The End of the Grand Credit Cycle

News

|

Posted 10/06/2016

|

6912

Listen to our Weekly Wrap podcast today and you get a very clear picture of the real global economy… poor economic data, official downgrades, and dropping and negative interest rates implemented to try and resurrect growth. What the world is learning the hard way is you can’t just keep ‘buying’ growth with more and more debt.

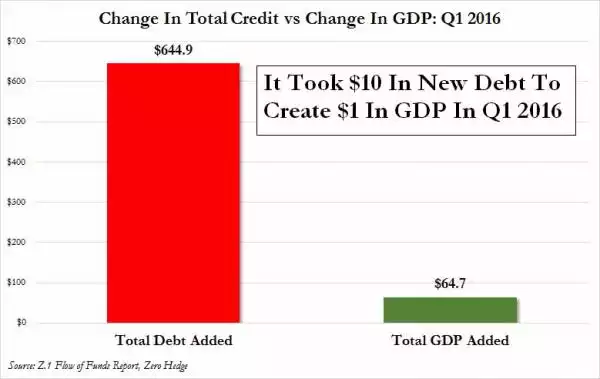

Zerohedge have just taken the latest official debt and growth rates from the US and paint a sobering reminder of what’s playing out. As the graph below shows the US added $645 billion of debt to it’s “pile” in just the first quarter of this year, taking total debt to an eye watering and all-time record $64.1 trillion. So what growth did that new $645 billion buy them? Just $65 billion. The US’s debt to GDP ratio is now 352%!

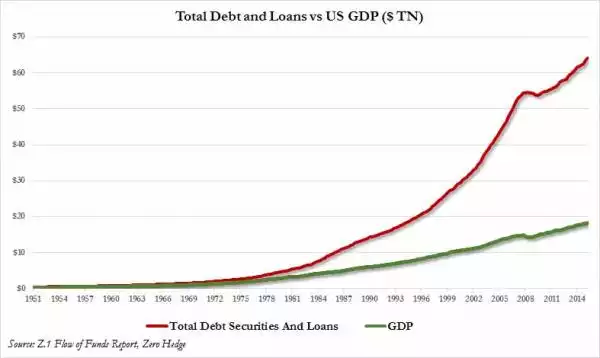

One quarter ‘does not a summer make’ you say? Let’s, then, step back and look at the situation. Can we remind you too, that we left the fiscal discipline of the gold standard in 1973 (you’ll spot that easily on the graph below) and launched the biggest credit cycle planet earth has even seen.

The thing is credit cycles throughout history have always collapsed, erasing untold amounts of ‘paper’ wealth. One asset has survived each and every event. Precious metals - gold and silver. ‘Smart money’ is starting to pile into it in 2016. It’s feeling close.