“If It Walks Like Lehman and Talks Like Lehman…”

News

|

Posted 28/09/2016

|

5071

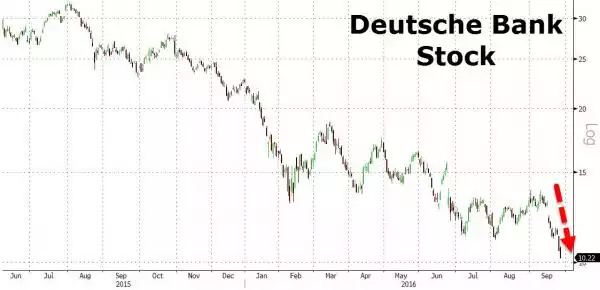

…it is Lehman”. This remark by a Wall Street trader yesterday reflects the fear overcoming global markets last night as Deutsche Bank’s share price plunged to new lows. We’ve written extensively on DB, most recently here. Yesterday the troubled bank, named by the IMF as presenting the greatest systemic risk to the global financial system, hit a low not seen since the mid 80’s and perilously close (22c!) to single digits, which psychologically analysts are calling the line in the sand.

As we reported in Friday’s Weekly Wrap, the bank faces fines of $14b from the US Dept of Justice, possibly the proverbial straw on this crippled camel’s back. The further falls this week came after Merkel stated there would be no bail out of the bank from the state. Yesterday Bundesbank (Germany’s central bank) reiterated that view even more forcefully saying "state support of banking sector must end," and bluntly stating it just "props up zombie banks." . Casting a broader net than just DB they called for structural reform of all banks stating that a “systematic clean-up, inevitable after the bursting of the financial bubble, isn’t finished yet,”. Not exactly confidence inspiring stuff… Not surprising then, Bunds (German sovereign bonds) have spiked on the news to a level equating to negative yields all the way out to 15 years.

It wasn’t just Euro markets either. The news brought down global markets and saw bonds up strongly until the relief rally last night after the perceived Clinton victory in the US debate. The VIX dropped back to 12 as well and both gold and silver saw large drops as clearly everything is awesome... If you didn’t read yesterday’s news, that is your cue….

Whilst they try and tell us this isn’t like Lehmans, the fact remains that when a bank is so publicly in trouble, a bank run is on the cards. Whilst most people think of a bank run as retail depositors getting their money out while they can all at once, as we saw in the GFC the bigger and faster danger is a wholesale liquidity run. Whilst DB is in the spot lights there are others struggling in this negative interest rate environment as well.

We spoke of Black Swans yesterday and DB is most definitely a big one.