WGC - Gold Demand Trends Q2 2018

News

|

Posted 03/08/2018

|

6847

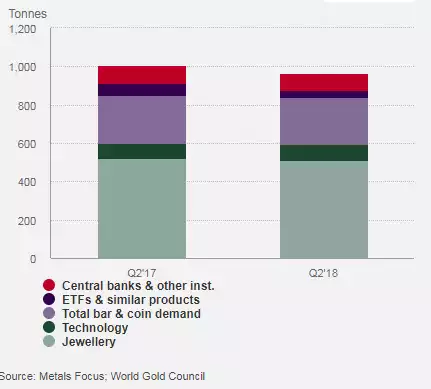

Unsurprisingly amid the soft gold price these last few months, the World Gold Council’s Gold Demand Trends Q2 2018 report shows global demand for gold fell 4% to 964.3 tonne, taking the H1 total to its lowest first half since 2009 in the global liquidity squeeze of 2009 at 1,959.9 tonne.

Below are the WGC’s highlights for the quarter:

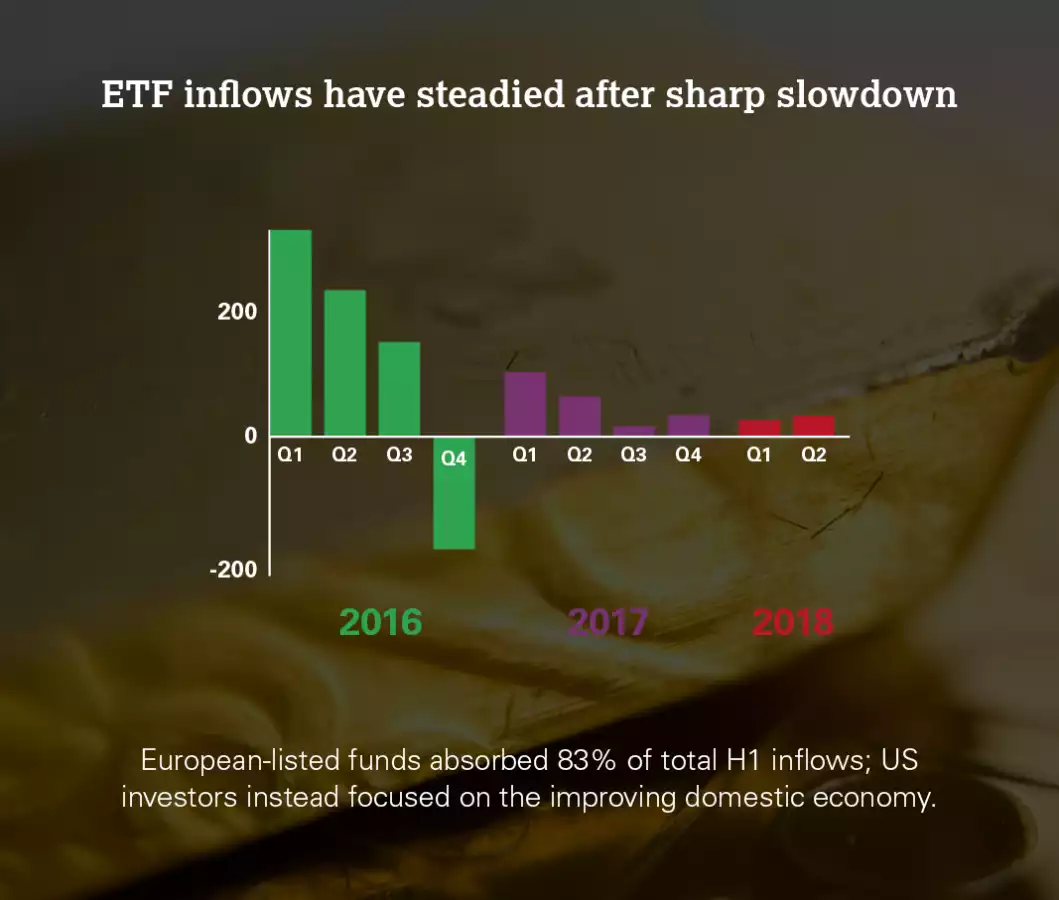

ETF’s

Inflows into ETFs remained at a steady trickle, having slowed sharply from the torrent of 2016/17. Inflows were 46% lower y-o-y. European-listed funds saw decent inflows we believe due to uncertainty stemming from Italian elections and the monetary policy outlook. But holdings of North American-listed funds fell by 30.6t as investors focused on domestic economic strength.

Jewellery

Despite the Q2 decline, H1 jewellery demand was scarcely changed at 1,031.2t. Weaker demand in India and the Middle East during Q2 was partially offset by growth in China and the US.

Technology

Q2 was the seventh consecutive quarter of y-o-y growth in the technology sector: demand grew 2% to 83.3t. Gold used in electronics continues to thrive due to enduring demand for smartphones, games consoles and automotive electronics.

Physical Investment

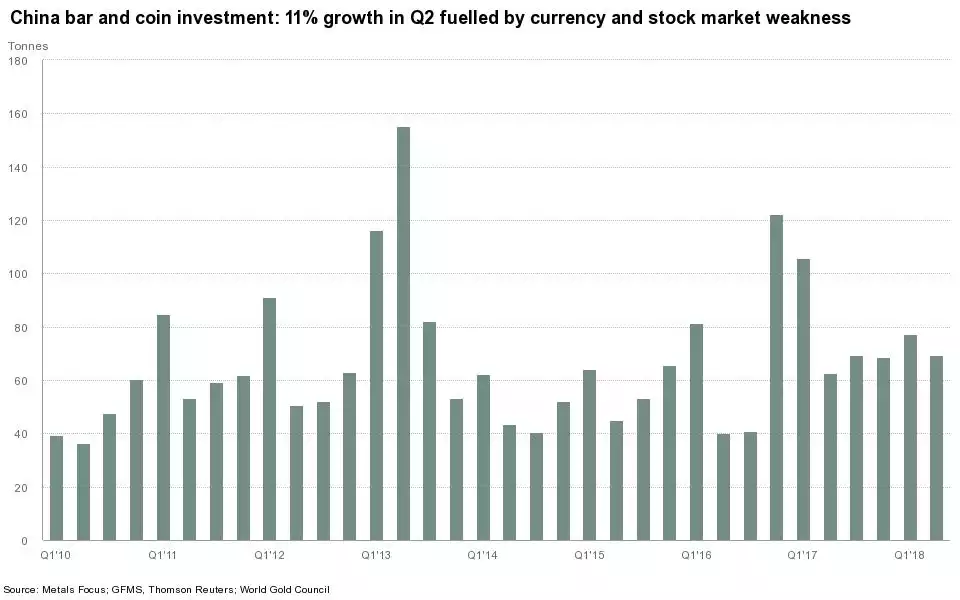

Global bar and coin investment was virtually static at 247.6t. Stronger demand in China and Iran – fuelled by increasing geopolitical tensions with the US – were offset by falls in Turkey, India and Europe, where local prices remained elevated.

Central Banks

Central banks added 89.4t of gold to global official reserves in Q2, down 7% y-o-y. Cumulative H1 purchases of 193.3t were the highest since 2015.

Whilst the report notes declines in the world’s 2nd biggest consumer, India in the quarter, news emerged this week that Indian gold imports were up a whopping 22.43% in their fiscal year 2017-18 just finished at 955.16 tonne compared to 780.14 tonne in 2016-17 year. The report noted the demand in 2017-18 had increased during first and second quarters and declined in third and fourth quarters as compared to corresponding period in 2016-17.