‘Animal Spirits’ meet Fundamentals

News

|

Posted 20/03/2019

|

6264

When we see a disconnect between fundamentals and markets it often comes down to emotion. One of history’s most famous economists, John Maynard Keynes called these ‘animal spirits’ in this famous quote:

“Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than mathematical expectations, whether moral or hedonistic or economic. Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as the result of animal spirits-a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.”

Market analyst Doug Kass offered the following explanation of what’s happening now:

“The markets, confounding many, have vaulted higher from the Christmas Eve lows with nary a selloff.

This morning, let’s briefly explore the catalysts to the advance and consider what might follow:

- Liquidity (and financial conditions) have improved, as Central Bankers, to some degree, have reversed their tightening policies. Interest rates and inflationary expectations have moved lower than expected, providing hope for an elongated economic cycle that has already been a decade in duration and appeared to be “long in the tooth.”

- Market structure (and the dominance of price following products and strategies like ETFs, CTAs and Risk Parity and Volatility Trending/Targeting) exacerbated the trend lower into late-December. The breadth thrust and reversal in price momentum contributed to the post-Christmas rally. As I have previously noted, in an investment world dominated by the aforementioned products that worship at the altar of price momentum – ‘buyers live higher and sellers live lower.’ This phenomenon has exaggerated market moves and has created an air of artificiality and absence of price discovery (on both the upside and the downside).

- Corporate buybacks – abetted by tax reform introduced 15 months ago – provided another reason for a strong backdrop for higher stock prices.

- As a result of the above factors (and others) animal spirits rose and valuations expanded.

These four conditions have offset the deceleration in the rate of global economic growth and U.S. corporate profit growth.”

However this latest rally off that December low is notably not breaking through technical buy signals. From Lance Roberts:

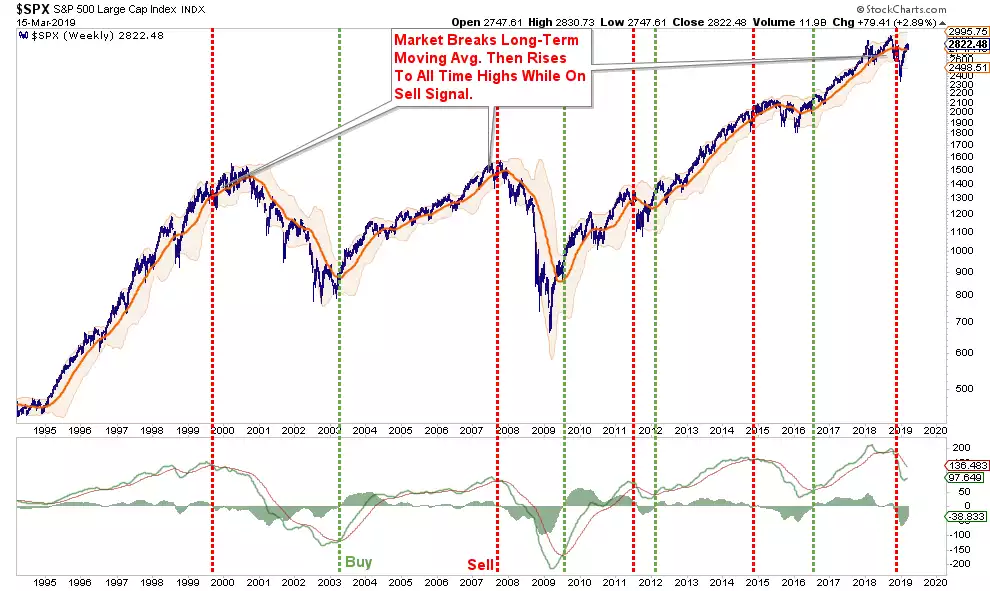

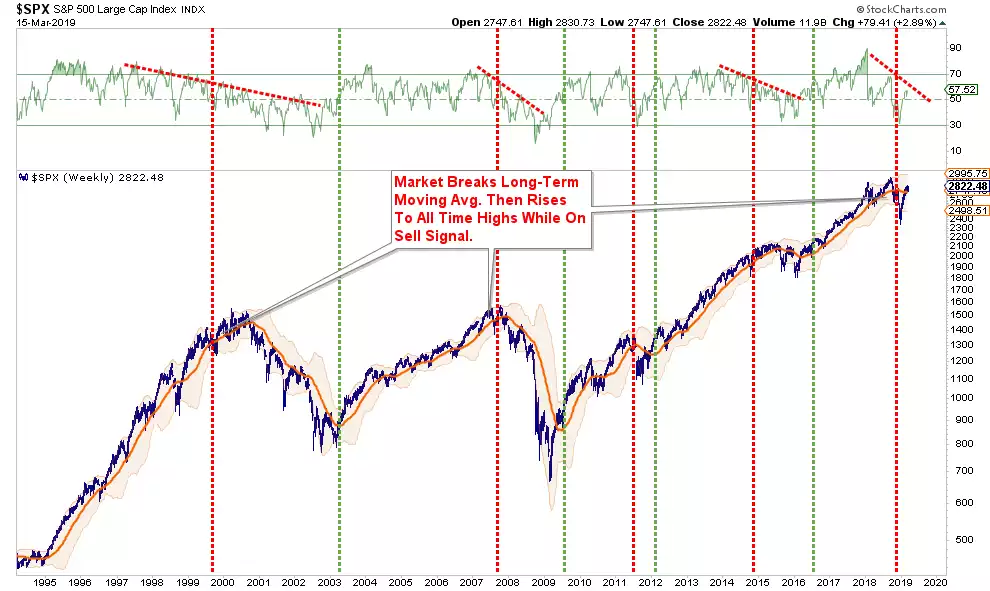

“It isn’t just the economy that is reminiscent of the 2007 landscape. As noted above, the markets also reflect the same. Here are a couple of charts worth reminding you of.

Notice that at the peaks of both previous bull markets, the market corrected, broke important support levels and then rallied to new highs leading investors to believe the bull market was intact. However, the weekly ‘sell signal’ never confirmed that rally as the ‘unseen bear market’ had already started.”

Firstly MACD (Moving Average Convergence Divergence):

Then RSI (Relative Strength Index):

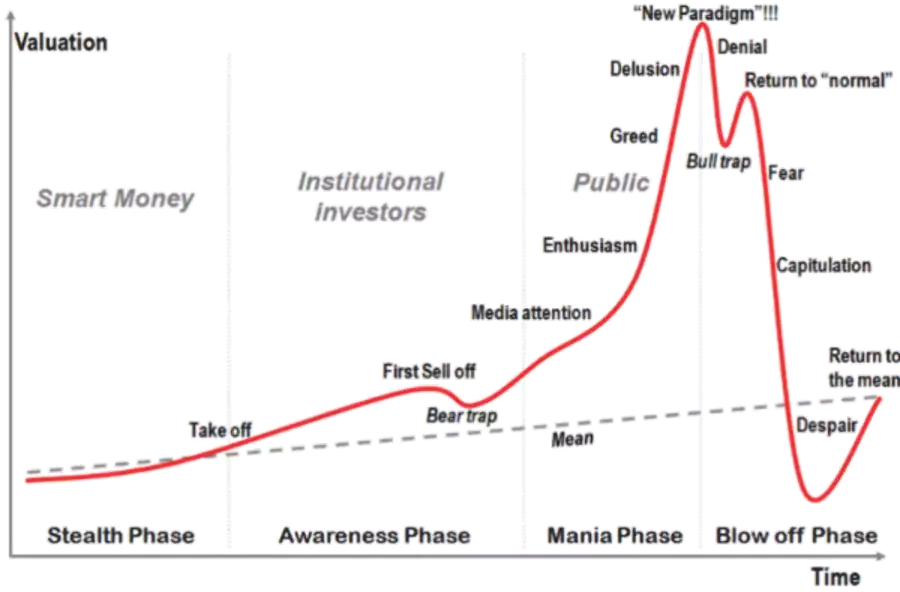

So whilst the ‘animal spirits’ have underpinned this post correction rally, it is looking awfully like a classic ‘Bull Trap’ per the oft shared investor psychology chart below:

Tomorrow the US Fed meet for the month. This market has rallied largely off their flip flop back to a dovish or accommodative stance. They have often been guilty of cognitive dissonance… should they blink at all, the market could move violently. Last week we told you this week is a week of corporate buyback blackout given earnings announcements. In other words there is not the safety net of the market’s biggest buyer, corporate buybacks, at the ready….