AUD – Casualty of the Trade War

News

|

Posted 10/08/2018

|

7335

SafeHaven.com recently penned the following article spelling out the headwinds for our Aussie dollar. As the USD strength continues to put pressure on the spot price of gold, a disproportionate weakening of the AUD helps maintain gold prices in our currency.

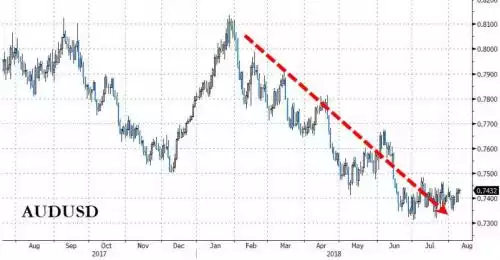

“The Australian dollar has been the worst performer among the world’s major currencies this year, dropping like a rock against most other currencies apart from the Swedish krona. AUD has weakened about nine percent against the U.S. dollar, currently changing hands at 73.91 cents against the greenback from the January high of 81.15 cents.

Despite the deep slide, the current optimism that the Aussie has found a bottom may be a tad premature.

The currency might get another drubbing if the U.S.-China trade war plays out in the current trajectory and things continue heading south for Australia’s major trading partner. Meanwhile, the Australian central bank is expected to soon reaffirm its commitment to keep interest rates at record lows when it meets later this week.

Here are three key reasons why the AUD might still be a juicy short candidate:

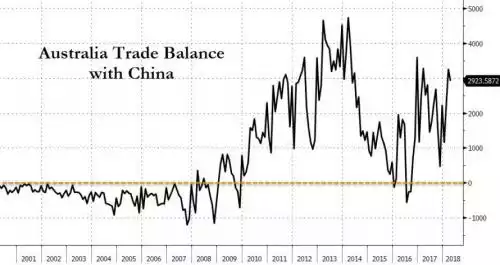

#1 Trade war casualty

Deteriorating U.S.-China trade relations will send ripples across many economies across the globe. But few countries are likely to feel the heat more than Australia, China’s leading trading partner. AUD tumbled 1.5 percent on June 14 when President Trump warned that he could confront China very strongly.

And it just keeps getting worse...

After imposing 10 percent tariffs on $200-billion of Chinese imports, Trump has threatened to not only bring the country’s entire range of exports worth half a trillion dollars under the tariffs but also to raise the rate to 25 percent. Top Aussie forecaster Marcus Wong of Singapore’s CIMB Bank has said escalating trade tensions mean the worst is yet to come for the currency. Meanwhile, Morgan Stanley recommends shorting the AUD/USD pair as well as the yen on “rising protectionist risks”.

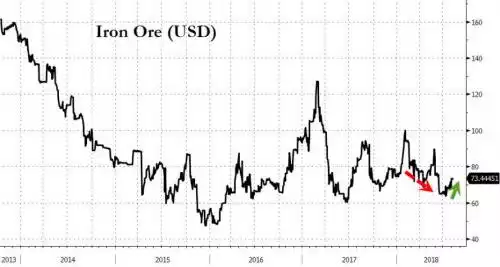

#2 Iron prices plateau

Iron-ore prices have grinded higher from this year’s low to trade around $69 per metric ton. They, however, are still 8.6 percent off their 52-week high and nearly 50 percent below their 2014 highs.

And they might fall even further. The Department of Industry, Innovation and Science slashed its forecast for the commodity last month to $51.10 next year as China starts dialing back purchases. That’s good for 26-percent downside.

The technical outlook is not good either, with prices approaching the 200-day moving average for the first time since March. Recent history has shown that prices frequently fall back whenever they approach that level.

#3 Low Interest Rates

The Fed has raised benchmark interest rates seven times during the current cycle. The Reserve Bank of Australia, in contrast, has kept the country’s interest rates at a record low of 1.5 percent where they have remained stuck for two years running.

Australia’s 10-year bond yields dropped more than 30 basis points vs. their U.S.’ counterpart by July and the divergence is expected to keep widening since RBA is expected to keep rates low until well into 2019, while the Fed is expected to raise benchmark rates another two times before the end of the year.

Positioning data strongly backs up the bearish assessment for the Aussie.

Hedge funds and other large speculators have opened up a net short position for the currency to the tune of 28,441 contracts as at July 31 - the biggest net short position in two years. Aussie bets were in a net long position as recently as in May.”