“CREXIT” Getting Close

News

|

Posted 22/07/2016

|

6281

Yesterday we reported on S&P’s warning around corporate debt expansion. In a world awash with bonds issued to feed our endless consumption of debt many of these bonds are of a far less quality than sovereign bonds or treasuries, and therein lies the big risk – defaults. Indeed S&P are calling this threat “Crexit”.

Already this year has seen an increase in defaults in this highest risk debt with global corporate bond defaults reaching the unfortunate milestone of 100 in mid July 2016. Lead by US companies that number is 50% greater than the same time last year, and has only been exceeded in the GFC.

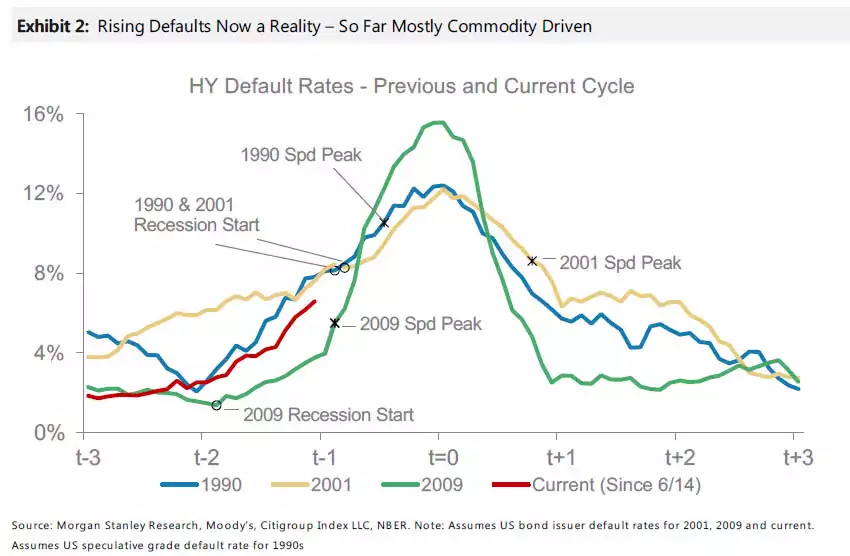

As we saw in the GFC, when there is a global loss of faith and scramble for the doors, you can see a spike in defaults, as the dominoes fall. Morgan Stanley Research put this nicely into perspective below in yet another chart showing evidence of how close we appear to that moment.