Gold vs Silver - Which Precious Metal Should You Buy?

Resources

|

Posted 21/09/2023

|

574

Gold vs Silver

Investing in precious metals such as gold and silver can offer various benefits to diversify your portfolio and hedge against inflation. Both metals have unique properties that make them valuable investment assets.

In this article, we'll discuss the history and characteristics of gold and silver, as well as the advantages of investing in each metal.

Gold: A History of Value and Stability

Those who invest in gold know it has been a safe-haven asset for thousands of years, serving as a form of currency and store of value. The ancient Egyptians were among the first to use gold for jewellery and religious purposes.

Over time, gold became widely used as a form of currency in many ancient civilizations, including the Greeks, Romans, and Chinese.

A Brief History of Gold in Australia

-

Early Discoveries (19th Century): The discovery of gold in Australia is often credited to Edward Hargraves, who found gold near Bathurst, New South Wales, in 1851. This discovery triggered a gold rush, drawing people from around the world to seek their fortunes in Australia.

In the following years, significant gold deposits were found in various parts of the country, including Victoria, Western Australia, Queensland, and South Australia.

-

Eureka Stockade (1854): In 1854, gold miners in Ballarat, Victoria, revolted against the colonial authorities in what became known as the Eureka Stockade.

This uprising was partly driven by discontent over gold mining licenses and taxation. It played a role in shaping Australia's democratic and political history.

-

Growth of Gold Production: Throughout the 19th century, Australia's gold production grew significantly, making it one of the world's leading gold producers.

This led to the establishment of numerous gold mines and towns in regions like Bendigo, Kalgoorlie, and Coolgardie. Owning physical gold began to grow as a trend during this time.

-

Minting Gold Bullion: The need for a stable and reliable currency system led to the establishment of several government mints across Australia. The Sydney Mint, Melbourne Mint, and Perth Mint were among the prominent institutions responsible for minting gold bullion bars and coins.

-

Impact on the Economy: Gold mining had a profound impact on Australia's economy, helping to fund infrastructure development and contributing to the growth of cities like Melbourne and Sydney.

The influx of wealth from gold also played a role in the development of Australia's financial and banking sectors.

-

Fluctuations in Production: Australia's gold production has experienced periods of boom and bust over the years, influenced by factors such as global economic conditions, technological advancements in mining, and fluctuations in the price of gold.

-

Modern Gold Industry: In the modern era, Australia continues to be a significant player in the global gold market. It is known for producing high-quality gold bullion, including coins and bars, which are sought after by investors and collectors worldwide.

The Perth Mint, in particular, is renowned for its production of gold bullion products such as collector coins which is an example of the endearing quality of gold today.

Investing in gold offers stability and reputation as a store of value. As a dense, soft, and corrosion-resistant lustrous yellow metal, gold bullion is a popular choice for coins and jewellery.

At Ainslie Bullion, we offer a vast selection of gold products tailored to your investment goals, including gold bars and coins from various mints allowing you to buy gold in a form that suits you.

Silver: A Diversifier and Growth Asset

Silver also has a rich history and distinct characteristics that make it a valuable investment asset. It was used as a form of currency in many ancient civilizations, including the Greeks and Romans, and played a significant role in the development of international trade.

A Brief History of Silver in Australia

-

Early Silver Discoveries: Silver was often found alongside gold deposits during the Australian gold rushes of the 19th century. Miners searching for gold also discovered significant silver deposits in various parts of the country, including New South Wales, South Australia, and Victoria.

-

Broken Hill: The Silver City: One of the most famous silver mining districts in Australia is Broken Hill, located in western New South Wales. In 1883, a massive silver deposit was discovered there, leading to the establishment of the Broken Hill Proprietary Company (BHP). This mine, often referred to as the "Silver City," became one of the world's richest silver mines and played a pivotal role in the development of the Australian mining industry.

-

Silver Production Boom: The discovery of substantial silver deposits led to a boom in silver production in Australia during the late 19th and early 20th centuries. Silver was mined both for its intrinsic value and for its industrial applications, including its use in photographic processes and electrical conductors.

-

Technological Advances: As technology advanced, mining methods became more efficient, allowing for the extraction of silver in larger quantities. This contributed to Australia's position as a significant silver producer.

-

Market Fluctuations: Like other commodities, the price of silver experienced fluctuations, which influenced the profitability and activity levels of silver mines in Australia. These fluctuations were often tied to global economic conditions and demand for silver in various industries.

-

Shift in Focus: Over time, the focus of mining in Australia shifted more toward other minerals, such as gold, iron ore, and coal. While silver production continued, it was not as central to the Australian mining industry as it had been during the peak of the Broken Hill mine's operation.

-

Modern Silver Mining: Today, silver mining in Australia continues, but it often occurs as a byproduct of other mining operations, such as lead and zinc mining. These metals are commonly found alongside silver in ore deposits.

-

Silver Bullion Production: The production of silver bullion, including silver bars and coins, remains a part of Australia's mining industry. The Perth Mint, known for its gold bullion production, also produces silver bullion products that are popular among investors and collectors

In Australia, silver was first discovered in the 1830s in New South Wales, with significant deposits found in the Broken Hill region during the 1870s and 1880s. During World War II, silver played a crucial role in the Australian war effort, being used for everything from weapons production to medical equipment.

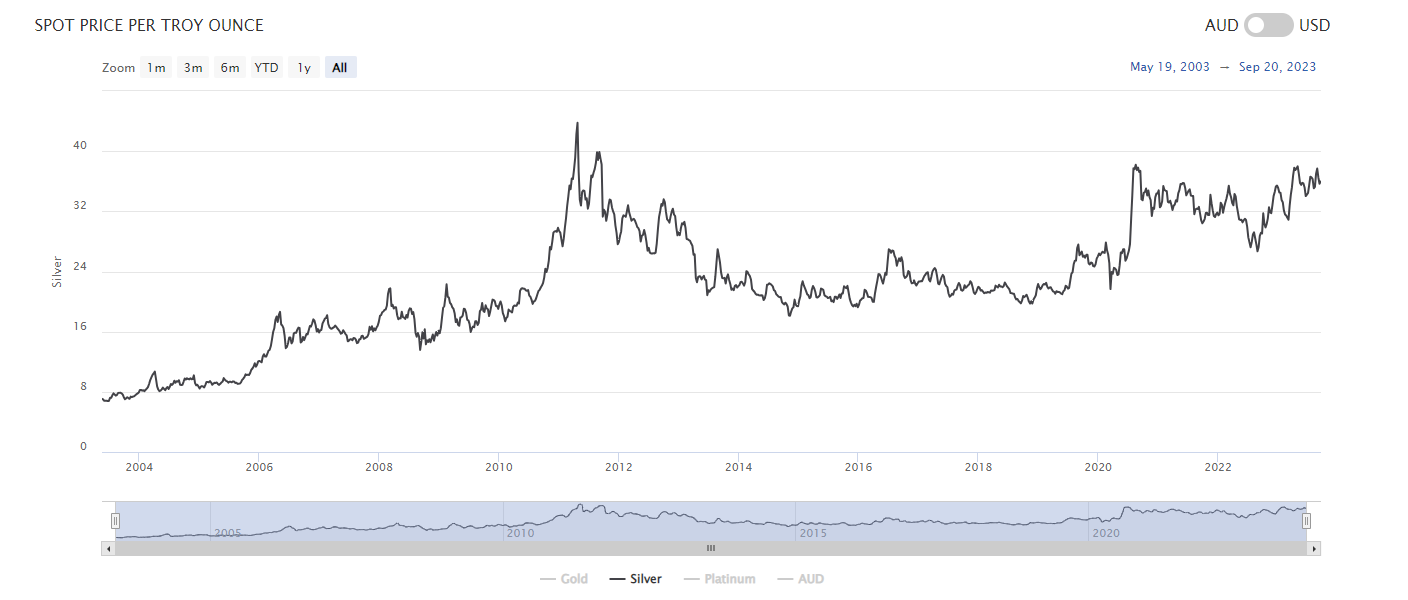

Investing in silver offers unique advantages as a portfolio diversifier and growth asset. Although it has been historically more volatile than gold, this can present opportunities for investors willing to take on a higher level of risk. The price of silver can fluctuate quickly in response to market events, providing an advantage for active traders. At Ainslie Bullion, we offer a vast selection of silver products tailored to your investment goals, including silver bars and coins from various mints.

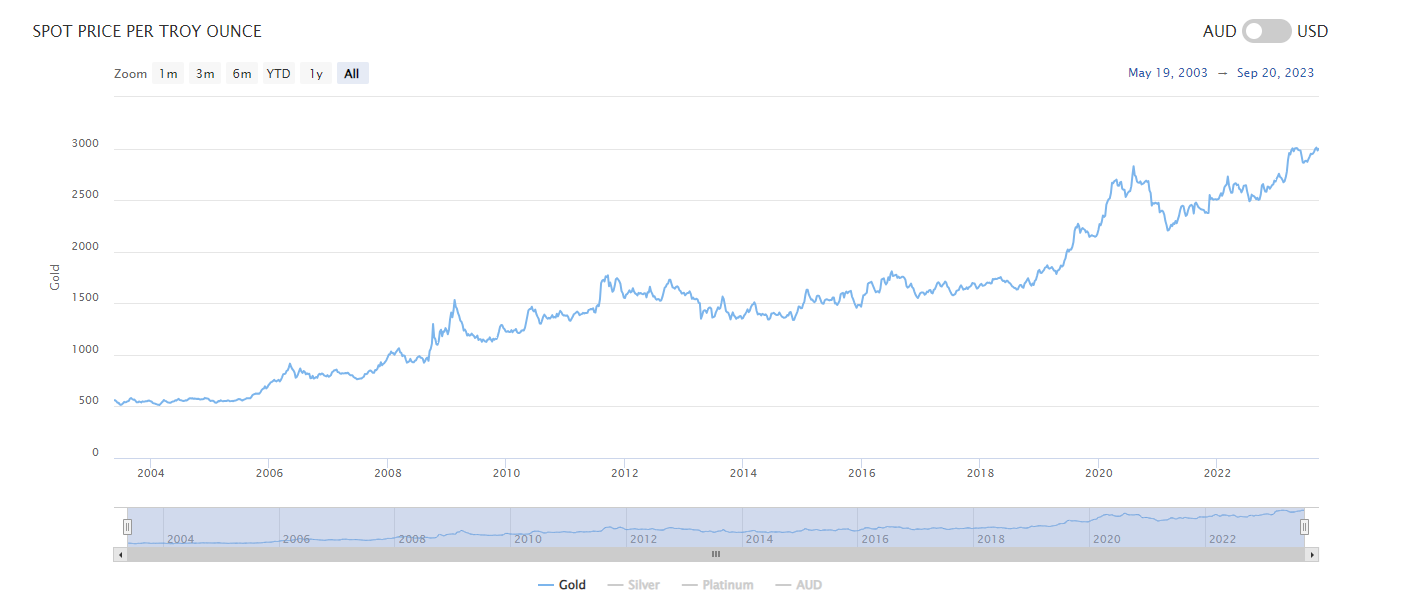

The Gold Silver Ratio (GSR) - Gold Prices vs Silver Prices

The Gold-Silver Ratio (GSR) can help you decide whether to buy gold or silver. It compares the prices of the two metals and shows which one is performing better.

If the ratio is high, gold prices are strong. If the ratio is low, silver prices are doing better than gold. Experts think that the ratio might soon correct downwards, which could be a good time to invest in silver.

To protect your investments against inflation, you can diversify your portfolio by investing in both gold and silver, and adjusting the amount you invest in each metal have on the GSR. It is also an important metric to that most investors use in order to identify the past performance of each precious metal

What Should You Choose- Gold Bullion or Silver Bullion?

Physical gold and silver are clearly a great way to store wealth but when deciding between pure gold bullion or silver bullion, there are a few factors to consider. Firstly, it's important to think about your investment goals and the purpose of the investment.

Each precious metal has it's own benefits. If you're looking for a reliable store of value and a form of currency, gold bullion may be the better choice. Gold has a long history of being used as a currency and store of value, and it has a reputation for being a safe-haven asset in times of economic uncertainty.

On the other hand, if you're looking for a portfolio diversifier and growth asset, silver bullion may be the better option. While silver also has a history of being used as a currency, its unique advantage lies in its industrial applications.

Silver is widely used in industries such as technology, medicine, and finance, which can drive demand for the metal and potentially increase its value over time.

Another factor to consider when choosing between physical gold and silver bullion is the price. Gold is typically more expensive than silver, which can make it more difficult to acquire for some investors. Silver, on the other hand, is more affordable and accessible, making it a popular choice for new investors or those with limited funds.

Compared to other precious metals, silver and gold are more accessible making holding the physical asset more achievable.

It's also worth noting that both physical gold and silver can be volatile investments, and their prices can fluctuate in response to market events. However, historically, physical gold has been less volatile than silver, which may make it a more stable investment for some investors.

Ultimately, the choice between gold and silver bullion will depend on individual circumstances and investment goals. It's important to do your research and consider your options.

Buying and Selling Gold & Silver with Ainslie Bullion

At Ainslie Bullion, investing in physical bars and coins is a simple and straightforward process. Here are the three easy steps to follow:

Step 1: Choose Gold or Silver

You can browse through our extensive selection of bullion products on our website or visit one of our showrooms to view our products in person. Our team of consultants will be available to assist you in choosing the right investment option for your portfolio.

Through our store you can browse the live gold price. We offer a wide variety of bars and coins in different weights and sizes, ensuring that you can find the perfect fit for your investment needs. You can view images and videos of our products on our website, and our in-store consultants can show you each item in person.

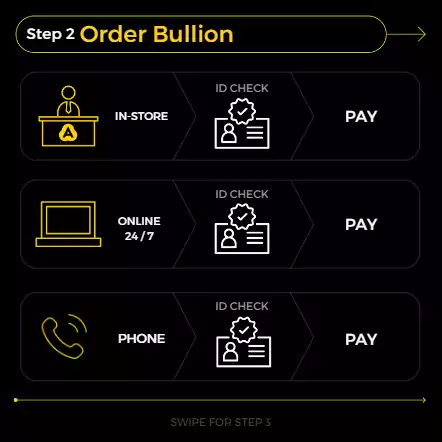

Step 2: Buy Gold or Silver

At Ainslie Bullion, you can purchase gold bullion online, over the phone, or in-store using your preferred payment method. We try to make buying physical gold and silver easy by accepting cash, card, or bank transfer, depending on your preference (However for our physical store we only accept Australian dollars).

Our website is user-friendly and allows you to place an order and make a deposit easily and securely. If you prefer to place your order over the phone, one of our consultants will assist you and send you an invoice for the full amount. In-store purchases can be made with cash or card, and you can take immediate delivery after payment.

Step 3: Pay and Receive Gold or Silver

We accept a 10% deposit for online orders and secure the remaining 90% payment through our website's safe payment methods. Alternatively, we offer PayID as a fast and secure payment option for you to pay the full balance immediately. For in-store purchases, you can take immediate delivery after payment. For phone orders, we'll send you an invoice for the full amount, and you can make your payment via bank transfer.

Once your order is fully paid, we'll hold it for pickup within 30 days or securely and discreetly pack and deliver it to your address fully insured. You can also opt for the 'remote control' convenience of a secure and fully insured Ainslie Storage Account.

Alternatively, you can store your gold bars in your own safe with our partner vaults, Reserve Vault and The Melbourne Vault. Our delivery options ensure the safety and security of your investments, and we'll inform you when your items are available in the vault. Purchasing gold is made easier by our streamlines processes.