SEC Endorses Ethereum – BIG news for crypto

News

|

Posted 15/06/2018

|

6979

You won’t see this in any main stream paper today but last night we saw potentially huge news in the crypto space. For those new to the area there is a long running debate and concern around the issue of whether certain cryptocurrencies are ‘security’ or ‘utility’ coins or tokens.

One of the biggest headwinds for crypto is around the issue of dodgy ICO’s and increasing regulatory control to protect consumers from them. There are and have been crypto offers for what are at best highly dubious or speculative offers, or at worst outright deliberate scams. These have been allowed to get through because unlike an IPO (initial public offering) for securities such as shares or funds which are very highly regulated by the likes of ASIC in Australia or the SEC in the US, ICO’s (initial coin offerings) have to date had next to no regulatory oversight or control. It’s been a happy hunting ground for scammers, but given the whole crypto space a bad name.

To overcome this, the likes of the SEC and ASIC are trying to tighten up the space and differentiate between security tokens and utility tokens. Simplistically, many an ICO appears as a share issue for a company doing something, a means of fund raising. Now there are some simply brilliant ICO’s out there and the ability to avoid the hurdles, costs and time associated with an IPO process means we all can enjoy many great and universally beneficial start-ups using the once in a generation new technology of blockchain. These would otherwise never have got past ‘go’. They also let the ‘little guy’ get in at the ground floor of new ventures, normally only put to high net worth individuals.

Most of these are defined as a utility token because they actually use the tokens you buy in the ICO or thereafter to ‘run’ the technology. i.e. they aren’t just fund raising mechanisms like shares, they are an integral part of the mechanics of the business. There is also the issue of ‘control’ by a third party and hence the regulatory oversight of that third party (like a fund manager) to protect investors from malpractice. It can however be a fuzzy line for the regulators and they are casting a fresh set of eyes on the whole space.

The implications are very large and clear too. If you are buying a security, normally that would mean that you have read and accepted a PDS (product disclosure statement) and purchased in a regulated environment. If you apply that to a crypto coin or token it removes the ability to trade it openly on an exchange or otherwise peer-to-peer as you bypass the whole PDS process. The implications are therefore rather big given the predominance of trade on exchanges.

Whilst the pure ‘money’ or medium of exchange cryptos such as Bitcoin, Litecoin and Bitcoin Cash are clearly not securities and indeed the SEC calls them ‘currencies’, there has been a cloud of doubt hanging over the 2nd biggest by market cap, Ethereum, as the SEC announced its review of the space.

Overnight they have announced that it isn’t, and also gave further explanation that sends positive signs for others. On Ethereum specifically they said:

“Based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions,”

And then encouragingly for the broader crypto space they clarified:

“…if there is a centralized third party, along with purchasers with an expectation of a return, than it is likely a security... The key here of course being that Ether is decentralized……If a cryptocurrency network is sufficiently decentralized and purchasers no longer have expectation of managerial stewardship from a third party, a coin is not a security”

They also clarified the debate around ‘coin’ versus ‘token’ as a contributing factor

“Similarly, labelling an investment opportunity as a “coin” or a “token” does not make something not a security”

In addition to the simple matter of trade via exchanges, the clarification also now allows the futures giants to add Ethereum to Bitcoin in futures trading. Indeed Cboe announced soon after the decision:

"We are pleased with the SEC's decision to provide clarity with respect to current Ether transactions.

This announcement clears a key stumbling block for Ether futures, the case for which we've been considering since we launched the first Bitcoin futures in December 2017."

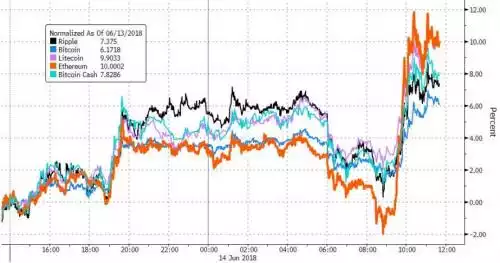

Not surprisingly the market has responded positively to the news after heavy losses this last week, with Ethereum in particular up around 9% but the gains largely across the board.

--------------------

Ainslie Wealth has reduced its Crypto margins, making our crypto products even more competitive!