Fundamentals Don’t Support this Rally

News

|

Posted 14/02/2019

|

5626

Metals came off a bit last night and shares continued their Santa rally despite nothing really changing since the October – December sharemarket correction last year. The trade war is unresolved (though yet again last night looked better, hence the rally, but still just off again, on again words we’ve seen before), Brexit looks certain for a hard exit, the Fed’s dovish appeasement is so far just words, and the US remains in shutdown. Moreover there are more recent developments in the global economy that, so far, seem to be ignored. Let’s just look at a few charts from a walk through today’s news….

Earnings expectations are falling, but the market is not fussed.

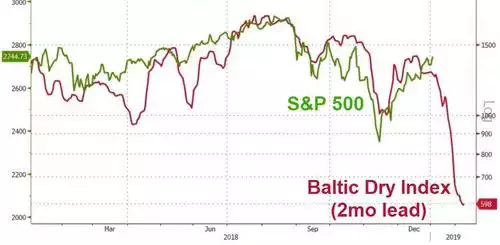

The bellwether of global trade, the Baltic Dry Index, is plummeting, marking nearly the worst start to a year since 1984, but the market is not fussed.

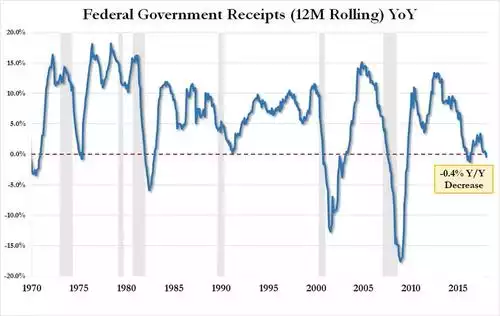

The US Treasury just released the figures for December. Another month of deficits, $14b or $319B year to date and on track to $1.1 trillion for the year. That is not helped by receipts (tax etc) down by 0.4% to just $3.33 trillion. Over the last half century, receipts turning negative have coincided with recessions in all but 2 cases, one being the Trump election but bounced on promises of everything being great again. But the sharemarket is still not fussed. Clearly this time is different again…

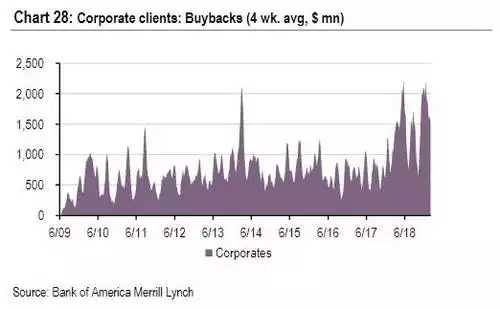

So why is the market appearing unfussed? How have shares rallied amongst such fundamentals? Corporate buy backs YTD have jumped a staggering 78% on the same period last year. And that’s not off a low base. 2018 was a record year with $1 trillion in corporate buy backs.

Apart from cheap debt and artificially raising the price of the shares senior executives have their bonuses tied to, the US also allows a tax break on share buy backs as opposed to dividends. Presidential hopeful Marco Rubio is on a mission to abolish that. He’s filing a bill to do exactly that, tweeting:

“Right now don’t have a “free market”. We have tax code which engineers economy in favor of inflating prices of shares at the expense of future productivity & job creation. If we are going to use tax code to incentivize behavior, it should be investing in productivity & jobs”

So if successful, what happens to share prices with no basis of fundamental support and less incentive for self inflating buy backs?.....

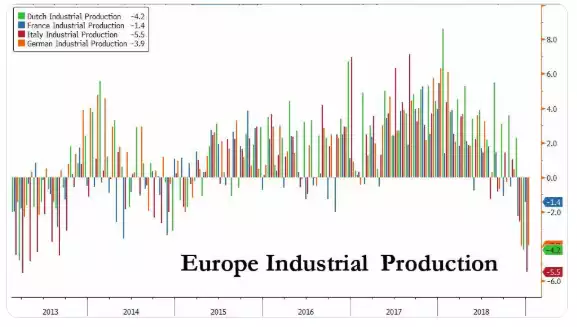

And let us remind you, the US is supposedly the economic darling of the world! Europe is a mess. Bloomberg recently reported that it is not the China Trade War that presents the biggest global risk but “it is Europe that increasingly looks like the biggest threat to global growth." citing industrial production across the Eurozone is “falling at the fastest pace since the financial crisis, and deteriorating demand is evident as the region finds itself squeezed between international and domestic drags."

It’s not just industrial production either. With all the Yellow Vest protests in France, household spending has come to a halt and as you can see below, the biggest player in Europe, Germany has a toxic mix of negative GDP, falling retail, falling economic confidence and manufacturing index. Germany and France alone account for half of the entire Euro economy. Italy is next and its woes are well know.

So ask yourself how sustainable this rally seems….