Gold Consumption – A Matter of Perspective

News

|

Posted 11/06/2018

|

6918

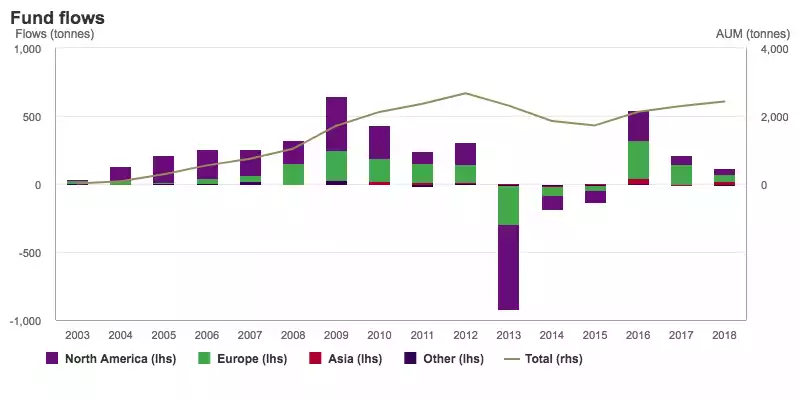

Last week the World Gold Council released their monthly gold backed ETF data which saw 15 tonne added to global holdings, taking the total to 2,484 tonne to the end of May. The gain was courtesy of European and Asian markets, up 26 tonne and 21 tonne respectively, whilst North America declined 30 tonne because, well, ‘everything’s awesome’… Whilst the net gain is meagre compared to those big flows in 2016 amid the sharemarket chaos and strong price gains in gold, it is encouraging given gold has done little this year. Whilst gold sits almost unchanged in USD terms (though up 3% in AUD) that is despite the headwinds of the USD up 4%, so again encouraging signs.

The Asian rise takes inflows up 20% year to date. However Asian buyers typically prefer to hold the real thing rather than ‘paper promises’ that ETF’s represent. It’s instructive therefore to look at just the Chinese market in that Asian complex and compare the ETF situation with the real deal.

Firstly some context. Even after those losses the North American market still holds the most gold in ETF’s at 1,295 tonne. Europe holds 1,051 tonne. Asia, despite that 20% gain sits at just 100 tonne.

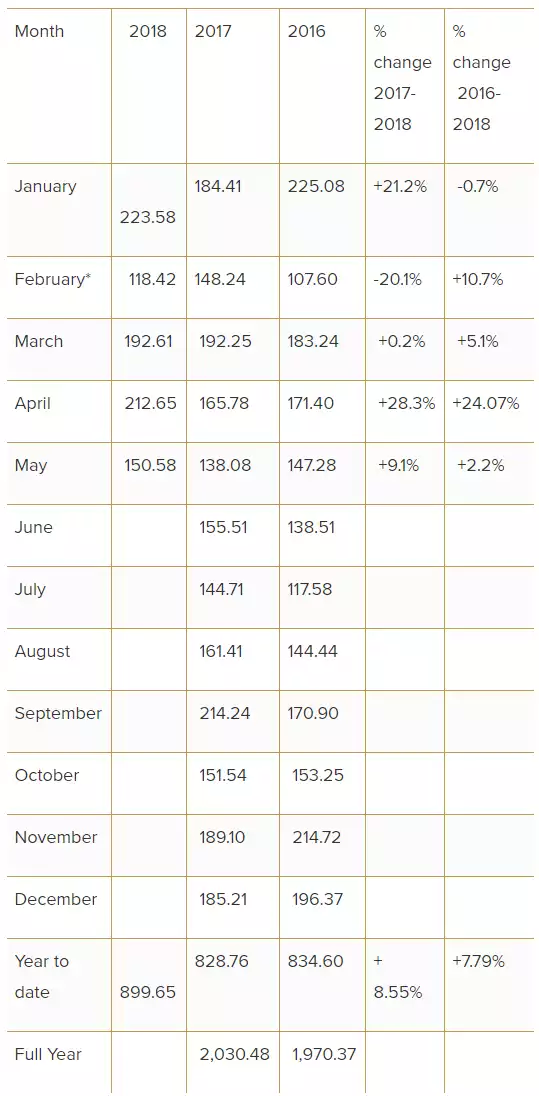

The Shanghai Gold Exchange (SGE) handles essentially all gold consumed in China. The only thing it misses is gold in and out of Hong Kong without hitting the mainland. So for the more informed, it is the most reliable source of Chinese consumption and likely conservative because of Hong Kong. So keeping in mind that 100 tonne in ETF’s in Asia, and even at its peak in the GFC of total global inflows to ETF’s of around 650 tonne in 2009, let’s just remind ourselves of the elephant in the room… (table courtesy of Lawrence Williams & SGE)

So China consumed more physical gold in the last 4 months than global ETF’s did for the entire year during the flight to gold in 2009 amid the GFC chaos. AND, it’s on a relentless increase.

So including Hong Kong, Chinese consumes in the order of 70% of global mine production. And as Lawrence Williams wrote in the source article for the above table:

“With the Chinese middle class expanding and GDP rising and the propensity of the Chinese to buy gold as a wealth protector, this proportion of global new mined gold output is likely as not to continue upwards, particularly if peak gold, or thereabouts, is now with us as most analysts suggest.”