“Everything Bubble” includes US Property

News

|

Posted 30/10/2017

|

6633

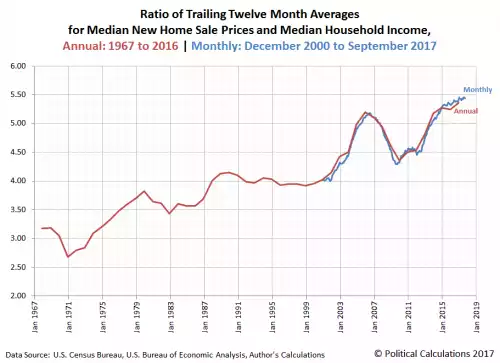

Further evidence has emerged that the ‘everything’ in the now entrenched “Everything Bubble” descriptor for our current market goes well beyond traditional financial markets. Whilst Canada and Australia have recently taken the global headlines for our property bubbles, the US, whose property bubble in 2006 triggered the GFC, is now above even those per GFC levels too. The US has seen the double whammy of strong price growth and poor income growth meaning their median new home sale prices to median household income has hit an all-time high of 5.45.

For perspective Australia’s median dwelling price for combined capitals sits at around $585,000 and against the 2016 census median household income of $74,776 gives us an even more concerning 7.8 ratio.

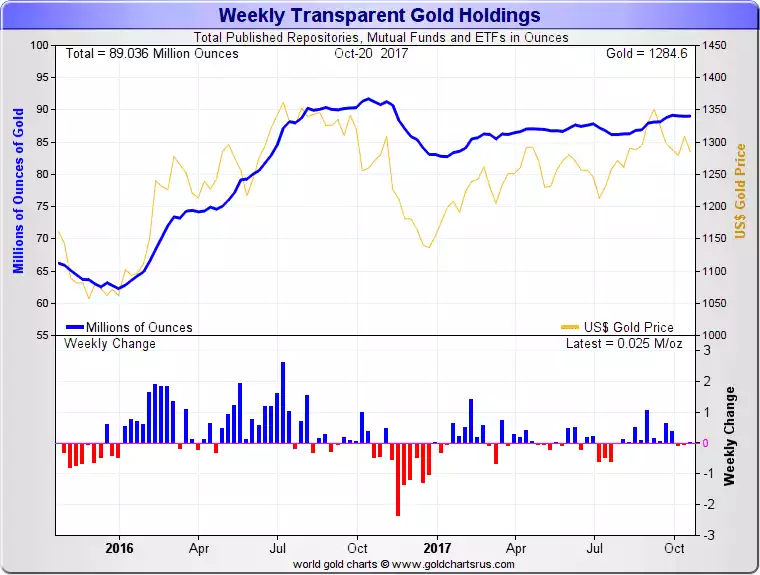

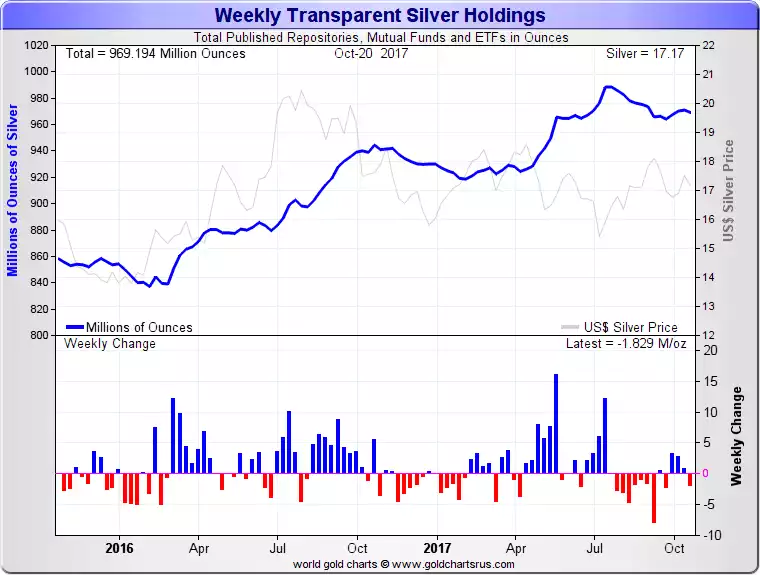

This, combined with the endless metrics of sky high US financials valuations, should reconfirm why gold and silver, whilst still firmly up on the November 2015 lows are, by any real measure ‘bouncing along the bottom’. Gold and silver are your ‘uncorrelated monetary asset’ and whilst financial and property assets are reaching all-time highs they are behaving as you should expect. That said there are plenty quietly loading up as can be seen from the following two graphs:

Whilst that is happening steadily the price growth is subdued. When the masses head for that door however…..