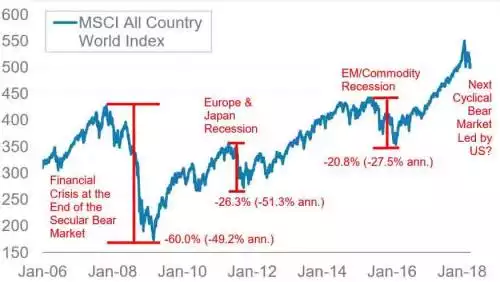

Morgan Stanley see this as precipitating the next bear market. Indeed their latest Global Strategy Mid-Year Outlook is titled “The End of Easy”.

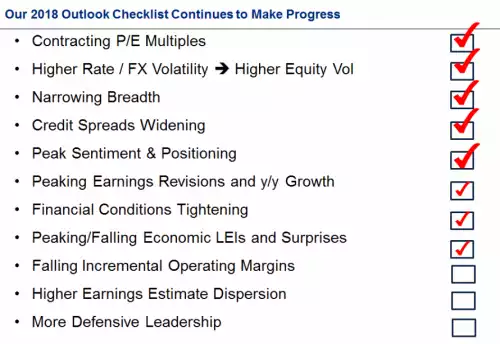

They also updated their 2018 economic checklist which is well on its way to achieving all they warned about earlier in the year:

When conditions tighten like the Fed is endeavouring to do there is less “easy” money to drive debt funded growth, hence “The End of Easy”. Compounding this, the less USD in global circulation means less investment in EM risk growth as well. So will the Fed stop the tightening or indeed even ease again? Macquarie put it simply:

"All cost of capital globally, eventually, will have to go negative and the reason is very simple: it's the degree of leverage and financialization that we have globally. Pretty much every country now needs 3 to 4 dollars of debt for every incremental dollar of GDP that they generate",

Does that sound sustainable to you? If you are still unsure let us leave you with the very words from the head of the US Federal Reserve in front of US Congress last night in regard to the US continuing to spend more than its income through more and more debt:

"U.S. fiscal policy has been on an unsustainable path for some time. It continues to be unsustainable"