“Stunning” record in Corporate Bonds that Can’t be Ignored

News

|

Posted 10/09/2021

|

6271

If anyone needed reminding about the extent to which easy money is inflating sharemarkets the charts below paint a clear picture. In a nutshell, the zero interest rate and QE fuelled monetary stimulus central bank policies are designed to rob you of any traditional ‘safe’ yield via savings or bonds and force you to look for yield via shares and make everything look awesome.

One of the most under rated drivers of these near all time high share prices is corporate buybacks. The playbook is simple. Borrow money via corporate issued bonds at ridiculously low rates and buy back your own shares to lift their value even higher. None of that intrinsic real value increasing R&D or Capex rubbish of yesteryear… Oh no, lets squeeze this easy money fuelled shareprice mania for all its worth… with easy money. You may well have spotted some irony or dare we say Ponzi elements to that last sentence and you would be right.

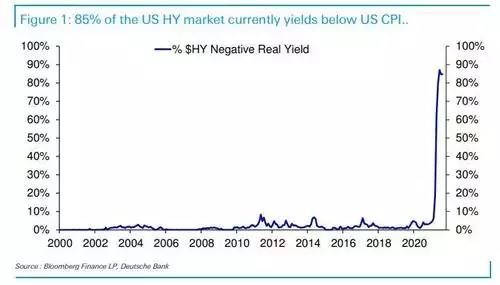

Below is a chart via Deutsche Bank showing (in their words) a “stunning” 85% of all the US high yield (corporate) bond market is yielding BELOW the current inflation rate (i.e negative real rates). Outside the last few months this had never been above 10% and as recently as the end of 2020 was just 4%.

Deutsche note - "Financial repression has indeed stretched a long way down the credit curve and you have to take more and more risk to beat inflation these days. Indeed the current yield on US single-Bs is 4.3% and on CCCs 7.1%." i.e. even the junkiest of junk is yielding just 7%.

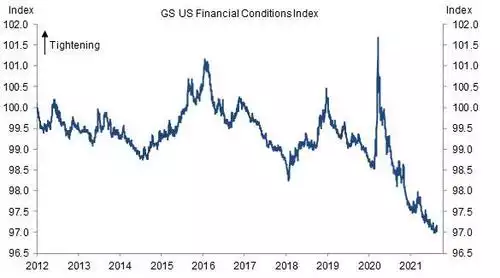

Needless to say that the conditions for lending have never been easier, a point reinforced by Goldman Sachs:

This week saw a record 2 day $60.6b binge on corporate debt in what Bank of America likened to “drinking from a firehose”

Last night saw the ECB announce they will be tapering QE and US shares saw their 4th straight day of losses when combined with more ruminations from Fed officials about the prospect of the Fed joining them as soon as an announcement this month. The issuance of all these bonds is a combination of companies locking in low rates and building their war chest for buybacks.

There is a 100% track record of tapering causing sharemarket crashes. There is a 100% track record of central banks doubling down on stimulus afterward. There is also a near 100% inverse correlation between the gold price and negative real rates. And its September….

But its probably nothing…