Global Bonds Just Inverted – What happens now?

News

|

Posted 18/06/2018

|

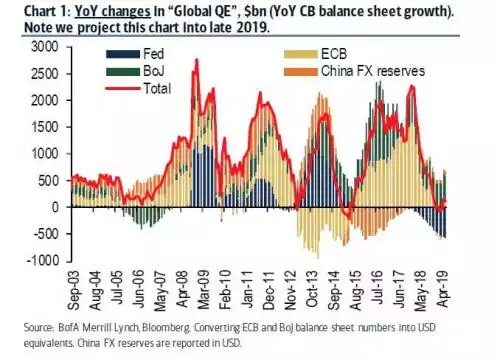

6637

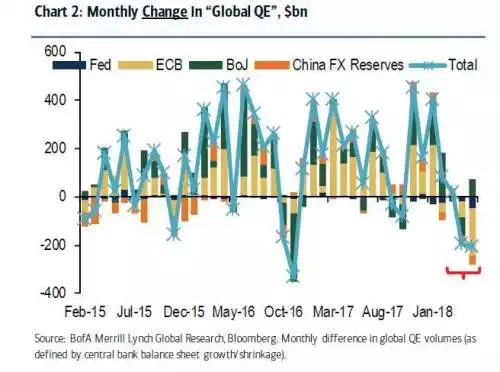

The big money normally use both bonds and gold for safety when they get concerned about the potential for equities to outperform the safer option. As we discussed and explained back in April, there has been growing concern about the so called flattening of the yield curve in US Treasuries. Last week we saw central bank meetings in the US, Eurozone and Japan and the message was consistent… we are tightening. The 2 graphs below show the year on year and monthly change for each. You can see in the first it all started from the GFC..

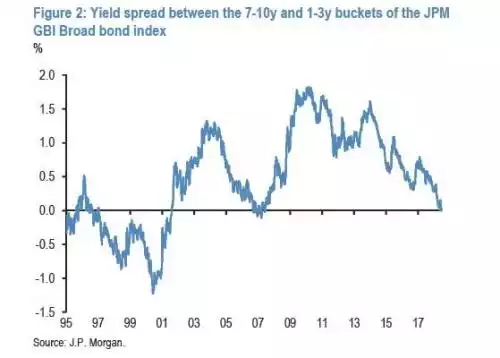

JP Morgan have just released a report looking more broadly at global bonds (not just UST’s) and that yield spread just crossed ‘the line in the sand’ and is inverting:

Whilst we explained this in that previous article, JP Morgan sum it up again quite succinctly as follows:

“In other words, in normal times, bond investors demand a premium to hold longer-dated bonds and to tie their money for a long period of time vs. investing in lower risk short-dated bonds. But when investors have little confidence in the trajectory of the economy or they think monetary policy tightening is overdone or they see a high risk of a correction in risky markets such as equities, they may prefer to buy longer-dated government bonds as a hedge even though they receive a lower yield than short-dated bonds. This is perhaps why empirical literature found that the slope of the yield curve is such a good predictor of economic slowdowns and/or equity market corrections.”

Bonds, by virtue of their accessibility, are normally a tool of the ‘big end of town’. We reported recently this ‘smart money’ is clearly heading for the exits and the flattening, and indeed inversion of the yield curve certainly reinforces this.

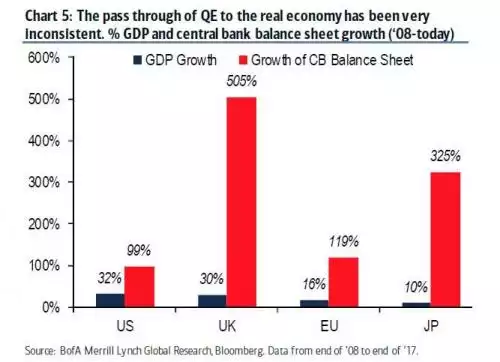

The effects of this unprecedented artificial stimulus winding down are becoming more and more apparent. Let us leave you with a very telling chart from Bank of America Merrill Lynch that illustrates how little ‘bang for buck’ the real economy got from all this debt accumulating stimulus which of course begs the question, what happens when it is removed…