“Errors of thinking” could see a messy unwind

News

|

Posted 23/06/2021

|

6919

The Fed chair came out last night in his congressional hearing firmly reinstating his dovish stance after the market’s reaction on decidedly less dovish comments from 2 other Fed officials late last week.

Powell again maintained his conviction that inflation is transitory and that it would be “very, very unlikely” to see the kind of 1970s-style inflation some are fearing is before us. He was joined early this week by his colleague John Williams who said that any discussion about raising interest rates is still “way off in the future.”

This buoyed markets as fears of tapering subsided.

At the end of last week Fed member Bullard said “No one really knows how this is all going to unfold,” and that it was “appropriate” that the committee started talking about tapering.

His colleague Kaplan supported the view saying “We have to be ready for the idea that there is upside risk to inflation and for it to go higher.”

Neither Bullard or Kaplan are actually on the FOMC as voting members so aren’t those ‘2 dots’.

Regardless, this of course got markets all jittery again.

Williams is arguably the most influential FOMC member outside of the chairman and his conviction is high. In regard to the all important labour market he said: “I cannot stress enough that we still have a long way to go to get back to full strength”.

Outside of the Fed we saw two Wall St stalwarts weigh in at the Qatar Economic Forum. From Bloomberg:

““It’s easy to say that the Fed should tighten, and I think that they should,” said Dalio, the founder of Bridgewater Associates, the world’s biggest hedge fund. “But I think you’ll see a very sensitive market, and a very sensitive economy because the duration of assets has gone very, very long,” he said.

At the same event, former Treasury Secretary Lawrence Summers remained more strident.

“Much of the consensus of professional forecasters in February was that we would have inflation just above 2% this year,” said Summers, a paid contributor to Bloomberg News who served in previous Democratic administrations. “We’ve already had more inflation than that in the first five months of the year.”

That suggests “to me that people should not just modify their forecasts but should think about what their errors of thinking were that led them to be so far off in their forecasts,” he said.”

These are certainly interesting times when we have such divergent views on such important fundamental macro economics.

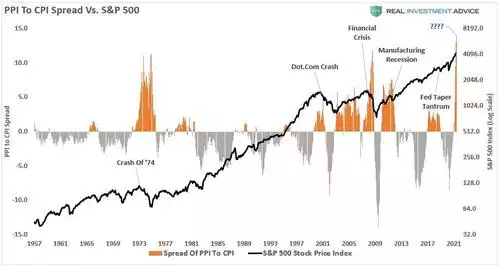

Real Investment Advice showed just how high the tensions are in the inflation space with the following chart showing the “the massive spread between the Producer Price Index (PPI) and the Consumer Price Index (CPI).” You can see it’s the highest ever.

“Please pay attention to this spread as it shows producers cannot pass along inflation to their customers. Therefore, the retained inflation, and by this measure, a lot of it, will erode profit margins and earnings in the future.”

You will note the coincidence with spikes in these spreads and market corrections afterwards.

The market is now totally reliant on an accommodative Fed and at real risk of weakening later this year. We may see short term expectations as talk of tapering continues, but the bond market is clearly pricing in economic pain ahead and it is usually right. Whatever triggers this market correction is unknown, there are so many candidates. The elephant in the room is probably the USD.

Irrespective, the outcome is the same. Printers will go brrrrr, and gold and bitcoin would likely surge again after this current weakness. The trillion dollar question is when?

There is the old saying – ‘better a year too early than a day too late’ and that may be one to consider over the coming weeks.