What Do JPM Know That You Don’t?

News

|

Posted 27/08/2018

|

7616

Friday saw gold dramatically jump back up over the $1200 threshold. The impetus appeared to be weak economic data and so of course shares jumped too as they care not for fundamentals but hope it will put the brakes on interest rate hikes and everyone can borrow more money cheaply. But gold saw additional tailwinds off what is becoming a very ominous yield curve. We explained the yield curve in this earlier article. The US Treasuries (2Y-10Y) yield curve just hit its lowest since just before the GFC in 2007. We also saw what Deutsche Bank called a “landmark moment” with the US treasuries yield curve falling below the Japanese equivalent, again for the first time since the onset of the GFC in November 2007.

One key concern buried in the yield curve is how the Fed can then bail out the system again should we have a market crash. Euro banking giant Societe Generale’s senior economist, Omair Sharif recently had this to say:

"We know there's a bunch of people who are saying this time it's different [when discussing the yield curve]. Yet they spent a good chunk of that [July] meeting listening to a staff presentation on whether their tool kit is sufficient if there's another downturn. They're kind of prepping their tool kit."

i.e. they have no bullets left in the gun.

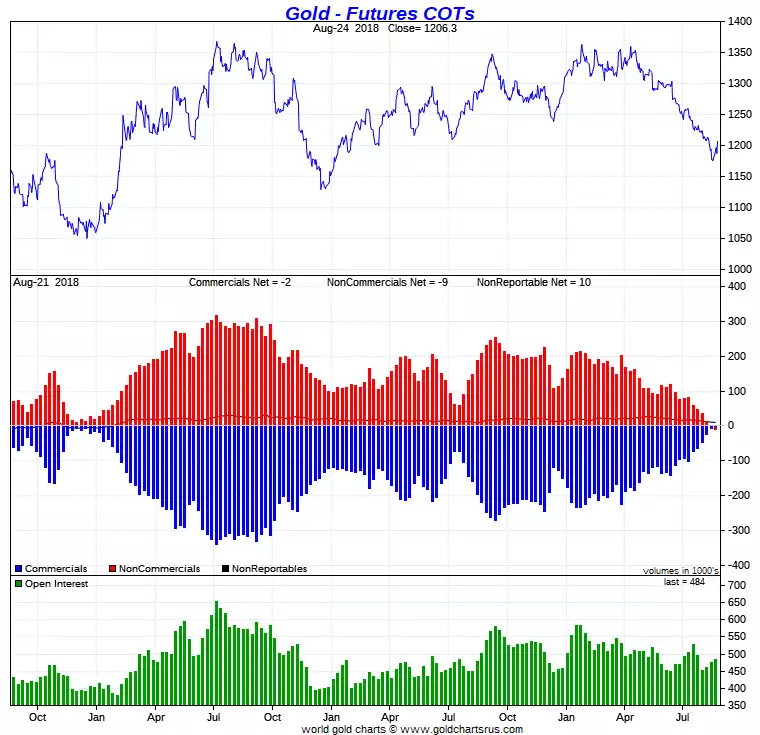

It would appear they are not alone in ‘prepping mode’. This last week’s Commitment of Traders Report saw yet more positioning out of the their shorts by the big Commercials as the Speculators continue their ‘everything’s awesome’ play, now actually fully net short!

Analyst Ed Steer had this to say, specifically focusing on the biggest of those Commercial’s, J P Morgan:

“How long this U.S. version of Kabuki theatre can last, or be propped up, remains to be seen, but this 'now-longest economic expansion in U.S. history' has only made it this far by massive financial and monetary interventions at all levels. At some point it will come to an inglorious end -- and it will certainly take the rest of the world's equity markets with them when it does happen.

This sudden and mysterious 'exit, stage left' by JPMorgan in the precious metal markets is somehow related to all the above. As I've said before, Jamie Dimon [JPMorgan CEO] is as plugged in as they come -- and you have to wonder what got whispered in his ear that made him head for the exits in the COMEX futures market when he did.

Whatever it was, we won't find out about it until after the fact. But JPMorgan is now out of its short positions in all the precious metals, except for silver -- and whatever is coming down the pipe, they're as ready as they're ever going to be.

But after Friday's price action in the precious metals and their shares, it certainly appears that the end of these engineered price declines are behind us.

Now we await for the upside resolution. Hopefully it began yesterday [referring to Friday’s jump] -- and we should find out pretty quick once the first big moving average is penetrated to the upside”

Steer maintains that J P Morgan have amassed the world’s biggest physical holding of silver, bought cheaply through the effects of the world’s biggest short position in futures on COMEX. That they are nearly completely out of their short position could finally mean this is the ‘foot off the brake’ moment so many have waited for.